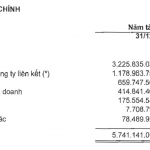

Novaland, a leading real estate investment group in Vietnam, has released its second-quarter financial report for 2024. The report reveals a decrease in short-term debt by VND 438 billion compared to the beginning of the year, while long-term debt increased by VND 1,942 billion.

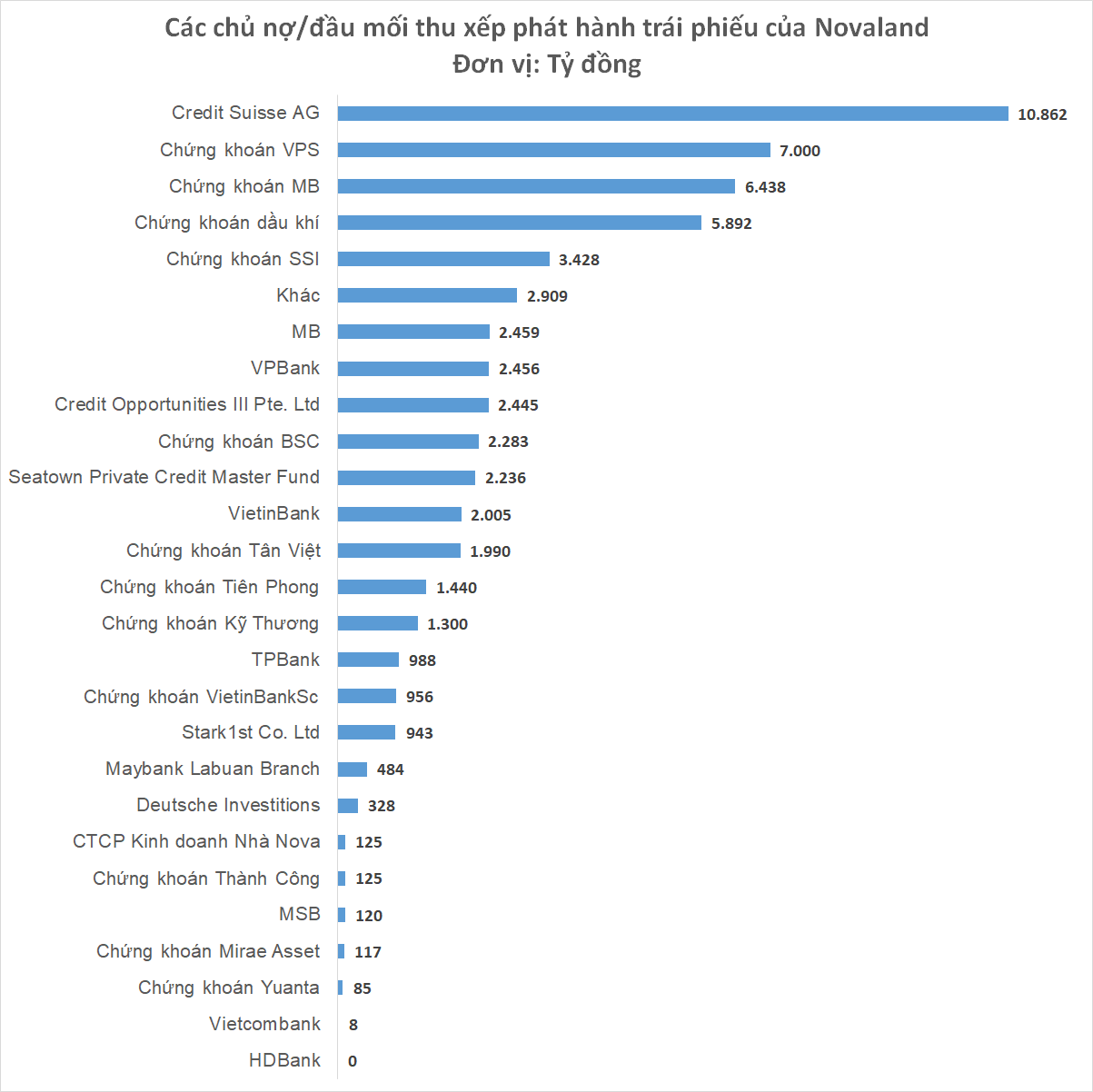

Credit Suisse AG remains Novaland’s largest creditor, with a total debt of VND 10,862 billion, an increase of VND 449 billion from the beginning of the year. This is followed by bond issues arranged by securities companies such as VPS Securities (VND 7,000 billion), MB Securities (VND 6,438 billion), PetroVietnam Securities (VND 5,892 billion), and SSI Securities (VND 3,428 billion).

MB and VPBank are the top lenders to Novaland, with outstanding loans of VND 2,909 billion and VND 2,459 billion, respectively. Other major lenders include VietinBank, with loans exceeding VND 2,000 billion, and TPBank, with nearly VND 1,000 billion in loans.

Novaland recently held a briefing on its restructuring progress and project development updates. During this briefing, Novaland’s CFO, Mr. Duong Van Bac, shared that the company’s outlook has significantly improved. He stated that Novaland plans to repay all its debts and bonds by the first or second quarter of 2026.

According to Mr. Bac, from now until at least the second quarter of 2025, the company will focus on completing legal procedures, delivering sold products, and collecting payments. Most of the company’s projects are expected to enter into sales contracts by the end of this year or early next year. However, it will take time for the cash flow to be realized.

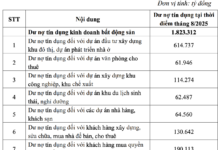

Regarding Novaland’s projects, Mr. Bac shared that 14 out of 16 projects within their development clusters are currently under construction, with a total construction limit of VND 12,100 billion. Many large contractors have agreed to the principle of “harmonious interests and shared risks,” choosing to commence construction first and receive payments later, once the products are sold. The total value of these products, if completed and delivered, is estimated to be nearly VND 480,000 billion.

“Our construction sites were almost inactive in June and July 2023. Now, although construction is not yet in full swing due to legal issues with some projects, the situation has improved significantly. For example, in Ho Chi Minh City, we have four projects currently underway: Sunrise Riverside, Palm Marina, Victoria Village, and The Grand Manhattan,” said Mr. Duong Van Bac.

One of Novaland’s key projects, NovaWorld Phan Thiet, is nearing completion in terms of legal procedures, with 90% of the issues already resolved. The project is expected to finalize its legal status by September 2024, after receiving the land use fee notification. Construction has been accelerated since January 2024.

“People have been wondering if NovaWorld Phan Thiet is still alive. I can assure you that it is very much alive and vibrant,” affirmed Novaland’s CFO.

NovaWorld Phan Thiet has completed its detailed planning at a 1/500 scale, and 1,111 products have been delivered so far. By the end of this year, they aim to deliver an additional 820 products, with a target of delivering 2,069 products in 2025.

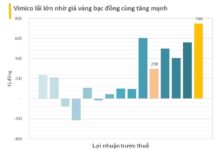

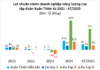

Novaland reports over VND 1,600 billion in profit for Q4/2023, bond debt reduced by VND 6,000 billion in one year.

In 2023, Novaland achieved a profit of over 800 billion VND, in contrast to the first half of the year when the company incurred a loss of over 1,000 billion VND.