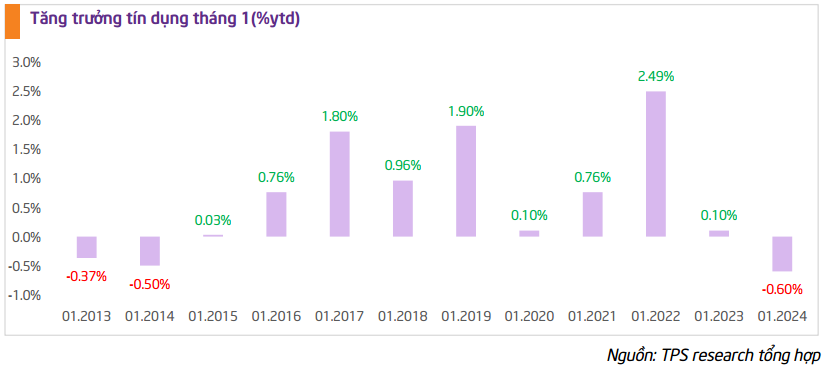

The analytics team at TPS expects credit growth (recorded at -0.6% in January 2024) to recover soon due to several supportive factors such as a positive macroeconomic environment, the low likelihood of recession in the US contributing to Vietnam’s export improvement, increasing demand for capital by businesses; The SBV has changed the mechanism and set a credit growth target of 15% for the entire system from the beginning of the year; many commercial banks have lowered deposit and lending interest rates in the early days of the year. Specifically, as of January 31, 2024, the average deposit and lending interest rates for new transactions of commercial banks decreased by about 0.15% and 0.25%, respectively.

The continuous decrease in deposit interest rates by commercial banks in the context of credit decline will lead to a decrease in deposit interest rates, thereby promoting the shift of savings into higher-yielding investment channels.

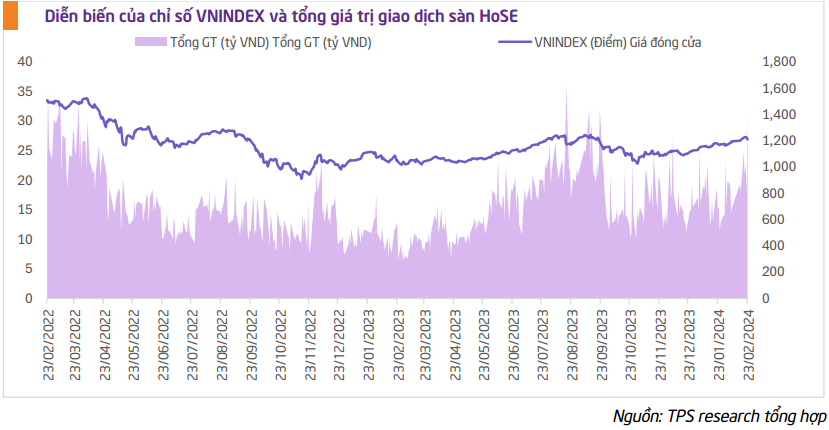

Liquidity and trading volume of the stock market have significantly improved in the days after the Lunar New Year. The total trading value in the first two months of 2024 reached VND 264.36 trillion, up 69% compared to the same period last year. In which, the trading value through matching orders reached VND 237.56 trillion, an increase of nearly 82%.

The number of new investor accounts has also increased. According to VSDC’s data, by the end of January 2024, the number of individual investor accounts in the country reached 7.35 million accounts, an increase of 125 thousand accounts compared to the end of the previous year.

In addition, the low-interest rate environment helps securities companies actively increase capital to stimulate margin lending.

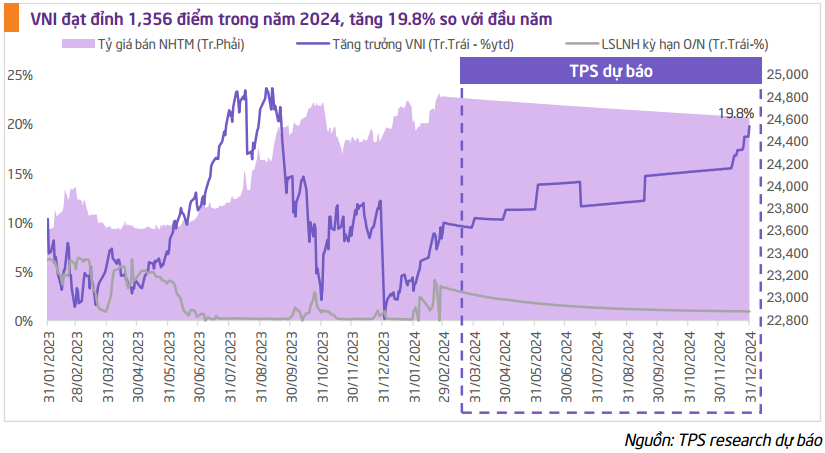

Regarding other factors, the analysis team believes that the USD/VND exchange rate will be more stable in 2024 compared to 2022 and 2023, when the Fed decides to cut interest rates and Vietnam’s export market recovers.

Accordingly, the movement of the USD/VND exchange rate is quite similar to the DXY index because an increase in the DXY implies a strong dollar, leading to a significant increase in the USD/VND exchange rate. However, the increase in the USD/VND exchange rate since the beginning of the year on February 20, 2024, is 1.1%, lower than the increase in the DXY index, which is 2.1%.

The inflation rate is also expected to cool down in 2024. Global inflation is forecasted to decrease sharply from 5.7% in 2023 to 3.9% in 2024. In Vietnam, experts assess that inflation in January 2024 is at a low level of 3.37% compared to 4.89% in the same period. Core inflation also decreased from 5.21% in January 2023 to 2.72% in January 2024.

“We expect CPI in 2024 to be around 3.72% and core CPI around 3.35%, still achieving the planned targets set by the National Assembly,” the analysis team forecasted.

Finally, the VAR model is used to evaluate the mutual impacts of exchange rates, interbank interest rates, and the VN-Index. The VAR model’s forecasting results show that the VN-Index is expected to reach the peak of 1,356 points in 2024, corresponding to an increase of 19.8% (calculated from the beginning of the year).