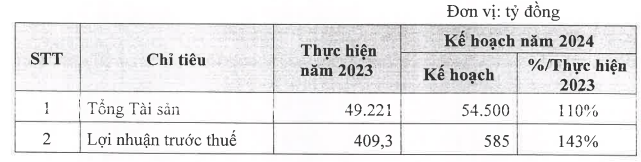

On March 15, Electricity Finance Joint Stock Company (EVN Finance, code EVF) will hold its 2024 annual general meeting. According to the published documents, EVF plans to present to shareholders the business plan for 2024 with a target of pre-tax profit reaching VND 585 billion, total assets reaching VND 54,500 billion, increasing by 43% and 10% respectively compared to the previous year.

In 2024, EVN Finance aims to further expand the scale of total assets, increase profit growth in line with the successful increase in equity capital in 2023. The company will also seek to develop relationships with strategic investors and enhance the capacity of equity capital sources.

EVN Finance is a rare financial company listed on the stock exchange. In 2023, the company’s pre-tax profit reached VND 409 billion, a decrease of 10% compared to 2022. The main reason for the decrease was a 23% decrease in net interest income to VND 708 billion. In addition, foreign exchange business activities and service activities were also less favorable. Total assets as of the end of 2023 reached VND 49,221 billion, an increase of 17% compared to the beginning of the year.

In terms of profit distribution plan for 2023, based on Directive No. 01/CT-NHNN dated 15/1/2024, credit institutions are encouraged to pay dividends to shareholders in the form of shares to enhance financial capacity and credit supply to the economy, and stabilize interest rates. EVNFinance proposes a dividend payment plan in the form of shares at a rate of 8%, corresponding to the issuance of over 56 million shares.

At the same time, the company also proposes the issuance of 7.5 million shares under the employee stock option program (ESOP).

If both of these proposed plans are completed, EVNFinance’s charter capital will increase by an additional VND 638 billion, reaching VND 7,681 billion. In 2023 alone, the company increased its charter capital from VND 3,510 billion to VND 7,042 billion, through the issuance of shares to existing shareholders and the issuance of shares under the employee stock option program (ESOP).

Also at the upcoming general meeting, EVNFinance shareholders will discuss and vote on reducing the maximum ownership ratio of foreign investors from 50% to 15% of equity capital. According to the company, this is to create favorable conditions for domestic investors with potential and desire to participate as shareholders of EVNFinance.

At the end of the session on February 26, EVF’s stock price reached VND 19,200/share, the highest price ever recorded for this stock, an increase of 20% compared to the beginning of the year.