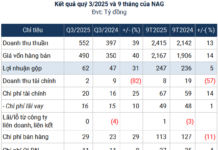

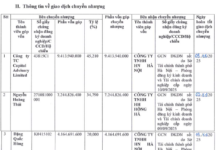

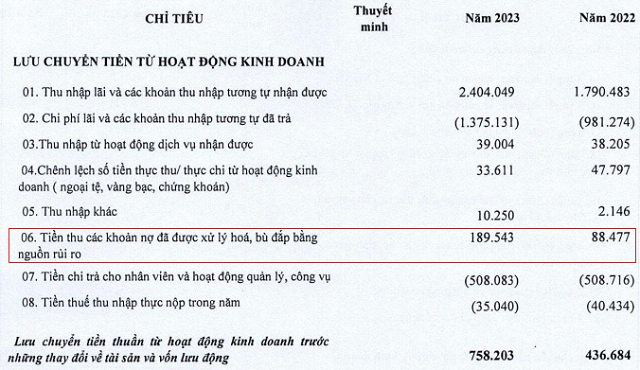

Saigonbank: Q4 profits surge 92-fold driven by non-interest income, group 5 debts account for...

The consolidated financial statement shows that Saigon Commercial Joint Stock Bank (Saigonbank, UPCoM: SGB) recorded a pre-tax profit of over 84 billion VND in the fourth quarter of 2023, representing a significant increase of 92 times compared to the same period last year. The proportion of non-performing loans at the end of the year accounted for nearly 60% of the total outstanding loans, indicating a high possibility of capital loss.

Cooling Down the VND/USD Exchange Rate

After several days of strong gains, both the in-bank and out-bank US dollar prices have cooled off as the international USD Index declines.

Transfers to Ho Chi Minh City reached over $9.5 billion in 2023

Despite the global economic downturn, inflation, and armed conflicts impacting economic growth and related remittance factors, the amount of remittance flowing into Ho Chi Minh City, Vietnam in 2023 still maintained a strong growth rate, reaching 9.46 billion USD.

LPBank Achieves 2023 Business Milestone with Lowest Non-Performing Loans in the Industry

In 2023, overcoming the challenges of the economy, LPBank has achieved its business objectives as entrusted by the Board of Shareholders. The credit growth has reached an impressive 16.83%, while the mobilization reached 13.7%. Aiming for extraordinary profitability, LPBank has earned over 7,000 billion VND. Moreover, LPBank has shown exceptional management by significantly reducing its non-performing loans to an impressive level of 1.34%, placing it among the top banks with the lowest non-performing loans in the industry.

HDBank achieves a profit of VND 13,017 billion, intensifying sustainable finance and comprehensive digital...

With a sustainable development strategy and effective risk management, HDBank has surpassed the fluctuations in 2023 to achieve high growth across all indicators, with its non-performing loans among the lowest in the industry.

Bring charges and arrest NHNN Inspector for forging documents to deceive

Phạm Trọng Cường, an expert in the field of State Bank Inspection and Supervision - Ho Chi Minh City branch, has recently been arrested by the Ho Chi Minh City Police for investigation into fraudulent activities involving misappropriation of assets and the use of counterfeit official stamps and documents.

Lunar New Year Special: SHB Offers Attractive Gifts for Business Customers

From now until March 31, 2024, Sai Gon - Ha Noi Bank (SHB) is launching the Tet promotion "Fully charged - Embarking on a prosperous New Year" nationwide, offering various gifts and diverse discounts on products and services worth up to over 600 million VND for business customers.

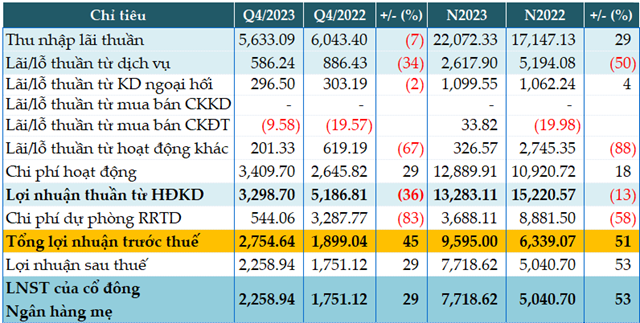

Sacombank records pre-tax profit of 9.595 billion dong in 2023, up 51%

According to the recently released consolidated financial statements, Sacombank (STB) reported a pre-tax profit of VND 9,595 billion in 2023, representing a 51% increase compared to the previous year, driven by a reduction in risk provisions.

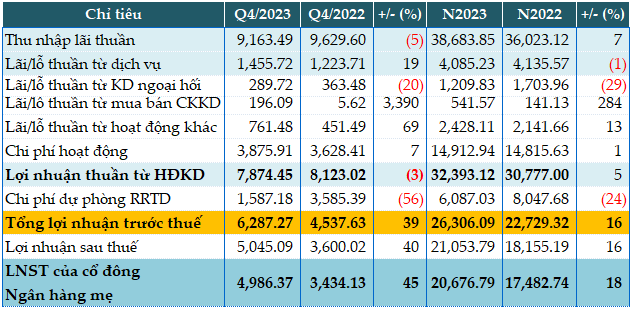

Maintain CASA ratio above 40%, MB pre-tax profit in 2023 exceeds 26,300 billion

Military Commercial Joint Stock Bank (MB, HOSE: MBB) has reported a pre-tax profit of over 26.306 trillion Vietnamese dong in 2023, showing a 16% increase compared to the previous year. This remarkable growth can be attributed to the reduction in provisions for credit risks.

Latest Vietcombank Interest Rates in February 2024

According to the latest survey in February 2024, the highest deposit interest rate at Vietcombank is 4.7% per annum, applicable to personal deposits of 12 months or more with interest paid at the end of the term.