China’s Gold Demand Rises 5.94% in Q1 2024

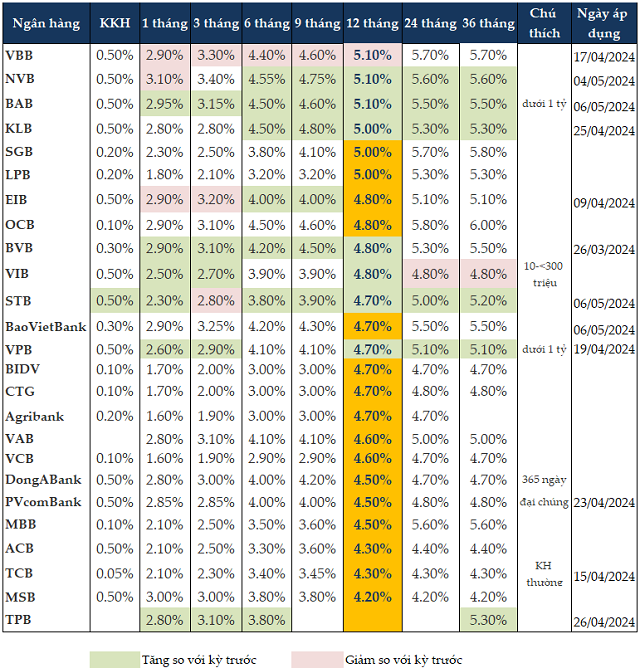

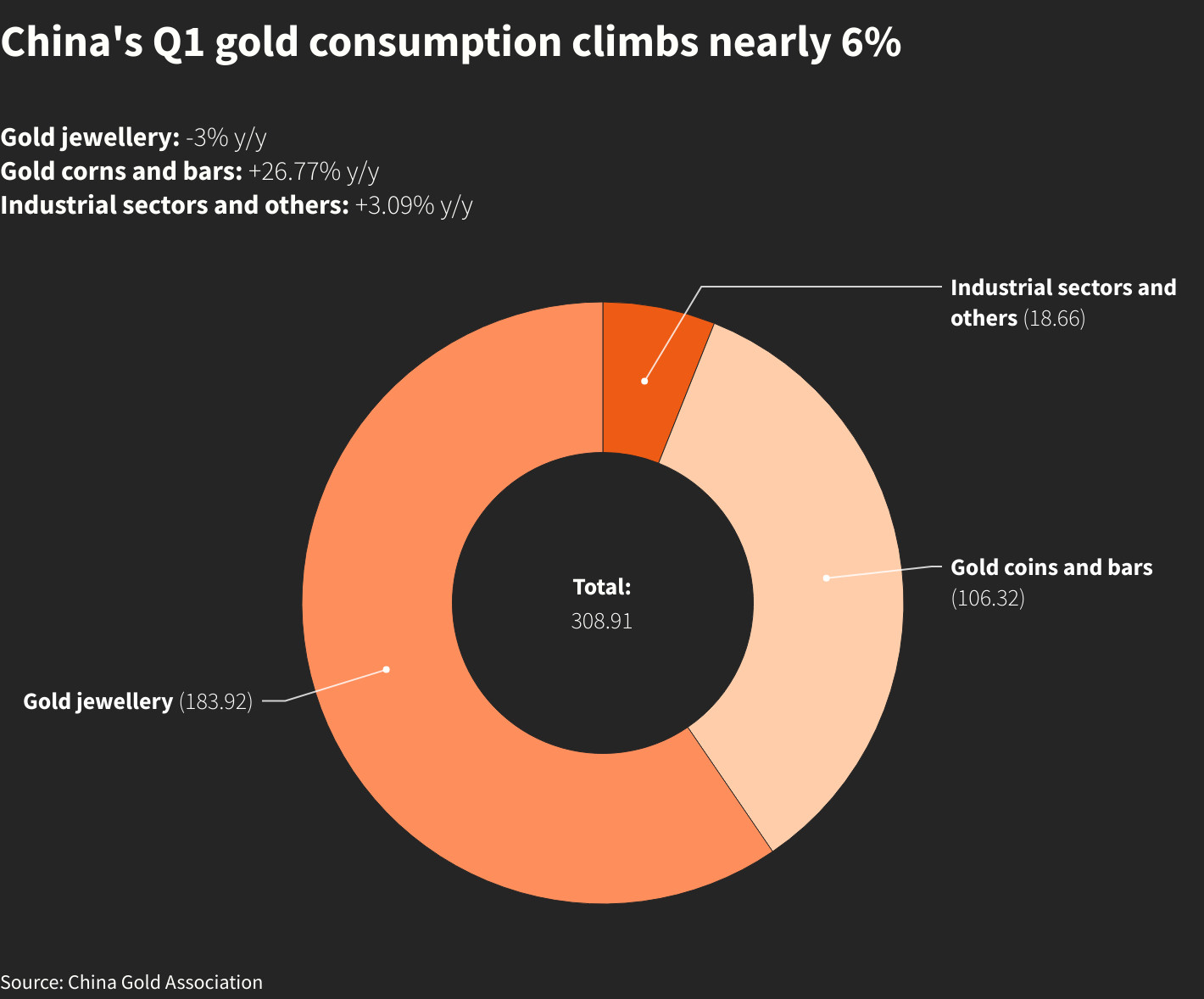

> China purchased a total of 308.91 tonnes of the precious metal in the first three months of the year. According to the China Gold Association (CGA), gold bars and coins accounted for 34% of total consumption, rising by 26.77% to 106.32 tonnes during the January-March 2024 period.

Buying by the central bank of the world’s second-largest economy continued for the 17th consecutive month, bringing total gold reserves to 2,262.67 tonnes at the end of March 2024.

> Active trading on China’s gold exchanges has also ignited enthusiasm among investors in the country. Gold futures trading volume on these platforms doubled in March and April compared to the same period last year, as Chinese investors seek to diversify their portfolios away from a struggling real estate sector and a declining stock market.

> Data tracked by Bloomberg shows that net long positions in gold on the Shanghai Futures Exchange (SHFE) currently stand at 295,233 contracts, equivalent to 295 tonnes of gold. This represents an increase of almost 50% since the end of September last year – just before geopolitical tensions escalated in the Middle East. In early April 2024, net long positions on the exchange reached a record 324,857 contracts.

> However, while soaring gold prices have made the yellow metal more attractive to Chinese investors, they have also made it too expensive for many regular buyers. Jewelry demand in the country fell by 3% in Q1 2024 to 183.92 tonnes, or 59.5% of total consumption, as some consumers became cautious amid rapidly rising bullion prices.

> The most-active gold futures contract on the Shanghai Futures Exchange settled at 531.3 yuan (US$73.32) per gram on March 29, 2024, up 10% since the start of the year.

> According to the CGA, the surge in gold prices has increased operational risks for gold bullion processing and trading enterprises.

> On the production side, China’s domestic gold output also increased by 1.16% to 85.96 tonnes in Q1, while gold production from imported materials jumped by 78% to 53.23 tonnes, bringing total domestic gold production to 139.18 tonnes, up 21.16% year-on-year.

> Meanwhile, Hong Kong’s Census and Statistics Department reported on Thursday, April 25, that China’s mainland net gold imports via the Hong Kong Special Administrative Region surged by 40% in March from the previous month.

> The data shows that the world’s top gold consumer imported a net 55.836 tonnes of the precious metal in March, compared to 39.826 tonnes in February. Total gold imports from Hong Kong rose by 40.2% to 63.499 tonnes.

China’s market data is particularly important for the global market as it is the world’s largest gold consumer, and its buying trends can influence global prices.

> It should be noted that the Hong Kong data may not provide a complete picture of China’s buying activity, as gold is also imported via Shanghai and Beijing. Elsewhere, Switzerland – the world’s largest gold refining and bullion trading hub – exported more gold to mainland China and the Hong Kong SAR in March.

> The People’s Bank of China (PBOC), which controls the flow of gold into the country through quotas for commercial banks, was reportedly the largest official-sector gold buyer in 2023.

> The Chinese central bank recently disclosed that it added 160,000 troy ounces of gold to its reserves in March, bringing China’s total gold holdings to 72.74 million ounces at the end of March 2024, up from 72.58 million ounces in February 2024.

> “Economic uncertainty is driving disposable income into gold as a hedge,” said StoneX analyst Rhona O’Connell. “Physical gold demand has strengthened in China this year because of ongoing currency weakness and economic concerns. Increasing numbers of Chinese investors are looking to diversify away from a struggling real estate sector and a declining stock market.”

> O’Connell added that February’s weak imports – reflecting restricted import quotas and the fact that the Lunar New Year fell in February this year – have been replaced by a return to more normal flows in March.

> Gold prices have undergone a correction in the past week, falling 2.26% in the space of a week. Despite this, JP Morgan analysts said on Thursday, April 25, that they remain bullish on gold, with a peak target of US$2,600/oz.

> Previously, there have been forecasts of gold price targets this year as high as US$3,000/oz.

> Sources: Reuters, Kitco