|

Forecast of Stock Trading for VNM ETF After Q1 Review

|

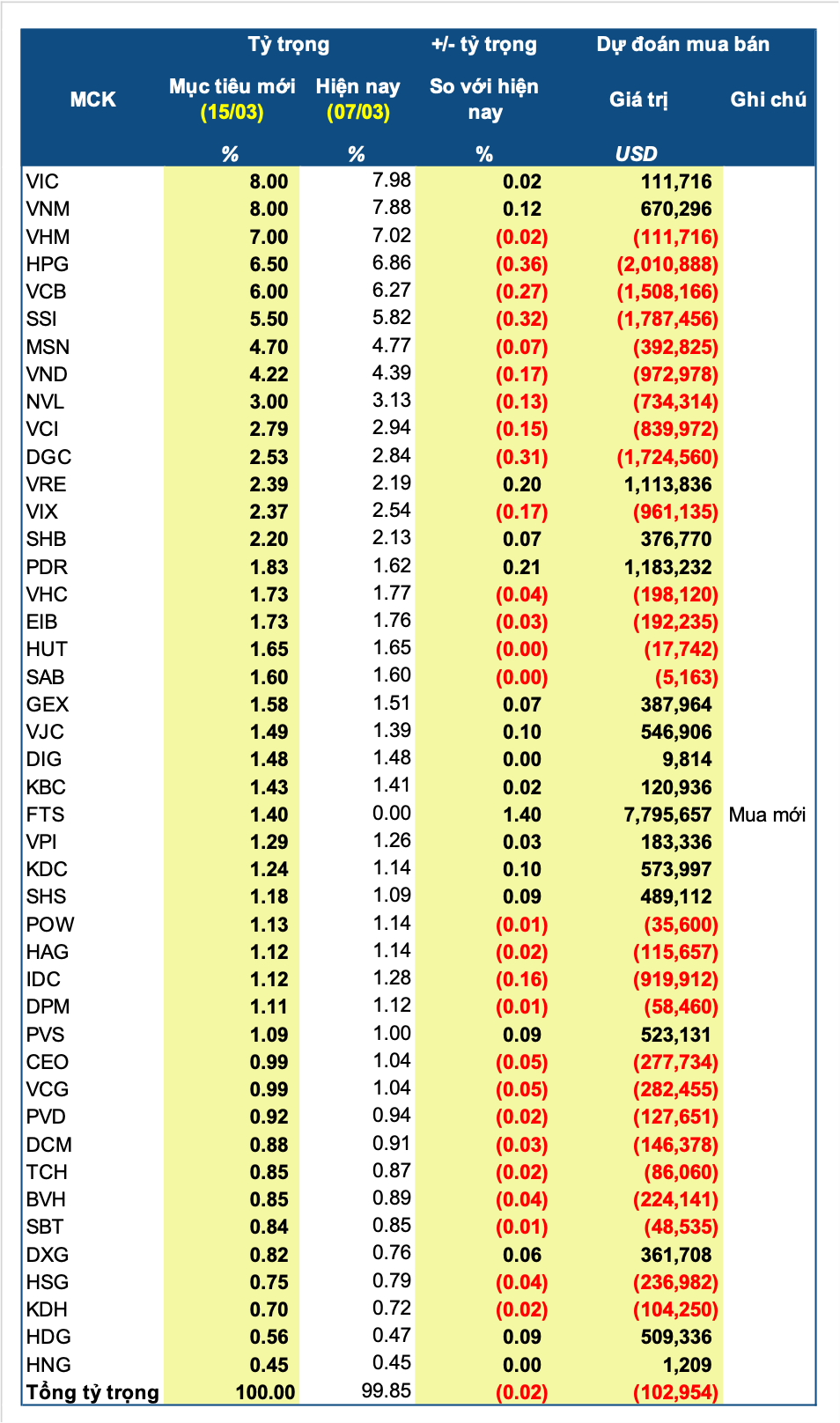

FTS is forecasted to be bought with a value of nearly 8 million USD, also the highest value stock purchased in this review. Based on the closing price of 08/03 at 59,300 dong/share, it is estimated that about 3.2 million shares of FTS will be bought.

The next two stocks are PDR and VRE, with values of around 1.2 and over 1.1 million USD, respectively, corresponding to around 1 million shares based on the closing price of 08/03.

On the other hand, HPG is expected to be the most heavily sold stock in terms of value, with over 2 million USD (about 1.6 million shares).

After the Q1 2024 review, the number of stocks in the MarketVector Vietnam Local Index portfolio – the benchmark of VanEck Vietnam ETF (VNM ETF) – is 45 stocks and 1 ETF certificate, increasing by 1 stock compared to Q4 2023. All are Vietnamese stocks. The largest expected weight belongs to VNM and VIC (both 8%). Then comes VHM (7%), HPG (6.5%), and VCB (6%).

The changes to the constituent stocks of the MarketVector Vietnam Local Index will take effect after the market closes on Friday (15/03) and will officially be traded from Monday (18/03).