High demand for mini apartment sales

Anh Hai (Nam Tu Liem district) – a real estate broker specializing in mini apartment segment, said that the sales of mini apartments have been booming recently. According to Mr. Hai, his company has been entrusted to sell dozens of mini apartment buildings in inner districts such as Thanh Xuan, Cau Giay, Nam Tu Liem, Dong Da… with prices ranging from 12 to 30 billion VND, depending on the location and size.

A mini apartment building in Nam Tu Liem district (Hanoi) with 36 self-contained rooms, 110m2 in size and 8 floors, is being sold for nearly 18 billion VND.

For example, a mini apartment building with 36 self-contained rooms, 110m2 in size and 8 floors, equipped with a full firefighting system in Nam Tu Liem district is being offered for sale for nearly 18 billion VND.

“The owner of the building stated that they borrowed a large amount of money from the bank to invest in the construction of the mini apartment building, so they are faced with the pressure of repaying hundreds of millions VND in interest every month. However, currently, the business situation for this type of property is difficult after the fire incident and the business and firefighting requirements for this type of property have caused monthly revenue to decline, making it insufficient to repay the bank’s interest. Therefore, the owner has decided to “cut losses” by reducing the selling price by nearly 2 billion VND compared to the previous period during Tet to recover the investment capital,” shared Mr. Hai.

According to Mr. Hai, despite the owner’s attempt to sell the building for several months, they still have not been able to sell it, only a few people inquired about the price and then disappeared.

Not only in inner districts, but in suburban districts of Hanoi such as Thach That – a place considered the “capital” of mini apartments in the past 2 years, the trend of massive sales is also emerging.

Mr. D. – the owner of a mini apartment building in the resettlement area of Bac Phu Cat, Thach Hoa commune, Thach That district (Hanoi), said that recently, the business of renting mini apartments has been difficult due to the impact of the fire incident and the inspections on this type of property. At the same time, due to the need for investment capital, he has decided to sell a mini apartment building with an area of 200m2, 9 floors, and 63 self-contained rooms for 25 billion VND.

According to Mr. D., many investors are also fleeing and selling a series of mini apartment buildings that were built for rent around universities under Hanoi National University, FPT University in Hoa Lac and Lang – Hoa Lac High-Tech Zone with prices reduced by several billion VND compared to before the fire incident.

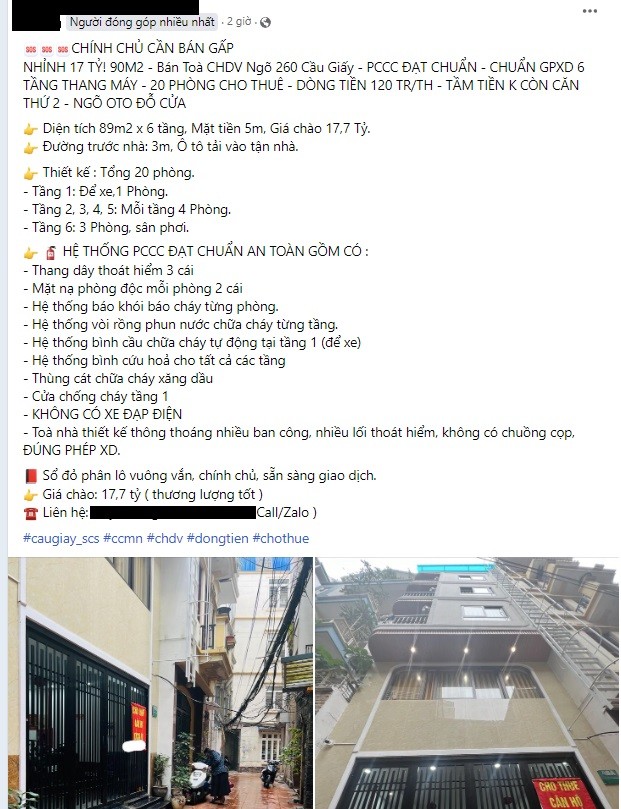

According to a survey by Tien Phong on online real estate buying and selling groups and pages, there is an increasing number of information about selling “cut-loss” mini apartments in Hanoi.

Beware of “down payment”

The trend of investing in mini apartments for rental or sale is no longer new. About a decade ago, there was a boom in investing in mini apartments. At that time, this type of property was considered a “golden goose” that brought “huge” profits to investors.

However, many experts warn that buying and selling mini apartments at this time is relatively “sensitive” due to the legal status of this type of apartment not being clear and the impact after the fire incident that claimed 56 lives.

There is an increasing number of information about selling “cut-loss” mini apartments in Hanoi.

In addition, most mini apartment buildings are built without permits and violate construction regulations (exceeding floors, increasing density, not passing firefighting inspections, etc.), which can result in the suspension of operations, business bans, or mandatory renovations in accordance with the permit. This can affect the revenue and profits of investors.

Mr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association (VARS), believes that mini apartments are a lucrative investment for those with available funds. However, in addition to the risks associated with financial leverage and borrowing money to buy and build mini apartments, investors also need to pay attention to the legal aspects of this type of property.

At the same time, investors should consider factors such as project location, legal compliance, compliance with construction plans, actual market demand, firefighting inspections… “In the short and medium term, this segment will continue to face more difficulties and pressures, so investors should carefully consider before making a down payment,” Mr. Dinh warned.

According to the People’s Committee of Hanoi, in 2023, after inspecting and reviewing the compliance with construction laws for mini apartments and business establishments providing rental housing services in more than 69,000 projects on their territory, they have discovered and handled violations in 156 mini apartment projects. The main violations of these projects include unauthorized construction, illegal construction, violation of planning, design errors, and other violations.

Regarding mini apartment buildings, the Construction Department proposes urgent evaluations of projects that have been put into use to detect firefighting violations for strict handling. At the same time, there should be measures to rectify, limit, and ensure the safety of people’s health and property,” according to the Vietnam Construction Department.