Are Central Banks Going in the Right Direction with Increasing Interest Rates?

Some economists believe that the sudden increase in prices is only temporary, inflation will eventually decrease, regardless of whether banks try to contain it through tighter monetary policies or not.

Lowest Interest Rates for Loans, It’s Time to Settle Down

Interest rates for loans are currently at their lowest level in 20 years, accompanied by a range of favorable lending policies from banks. This is creating an opportunity for potential homebuyers to invest or own their dream homes. The real estate market is gradually heating up as a result.

Official Implementation of New Regulations on Counterfeit Money Prevention

Effective from 2nd February 2024, Decree No. 87/2023/NĐ-CP on anti-counterfeiting and protection of Vietnamese currency shall come into force.

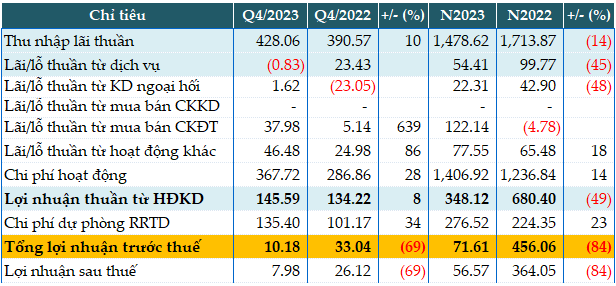

Why did BVBank’s profit in 2023 only reach 16% compared to the hundred billion...

BVBank, a commercial bank listed on the UPCoM under the ticker BVB, reported a pre-tax profit of nearly 72 billion VND in 2023, marking an 84% decrease compared to the previous year.

Governor: Strict penalties for ATMs with insufficient funds; no Lunar New Year wishes or...

The governor has mandated increased surprise inspections and strict handling of cases involving cash shortages and non-functioning ATMs due to the bank's negligence;...

Mr. Ngo Dang Khoa (HSBC): Exchange rate under pressure in Q1, expected to stabilize...

Prior to the rising trend of the USD, Mr. Ngo Dang Khoa - Director of Foreign Exchange, Capital Markets and Securities Services, HSBC Vietnam, has shared some insights and forecasts regarding the upward momentum of the USD and exchange rates.

Need to excel at writing ads that grab attention, engage readers, and drive results?

Even in a stable market with low and stable interest rates, offering an attractive credit package remains essential and meaningful for the Bank-Business Connection program.

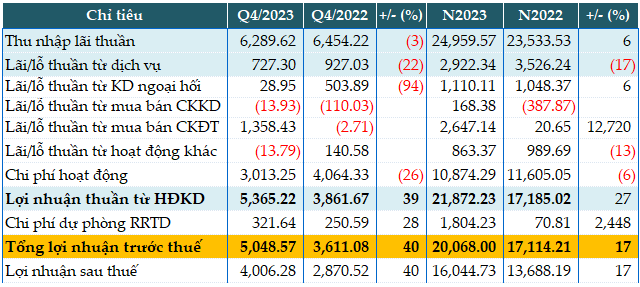

Explosive Stock Investment Profits: ACB’s 2023 Earnings Exceed 20,000 Billion

The recently released consolidated financial statements show that Asia Commercial Bank (ACB) (HOSE: ACB) recorded a pre-tax profit of VND 20,068 billion in 2023, an increase of 17% compared to the previous year. This was achieved despite the increased provision for credit risk, thanks to a significant increase in interest income from external sources.

OCB maintains business core growth, accompanying customers

OCB, the Commercial Joint Stock Bank of the East, has achieved remarkable success in increasing its charter capital to 20,548 billion VND and pre-tax profit by 19% compared to the previous year. The bank has continuously introduced a series of attractive credit packages with competitive interest rates, aiming to serve its customers better. These achievements highlight OCB's strong presence in the business landscape in 2023.

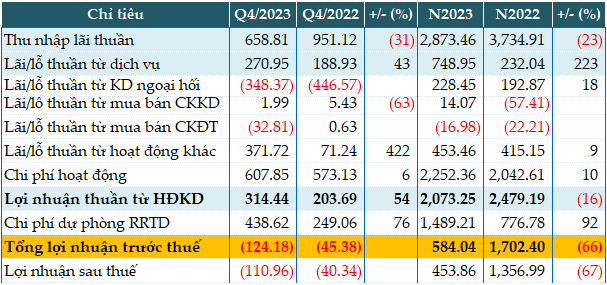

Why is ABBank’s 2023 profit declining despite a surge in interest rates from services?

According to the latest consolidated financial statements, An Binh Commercial Joint Stock Bank (ABBank, UPCoM: ABB) recorded a pre-tax profit of more than 584 billion dong in 2023, a 66% decrease compared to the previous year, despite a significant increase in profits from its services.