Billions of dollars poised to pour into Vietnamese stock market post-upgrade, revealing noteworthy stock...

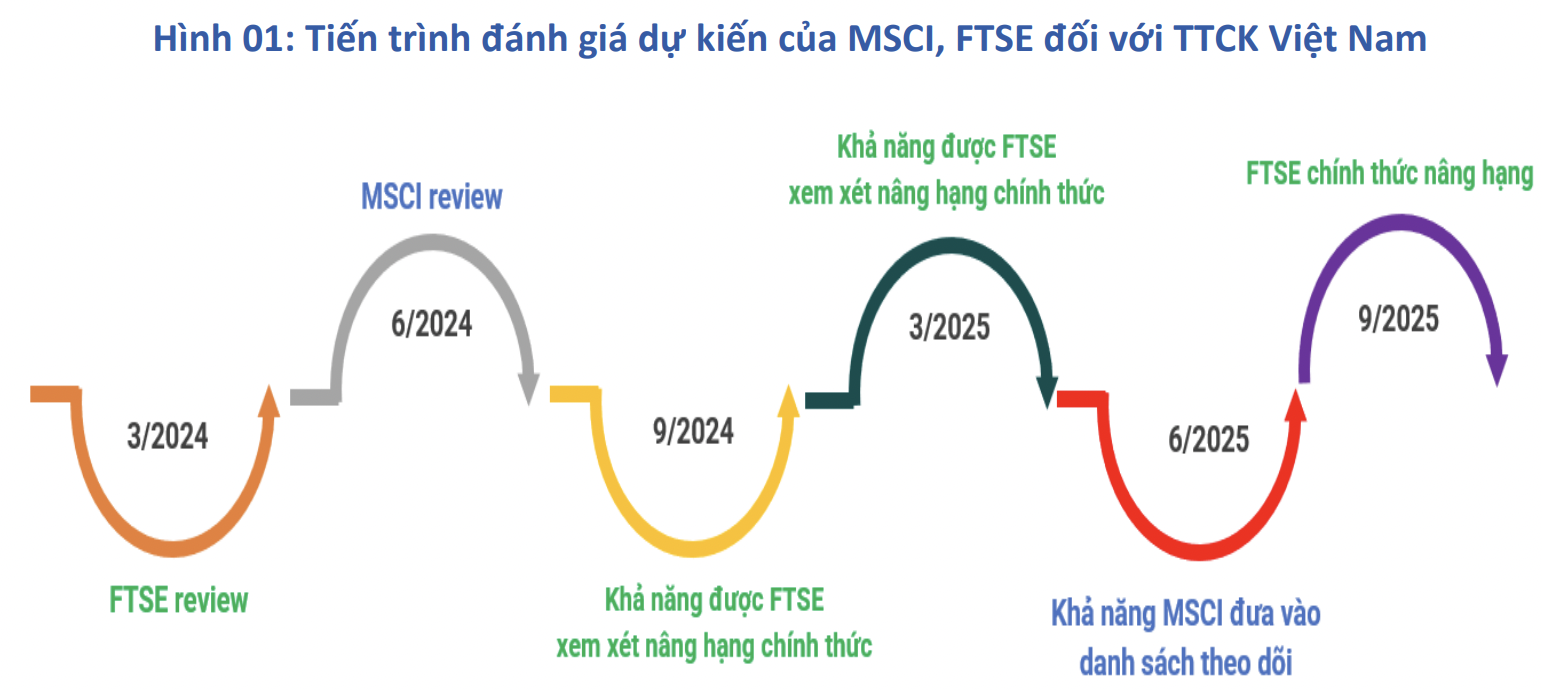

In the near future, according to BSC, the Vietnamese Stock Market may be officially upgraded to a frontier market by FTSE Russell. It is expected that the market will attract around 1.3-1.5 billion USD from open-end investment funds/ETFs referencing FTSE's criteria.

Event Schedule and Stock News 01/30

"Compile all the notable news related to listed companies on the stock market."

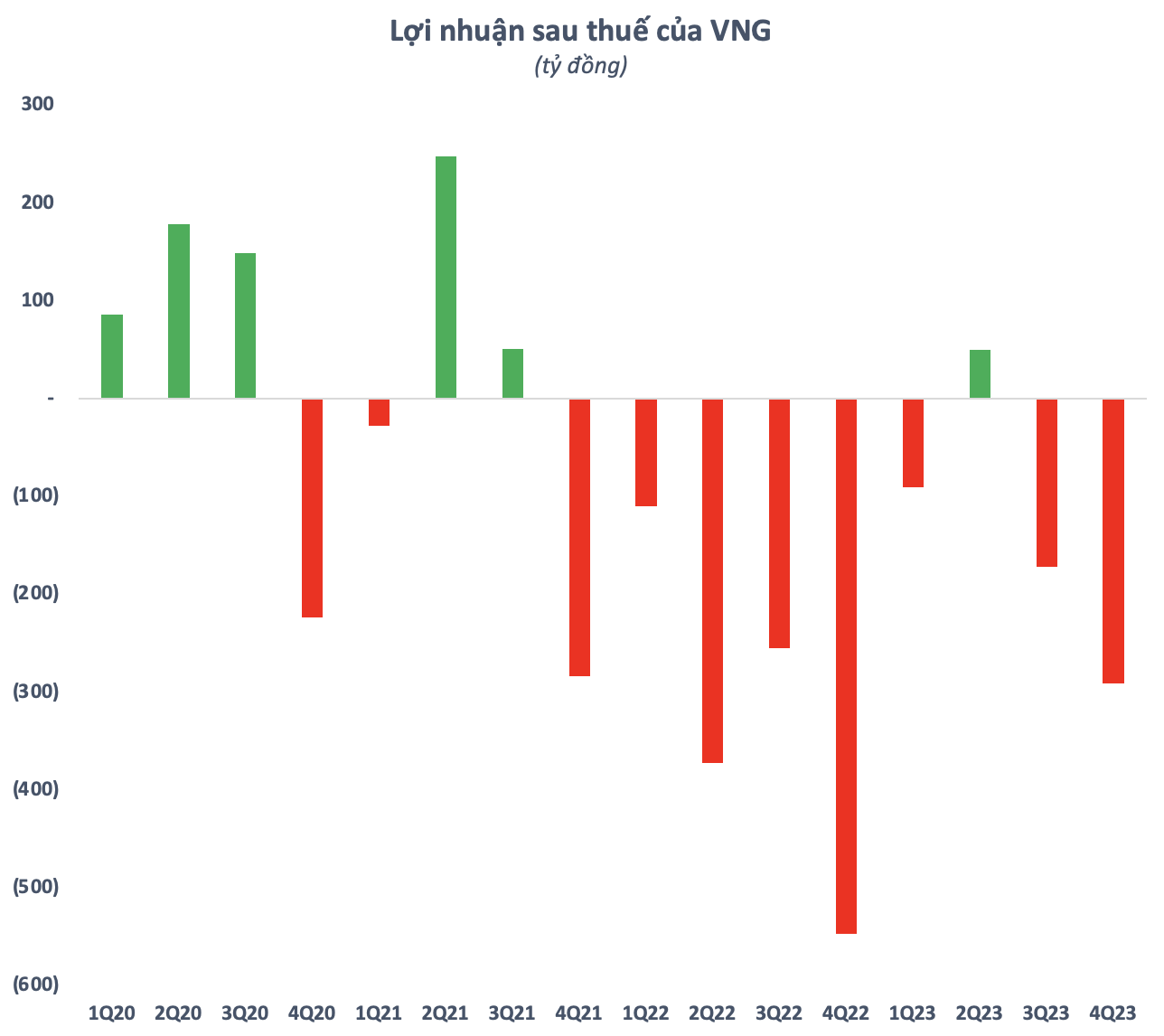

VNG, Vietnam’s “unicorn” in the technology industry, continues to pump money into ZaloPay despite...

The number of losses in 2023 has significantly narrowed compared to the previous year 2022, but it is not enough for VNG to achieve its net loss reduction target of 378 billion dong.

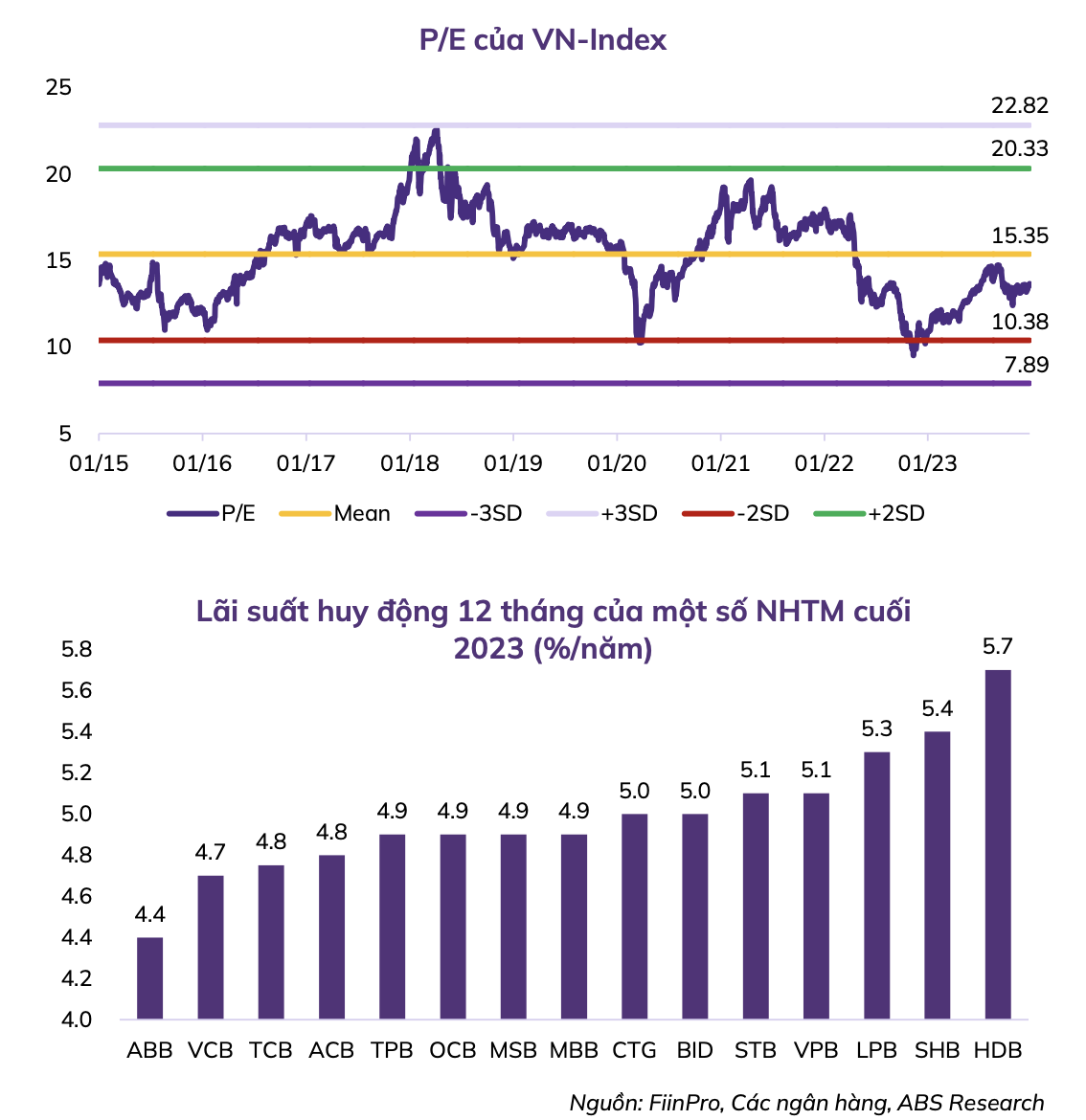

Attractive Value Opportunities in the VN-Index: Revealing the Names of Several Undervalued Stock Groups...

When it comes to P/E ratios compared to the 6-year average, ABS believes that large-cap industry groups have been heavily discounted.

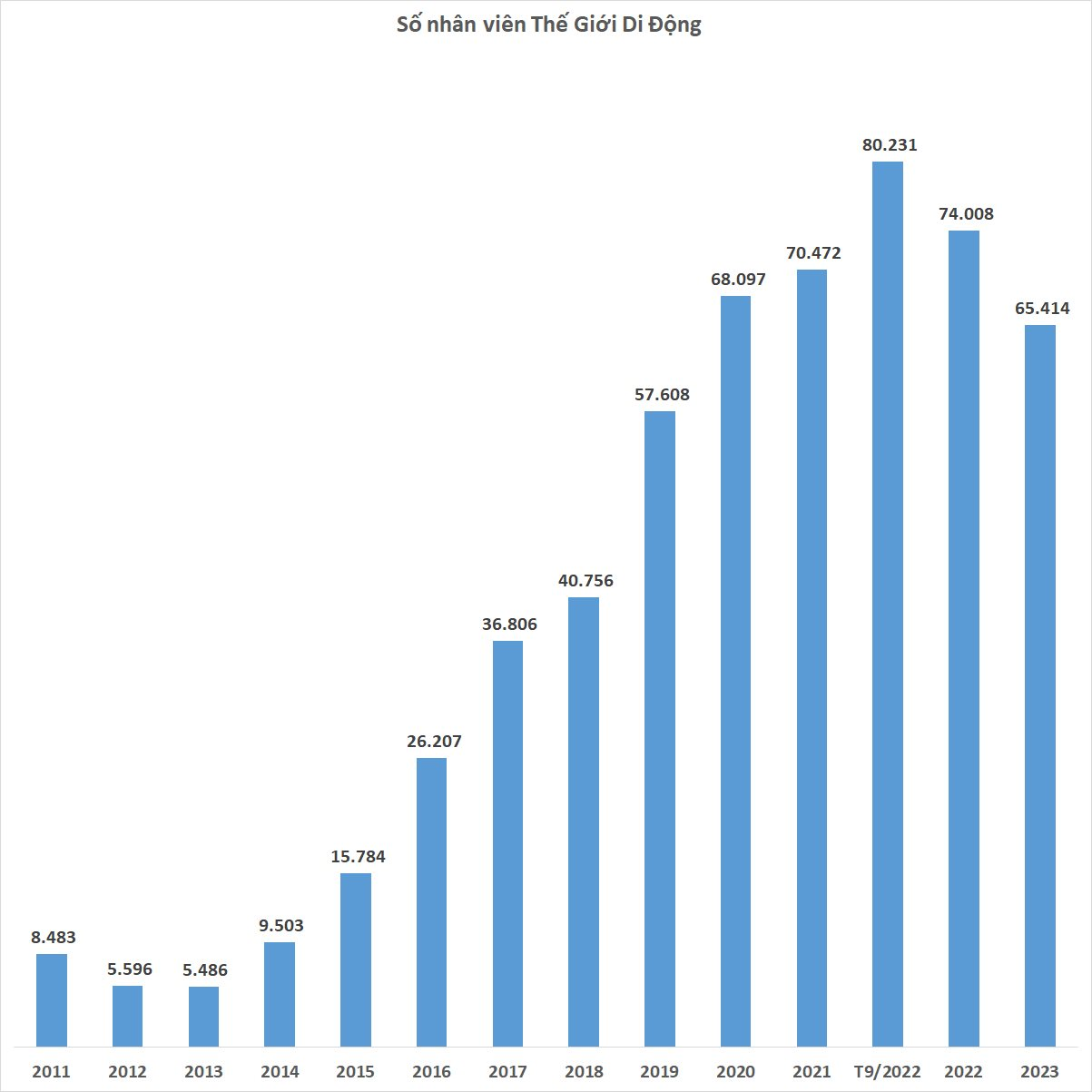

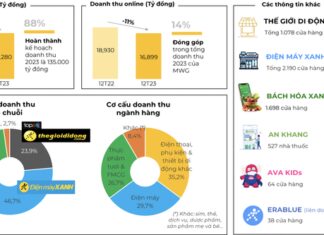

Captain Nguyen Duc Tai’s boat reduces 8,600 sailors in 2023, first decrease in a...

In 2019, when the company had a workforce of approximately 45,000 employees, Mr. Nguyen Duc Tai likened Thế Giới Di Động to a ship, with no employees or workers, but only a crew of 45,000 sailors setting sail together to fish and share the rewards. 2023 marks the first time in the past 10 years that the ship has reduced its crew.

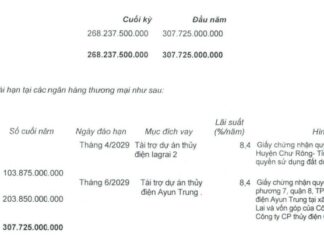

Q4 Boosts Quốc Cường Gia Lai’s Full-Year 2023 Profits

Quốc Cường Gia Lai recorded a net profit of 13.7 billion VND in Q4/2023, resulting in a full-year profit of 10.2 billion VND for 2023, a decrease of 68% compared to the performance in 2022.

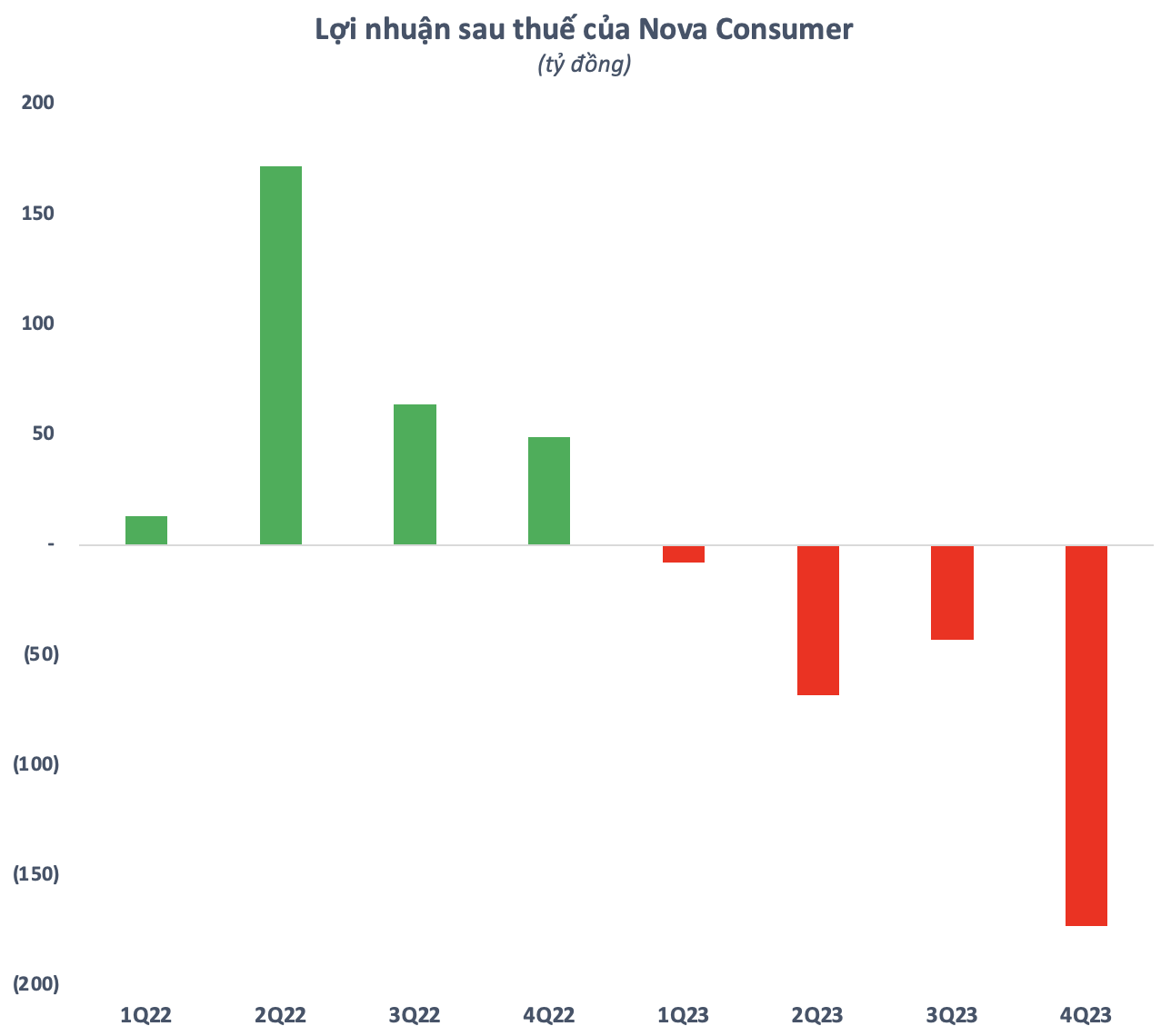

Record Loss for Nova Consumer Group (NCG) since IPO; Stock Plummets 66% in Value...

In Q4/2023, Nova Consumer recorded a net loss of over 173 billion VND, marking the sixth consecutive loss since its IPO in early 2022. With losses in all four quarters, the company's annual net loss for 2023 reached 247.7 billion VND.

World Mobile closes nearly 200 stores, how does the stock perform?

Large bank stocks continued to decline, making it difficult for the VN-Index as the Lunar New Year approaches. However, the main index managed to recover and surpass the 1,180-point mark thanks to the strong performance of a few individual stocks. Despite the recent closure of 200 stores by Thế giới Di động, MWG emerged as the market leader.

Once a formidable competitor in the stock market, the total market capitalization of the...

If you combine the market cap of Vietcombank and BIDV, along with the market cap of Vietinbank (which is approximately 960 trillion VND), it already surpasses the market cap of the top 30 largest real estate enterprises (which is around 788 trillion VND).

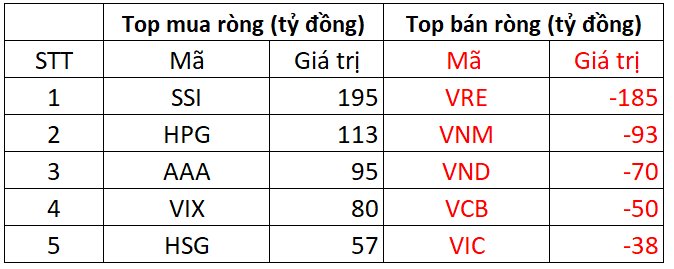

January 31: Foreign investors have an extraordinary net buying of over 1.2 trillion Vietnamese...

On HOSE, the main foreign buying focus is SSI stock with a value of VND 195 billion.