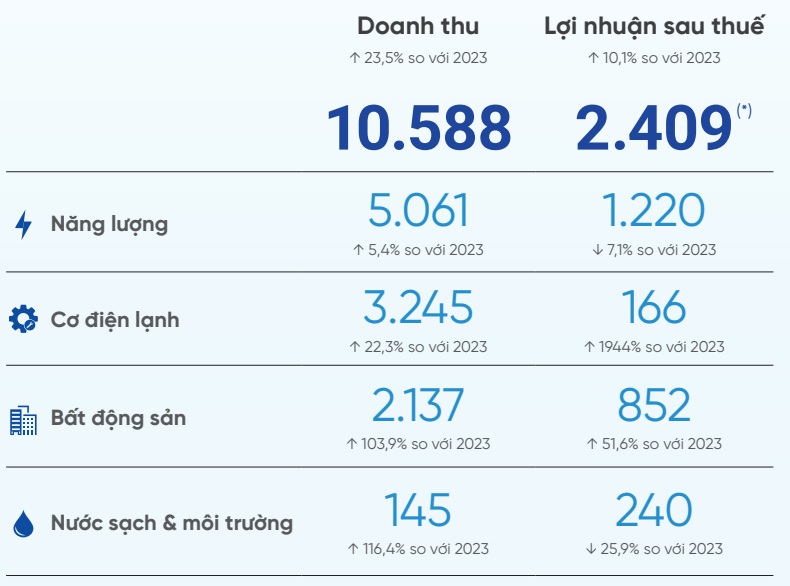

In its 2023 annual report, REE reveals its revenue plan for 2024 of nearly 10.6 trillion VND, a 24% increase compared to 2023. The target net profit is over 2.4 trillion VND, a more than 10% increase.

Specifically, the core electromechanical refrigeration sector is expected to generate over 3.2 trillion VND in revenue, a 22% increase, and may turn a loss of 9 billion VND in 2023 into a profit of 166 billion VND. The real estate segment is also expected to have a strong transformation with over 2.1 trillion VND in revenue (double the previous year) and a profit of 852 billion VND (an increase of nearly 52%).

Meanwhile, REE takes a more cautious approach with the energy and water sectors, both aiming to reduce profits. Specifically, the energy sector is expected to achieve over 5 trillion VND in revenue (a 5% increase) and over 1.2 trillion VND in net profit (a 7% decrease). The water and environmental sector plans for 145 billion VND in revenue, more than double the previous year, but the target net profit is expected to decrease by nearly 26% to 240 billion VND.

|

REE‘s business plan for 2024

Source: REE

|

Regarding the profit distribution plan, REE plans to propose a 25% dividend at the 2024 annual general meeting (including 10% in cash and 15% in shares – equivalent to issuing 61.3 million new shares). In 2024, a provisional dividend of 10% in cash is expected.

In addition, REE plans to propose a remuneration of nearly 11.3 billion VND for the members of the Board of Directors and the Supervisory Board in 2024.

Energy (REE Energy): Declining business due to El Nino, focusing on expanding the renewable energy portfolio

Regarding the detailed plan, REE believes that the El Nino phenomenon will have a significant impact on hydroelectric reservoirs in the first three months of 2024, and it is likely to continue until June 2024. At the same time, the alpha coefficient, adjusted for hydroelectric plants, will increase from 90% in 2023 to 98% in 2024. The full market price of electricity will decrease by 231.1 VND/kWh compared to the previous year, which also reduces the production capacity of power plants. Therefore, the company has set a cautious plan for REE Energy’s energy sector.

Image: REE

|

Thermal power plants are predicted to operate at full capacity and expect an increase in electricity generation. However, in REE‘s portfolio, many power plants have been in operation for a long time, leading to high heat consumption and high costs, which affect business results.

REE evaluates that 2024 will have some objective negative factors, such as the implementation plan for Power Development Plan 8 (PDP8) still being reviewed and improved, the incomplete electricity pricing mechanism, and unclear legal regulations. Therefore, the company will focus on expanding the portfolio with an additional 100 MW of renewable energy projects. Additionally, it will explore merger and acquisition opportunities, develop new projects, and expand capacity when PDP8 is completed and implemented.

Mechanical and Electrical (REE M&E): Aiming to maintain market share

As one of the core sectors, REE aims to maintain its market share in 2024 and considers it a milestone year to shape its business direction, expand its activities, improve competitiveness, and ride the wave of economic recovery.

Phu Bai Airport project – Image: REE

|

REE evaluates that the late 2023 interest rate cut and efforts to unblock the real estate sector indicate the potential for recovery in the private and foreign-owned enterprise project segment. Therefore, REE will selectively choose projects in advantageous fields, focusing on public investment projects related to key infrastructure projects with budget capital.

To strengthen internal capabilities and enhance financial health, starting in 2024, REE M&E will implement a risk assessment process for project implementation, exercise caution in evaluating participation in projects based on the feasibility of capital sources, legal requirements, and the investor’s capacity. Measures such as suspending construction work may be applied in case of payment violations by investors.

In terms of air conditioning business, REE forecasts intensified competition in technology, pricing, and policies. The top priority is to maintain market share through the development of a strong distributor network.

Real Estate (REE Land): Developing e.town 6 in the second quarter, continuing to increase land bank

For the office leasing segment, REE believes that e.town 6 is facing significant competitive pressure as there is a supply of high-end office space of up to 120,000m2 set to launch in Ho Chi Minh City during 2024-2025, along with over 81,000m2 of completed Grade-A office space in the next two years.

The construction of e.town 6 is expected to be completed and basic completion to be achieved by the end of March 2024, which is 6 months behind schedule. The building will be put into operation in the second quarter of 2024, with a total lease area of nearly 37,000m2 and an expected occupancy rate of 30%.

e.town 6 office project – Image: REE

|

According to REE‘s assessment, from 2024, the dominant trend will be green offices, and e.town 6, meeting this criterion, will be an ideal choice for many businesses that prioritize integrating sustainable development into their brands.

For real estate development, REE plans to prioritize the development of existing projects in 2024. These projects include the completion and handover of a commercial residential project in Bo Xuyen (Thai Binh) by the end of March 2024, recognizing all revenue and profit in 2024; completing land clearance and construction procedures for a residential project in Phu Hoi commune (Nhon Trach, Dong Nai); and initiating design and completing licensing procedures for a Commercial – Office building project in Phu Huu (Thu Duc).

In addition, REE aims to continue to develop its land bank by acquiring new projects through bids, auctions, or mergers and acquisitions.

Water & Environment (REE Water): Heading towards sustainable growth

REE aims to achieve sustainable growth in its clean water sector, with a slight increase in water production in 2024.

BOO Water Plant in Thu Duc – Image: REE

|

In terms of wastewater treatment, the company will continue to search for investment opportunities in wastewater treatment plants in Ho Chi Minh City, as well as research additional technologies.

Similarly, for waste treatment (incineration for power generation), REE will also continue to search for investment opportunities in plants with a capacity of 2,000 tons/day.