Pyn Elite Fund has just released its investment performance report for February, which recorded a 5.2% increase, significantly lower than the 7.6% increase of the Vn-Index. The underperformance was due to the stagnant growth of Sacombank’s STB shares and the 1% depreciation of the VND against the USD.

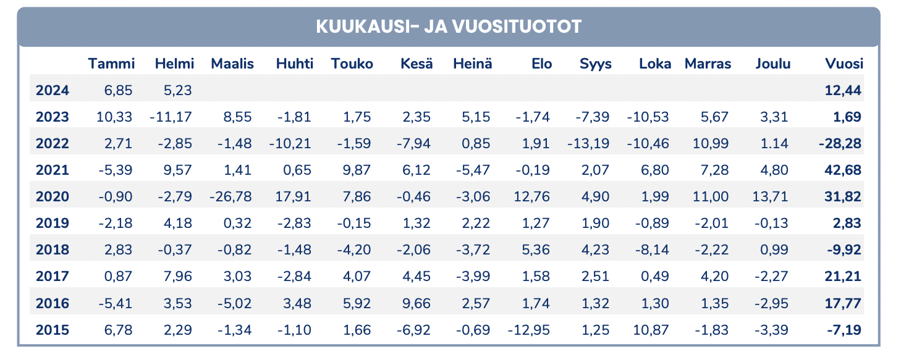

Overall, in the first two months of the year, Pyn Elite Fund’s investment performance reached 12.44%, higher than the 10.9% increase of the VN-Index.

In February, the strongest performing stocks in Pyn Elite Fund’s portfolio were VHC (19%), FPT (13.9%), and CTG (12.5%). On the other hand, MIG, DXS, and SHS stocks experienced modest declines ranging from 1% to 3%.

Currently, banking stocks still dominate the fund’s portfolio, but the proportions of STB, HDB, MBB, and TPB have all decreased slightly compared to the end of January.

In a recent letter to new investors, Pyn Elite Fund stated that they have high expectations for Vietnam’s profitability in 2024. Based on the performance of the VN index, domestic investors are returning to the buying side. The value of PYN Elite’s stocks has increased by 10% since the beginning of the year. Vietnam’s currency market has stabilized, with good bank liquidity and rapidly decreasing interest rates.

The fund believes that Vietnam’s listed companies will achieve over 20% profit growth in 2024. This year will be a positive year for the largest capitalized banking sector on the stock exchange. Stocks on the stock exchange, especially banking stocks, are still undervalued after a few years.

“The potential for these stocks to increase in value is significant as the economic activity continues to improve with a favorable monetary market cycle,” emphasized the fund from Finland.

In terms of macroeconomic conditions, Pyn Elite Fund predicts that manufacturing activity will strengthen as order numbers increase and inventories decrease. In the first two months of the year, exports increased by 19.2% compared to the same period last year. Industrial production increased by 5.9% compared to the same period but is still lower than exports. PMI increased from 50.3 in January to 50.4 in February due to higher output and order numbers.

Retail sales growth slightly increased to 8.5% in February (8.1% in January). Pyn Elite predicts that consumption will grow stronger in the second half of 2024 as the labor market improves alongside export recovery.