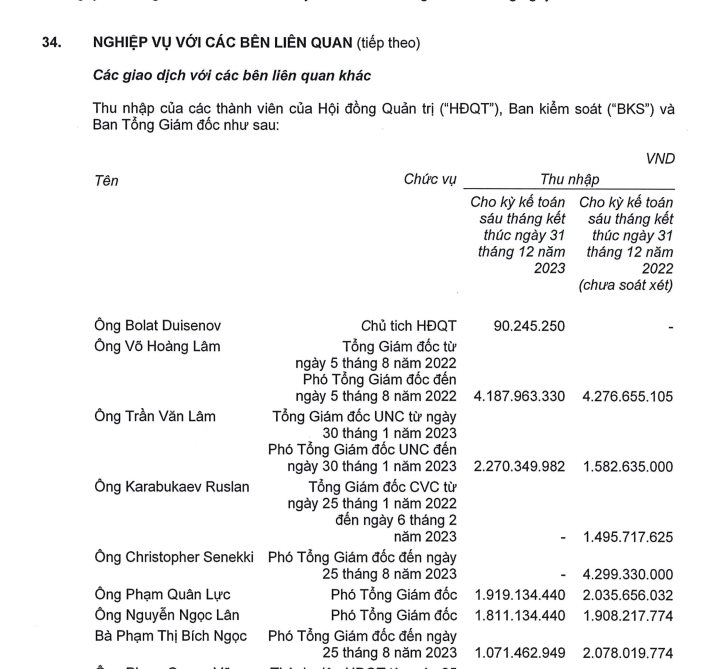

Coteccons (CTD) construction company has recently released its financial statements for the 6-month accounting period ending on December 31, 2023. Notably in the Income section, the Board of Directors, the Board of Supervisors, and the General Director have received significant compensation, with the CEO, Vo Hoang Lam, standing out with over 4 billion VND. This means that Lam’s monthly income is up to 700 million VND.

At Coteccons, the CEO’s income is currently more than 2 times higher than that of the Vice CEOs. Compared to the income of Chairman Bolat Duisenov (over 90 million VND/6 months), Lam is being paid 46.5 times higher.

Compared to the industry average, the CEO’s income at Coteccons is also comparable to the salaries of CEOs in billion-dollar companies on the stock market.

Regarding Lam, he has nearly 17 years of experience working and managing through various important positions from Commander, Block Director, Project Director at Coteccons. During the top management crisis in 2020, while most of the old “team” left with former Chairman Nguyen Ba Duong, Lam was one of the few who stayed.

Lam was then appointed as CEO of Coteccons on August 5, 2022.

In terms of business, for the 6-month fiscal period 2023-2024 (from July 1, 2023, to December 31, 2023), Coteccons recorded a net revenue of 9.784 trillion VND, a 5% increase compared to the same period last year. After deducting expenses, the net profit increased by 8.8 times to nearly 136 billion VND.

As of December 31, 2023, Coteccons held over 2.842 trillion VND in cash and cash equivalents, a 51% increase compared to the beginning of the year, all of which are deposits in banks. In addition, short-term financial investments totaled over 1.768 trillion VND, including over 1.462 trillion VND in fixed-term deposits with commercial banks lasting more than 3 months and not exceeding 1 year.

The company also had short-term securities investments of over 49 billion VND in ETF fund certificates of Kim Growth VN30 and over 28 billion VND in shares of FPT Corporation.

As for debts, the company’s total debt amounted to over 13.244 trillion VND by the end of the period. Among them, short-term loans accounted for nearly 582 billion VND, and long-term loans accounted for 496 billion VND.