Perhaps the phrase “red footprints” by Mr. Duc seems to imply the dominant color on the stock market in 2023. A color that no investor wants to see.

Sharing in the press about the stock market in 2023, Mr. Ho Sy Hoa – Research and Investment Advisory Director of DNSE Securities Company only used two words: Disappointed.

2023 – A year of many emotions

Looking at the developments of the stock market in 2023 is not all “red” as many investors say. In the period from the beginning of the year to the beginning of September, the market moved in a positive direction. The increasing sessions, although not dominant, had more in number than the decreasing sessions. There was a time when the VN-Index recorded an increase of nearly 24% compared to the beginning of the year, reaching over 1,255 points.

At that time, experts believed that the stock market would flourish due to the benefits of the State Bank’s loose monetary policies when interest rates were cut 4 times to support economic growth.

In general, in the first 3 quarters of 2023, the Vietnamese stock market followed the world stock market with fairly positive rebounds after a stormy 2022. Specifically, the VN-Index increased by 12% in 2023 and was one of the strongest-growing indexes in Asia. However, this increase was not enough to bring the index back to its previous peak. Even at the highest point of the VN-Index in early September, when it reached nearly 1,250 points, it was still far from the historical peak of 1,500.

The “sad” thing is that after the peak of that year, the market corrected downwards and in the past 2 months, the VN-Index has lost over 200 points. Thus, the achievements of the previous period have almost disappeared after a mainly externally-adjusted correction. Specifically, the DXY index (measuring the strength of the USD) increased by over 7% from mid-July to the beginning of October, creating pressure on the exchange rate, leading to the State Bank implementing measures to withdraw a large amount of money from the system through the bond channel. Meanwhile, foreign investors maintained their net selling trend. The psychology of domestic investors was affected, causing the VN-Index to decline, despite the positive domestic macroeconomic factors.

In the last period of 2023, the VN-Index fluctuated around 1,100 points, closing the session on December 29th at 1,129.93 points, increasing by 12.1% compared to the end of 2022. This is a year-end figure that does not please investors.

Many optimistic perspectives from the beginning of 2024

One of the important factors restraining the Vietnamese stock market is the imbalance in structure. According to data from Bloomberg, the financial and real estate stock group in the Vietnamese stock market accounts for more than 57% of the total market capitalization. This figure is much higher than that of markets in the region such as Thailand, Indonesia, China,… If compared to leading markets in the world, Vietnam’s share of this figure is even more remarkable.

With this structure, the recovery of the Vietnamese stock market almost entirely depends on the ability of the financial and real estate stock group to recover. However, these industries are facing many challenges and the prospects for recovery are still uncertain despite the many support measures and efforts made.

In general, the real estate market is still relatively bleak, affecting the revenue of real estate companies. This makes it difficult for them to access credit from banks, while the bond market, although more stable, still has unresolved constraints.

In addition, the pressure of debt repayment in 2024 is still very high for the real estate group, with an estimated VND 123,000 billion (USD 5.35 billion) of bonds maturing. FiinGroup has identified that real estate is a key industry and one of the main risks to next year’s economic recovery. The real estate market is expected to recover in the middle of 2024, but the current details of the recovery time are still undefined.

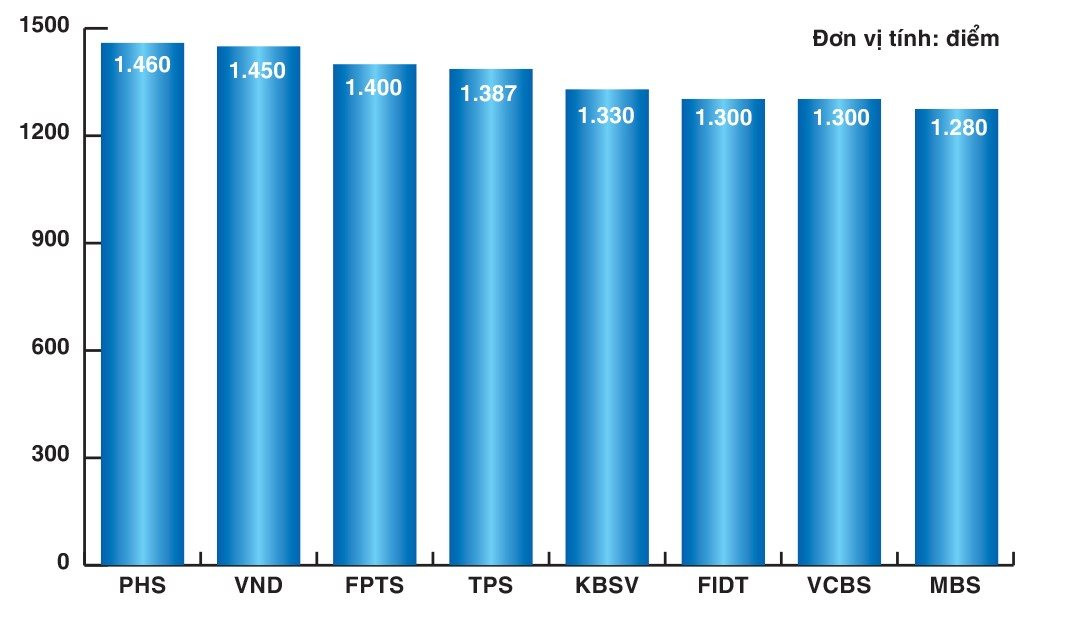

Meanwhile, securities companies still have optimistic forecasts for the Vietnamese stock market in 2024 and believe that the VN-Index will return to its historical peak.

Forecasts on VN-Index 2024 by Securities Companies.

National Securities Company (NSI) expects that the domestic economy will continue to recover and the VN-Index will reach around 1,400 points in 2024. VNDirect Securities also has an optimistic view of the market in 2024 with expectations that the VN-Index can reach 1,400 – 1,450 points.

In the Phu Hung Securities Company (PHS) report, the VN-Index is expected to increase to 1,460 points in 2024. PHS believes that the supportive policies from domestic investment will help Vietnam’s economy achieve the government’s goals. GDP is expected to regain a stable growth rate of about 6.5%.

With lower expectations, TPS Securities forecasts that the VN-Index will fluctuate around the target of 1,387 points, corresponding to a cautious growth rate of 10% for the whole year and a target P/E of 15.x (equivalent to the average P/E of the last 10 years). The reason given by TPS is that the macro difficulties will gradually decrease, laying the foundation for the world central banks to loosen monetary policies. Thereby stimulating consumption growth, creating conditions for Vietnam’s exports.

On a positive note, MB Securities (MBS) expects the profits of listed companies to increase by 16.8% in 2024, in a context of positive macro improvements. MBS also predicts that Vietnam’s exports in 2024 will grow by 6 – 7% from the low of 2023 thanks to the significant cooling down of the supply chain and the trend of bottoming out in phone and electronic component demand. Public investment disbursement is estimated to achieve a rate of 85% – 90% of the plan thanks to the efforts of management agencies. Monetary policy in 2024 will be more balanced and actively support growth. Input interest rates tend to reach a bottom in the first quarter of 2024 and increase slightly from the middle of the year but still remain at a low level.

Meanwhile, VinaCapital forecasts that the profit growth of listed companies in Vietnam will increase by over 20% in 2024.