In a recent report, FiinRatings believes that in 2023, changes in the legal framework that have not been passed, as well as inspection and investigation events, continue to be major obstacles to the recovery of the real estate market.

According to statistics from the Ministry of Construction, the number of licensed commercial housing projects in 2023 is very limited, however, the number of ongoing projects is at a record high. This reflects the overall market’s general concern, specifically the decrease in transactions in both finished housing and land plots, as well as the suspension of ongoing projects.

According to this unit’s observations, the majority of developers are facing pressure to mobilize capital to implement projects on land that has been accumulated for many years before the outbreak of the pandemic. At the same time, finding options for refinancing old debts will increase risks related to capital structure and liquidity.

Regarding the outlook for 2024, FiinRatings believes that residential real estate developers will continue to face pressures on liquidity, access to capital sources, and risks related to interest rates, economic downturn impacting people’s needs and ability to pay.

On a positive note, important laws such as the 2024 Land Law, the 2023 Real Estate Business Law, and the 2023 Housing Law, which are important legislations for the market’s recovery, will be passed by the National Assembly by the end of 2023 – early 2024. However, FiinRatings believes that these new policies will have certain delays and will take time to take effect. It is expected that the Government will issue 9 decrees and 6 guiding circulars in 2024 to support the acceleration of this process.

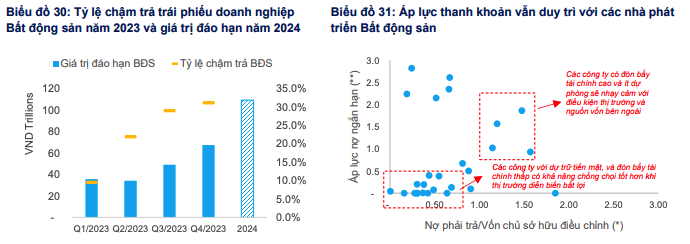

Overall, with pressure from a large amount of real estate bonds maturing at around VND 120,000 billion – the highest level in the past 5 years, FiinRatings assesses the risk of capital recycling remains high for real estate developers.

However, the analysis group believes that there will be strong differentiation in the ability to maintain business operations of each enterprise in the industry facing the prolonged general market difficulties from 2022 to the present.

“Enterprises with good brands, projects with guaranteed quality and diverse product lines, along with clean land funds accumulated through years of operation history, with the ability to implement and execute projects, are expected to be able to access diverse capital mobilization channels, and have better resistance to unfavorable market developments,” FiinRatings said.