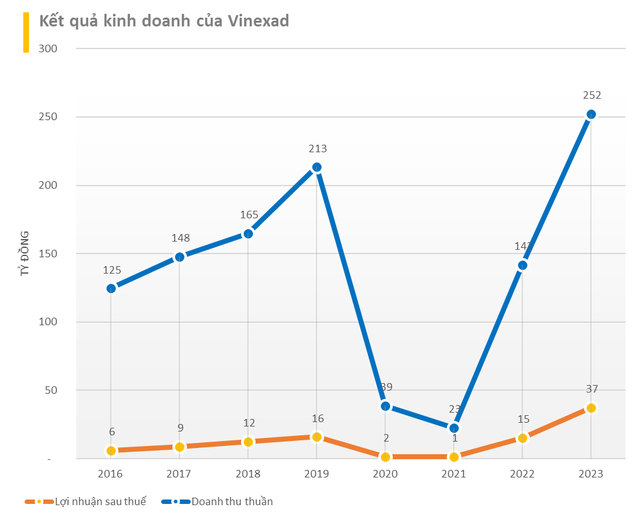

Vinexad Advertising and Trade Fair Joint Stock Company (Vinexad, stock code: VNX) recently announced its audited financial statements for 2023 with revenue of VND 252.3 billion, a 77.5% increase compared to the same period last year. After deducting expenses, the company reported a profit of VND 37 billion, 2.5 times higher than 2022.

This is also a record profit level in the history of Vinexad. In particular, the company also recorded an EPS of VND 30,580, the highest on the current stock exchange.

Vinexad used to be a state-owned enterprise under the Ministry of Industry and Trade, established in 1975, marking the birth of the advertising industry in Vietnam. The company currently operates in the fields of advertising, communication, event exhibition, and international trade promotion.

Vinexad connects businesses through programs, conferences, and collaborations to seek business opportunities and investment both domestically and internationally. Each year, the company organizes and participates in dozens of large-scale fairs and exhibitions, attracting thousands of businesses.

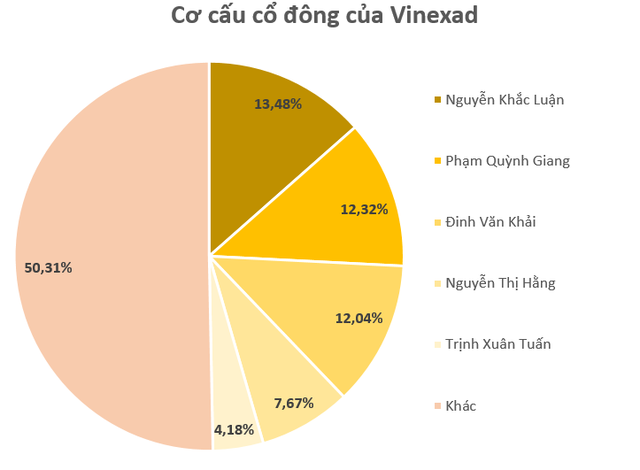

Currently, the Ministry of Industry and Trade has fully divested from Vinexad. The company first traded on the UPCoM exchange on June 10, 2010, with a charter capital of only VND 12.2 billion. Among them, Mr. Nguyen Khac Luan, the company’s CEO, is the largest shareholder of Vinexad with 13.48% of the capital.

Mr. Pham Quynh Giang, Chairman of Vinexad’s Board of Directors, is also a major shareholder of the company, owning 12.32%. Ms. Nguyen Thi Hang, Mr. Giang’s wife, owns 7.67% of the shares. In addition, Mr. Dinh Van Khai, Deputy CEO, currently holds 12.04% of the capital. Due to the majority of the company’s charter capital being held by the leadership and family members, Vinexad’s VNX shares on the UPCoM exchange have low liquidity.

As of December 31, 2023, the company’s total assets reached VND 120.4 billion, a 71% increase compared to the beginning of the year. Among them, nearly 80% of the company’s assets are cash and deposits, at VND 95 billion. Inventory is at VND 13.2 billion. The company has almost no financial debt. Owner’s equity is at VND 67.7 billion.

The company also regularly pays cash dividends. At its peak, in 2022, Vinexad paid shareholders VND 6,000 per share, equivalent to a 60% dividend ratio.

At the end of the trading session on March 1, VNX shares were priced at VND 27,000 per share and had almost no liquidity. However, VNX had previously witnessed a “shocking increase” in 2019.

Specifically, at the beginning of April 2019, VNX’s stock price was still as low as “a glass of iced tea,” at about VND 1,500 per share. However, by the end of August 2019, the stock had skyrocketed to VND 67,700 per share, equivalent to a 45-fold increase in just 4 months. However, liquidity was only a few hundred to a few thousand units per session.