At the end of 2023, Highlands Coffee introduced and launched a membership card, a physical card bearing the brand name, used for payment when purchasing directly at Highlands Coffee stores (excluding Highlands Coffee stores in Foodcourt Menas Mall, Giga Mall, Lotte Mart, Sense City, Aeon Mall, and Da Nang International Airport). Customers can top up money into this card and use it for payment instead of cash.

According to the regulations of this coffee chain, the card will be activated by topping up a minimum value of 100,000 VND and can be done by the cashier at the store. The maximum balance in the card at any time is 5,000,000 VND. Under no circumstances will the balance in the Highlands Coffee card be refunded or convertible into cash. The balance in the card will also not accrue interest in any form. In addition, the minimum limit to be able to use the Highlands Coffee card for payment is 10,000 VND. The card is valid for 12 months.

Highlands Coffee introduces physical membership card

The physical membership card is not a common form at coffee chains in Vietnam, especially in the context where payment methods and loyalty programs can be done online. However, this is also seen as a method to encourage customers to spend by attracting them to top up in advance. Highlands Coffee is encouraging customers to register and spend through the physical card, with additional incentives of 5-10% added value when topping up. At the same time, this method also helps develop a loyal customer group who loves the brand.

Prior to Highlands Coffee, Stabucks, a large coffee chain, had rarely implemented and quite successfully with the membership card issuance model. In addition to the physical Starbucks Card, customer loyalty programs, point information, and payments are also synchronized on the app, called Starbucks Rewards.

For customers, the benefits of this service are accumulating points, receiving stars to redeem free beverages or discounts. At the same time, with a reputable brand, this is also a way for many people to show off their sophistication.

With its membership card program, Starbucks coffee chain has received a large amount of cash that customers voluntarily deposit. According to Starbucks’ Q3 2022 report, there are currently 27.4 million active Starbucks Rewards members in the US alone. This number is almost double the 14.2 million members at the end of 2017. Information from The Wall Street Journal (WSJ) shows that about 44% of transactions at Starbucks are now made through the membership card program. This rate is believed to be up to 80% during the Covid-19 pandemic. In addition, Starbucks Rewards members tend to spend three times more than regular customers.

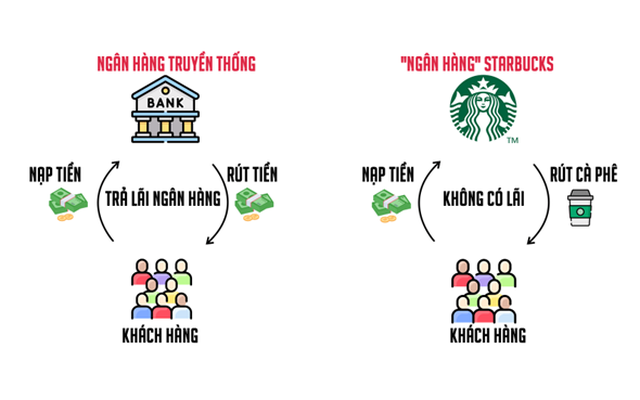

From Starbucks’s perspective, this membership card program not only collects customer consumption information, increases sales but also easily occupies capital with 0% interest. At the end of 2019, the coffee chain said it held up to $1.5 billion in pre-paid customer deposits in this membership card program. According to WSJ, this figure reached $2.4 billion by the end of 2022, ranking 385th out of a total of 4,236 banks in the US.

Therefore, Starbucks is also referred to as a “secret bank”, attracting billions of dollars in customer deposits without paying a single penny in interest. According to Medium, about 10% of these deposits are often forgotten or unused, creating an “unexpected income” for Starbucks. In financial reports from 2017 to 2019, the coffee chain recorded revenue from forgotten customer deposits at $104.6 million, $155.9 million, and $125 million, respectively.

However, at the beginning of 2024, the Washington Consumer Protection Alliance (WCPC) called on prosecutors of the state to investigate whether Starbucks’ policy violates consumer protection regulations.

“Starbucks has set up a membership card payment platform to encourage consumers to leave a surplus in the app. A few cents in these accounts may not seem like much to each person, but when added up, Starbucks has occupied nearly $900 million of customers’ capital over the past 5 years, thereby increasing revenue reports, profits, and bringing additional bonuses to the board of directors,” said Chris Carter, a leader of the WCPC. Consumers can top up a minimum of $5 and pay online a minimum of $10, making it difficult to use up the money in the account.

Nevertheless, Starbucks rebutted these allegations that customers can spend as they like without being coerced, and they can empty the account with odd amounts by paying cash at traditional stores.

Hoang Thuy