Novagroup JSC announces the stock transaction of its affiliated organization, No Va Real Estate Investment Corporation (NVL-HOSE).

Accordingly, Novagroup JSC has registered to sell 4.4 million NVL shares to restructure its investment portfolio and support debt restructuring. The transaction will be executed from February 28 to March 8 through matching orders and/or negotiations.

If the above-mentioned transaction is completed, Novagroup is expected to reduce its ownership at Novaland to 362,940,081 shares, accounting for 18.611% of the capital at NVL.

It is known that on February 22, Novagroup was also forced by securities companies to sell more than 60,043 NVL shares it held, thereby reducing its ownership to 367,340,081 shares, accounting for 18.837%.

Previously, Diamond Properties JSC has registered to sell 4 million NVL shares. The transaction is expected to be carried out from February 26 to March 26 through matching orders and/or negotiations.

If completed, Diamond Properties will reduce its ownership at Novaland to 171.4 million shares, accounting for 8.79% of the capital.

Currently, the NVL stock price on the market is around 16,750 VND/share. Therefore, after the two aforementioned transactions, Novagroup is expected to earn nearly 7.4 billion VND and Diamond Properties may receive 6.7 billion VND.

It is known that Novagroup and Diamond Properties are both affiliated organizations of Mr. Bui Thanh Nhon, Chairman of the Board of Directors of Novaland. Currently, he owns 96,765,729 shares, accounting for 4.962% at NVL.

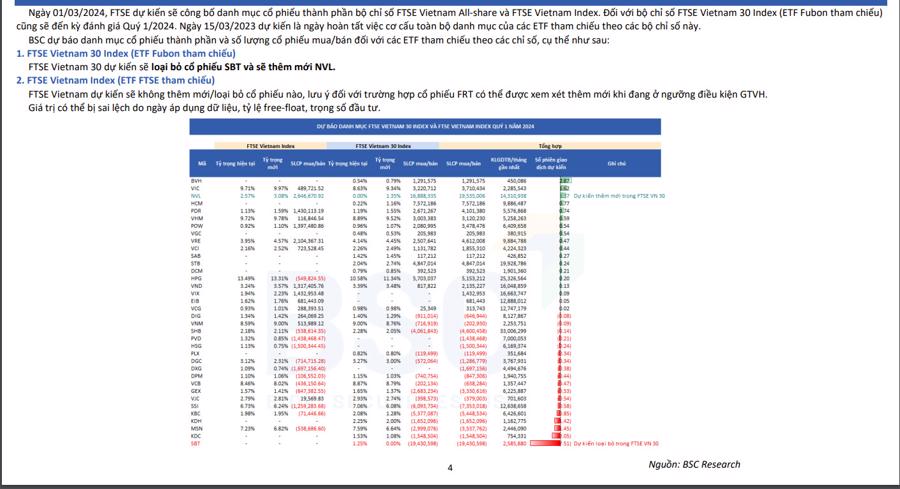

On March 1, FTSE will announce the component stocks of the FTSE Vietnam All-share and FTSE Vietnam Index. In addition, the FTSE Vietnam 30 Index, which is currently used as a reference by Fubon FTSE Vietnam ETF, will also undergo its Q1/2024 evaluation. On March 15, it is expected that ETF funds will complete the restructuring of their entire portfolios based on these indices.

According to BSC Research, FTSE Vietnam 30 is expected to exclude the SBT stock of Thanh Thanh Cong Tay Ninh Sugar JSC and add the NVL stock of No Va Real Estate Investment Corporation – Novaland.

In terms of business results, in 2023, Novaland’s revenue reached 4.8 trillion VND (-57% compared to the same period last year) and after-tax profit after minority interests reached 805 billion VND (-63% compared to the same period last year) compared to a net loss of 841 billion VND in the first 9 months of 2023 thanks to the recognition of extraordinary profits in the fourth quarter.

Bond value: At the end of 2023, Novaland’s total debt reached 57.7 trillion VND, with the remaining corporate bonds at 38.6 trillion VND, a decrease of 5.6 trillion VND compared to the end of 2022. The total value of corporate bonds expected to mature within 12 months is 16.2 trillion VND.

Cash forecast: Total cash (including short-term deposits) reached 3.46 trillion VND at the end of 2023 – stable compared to the end of Q3/2023 but a decrease of 5.5 trillion VND compared to the end of 2022.

Recently, Novaland has approved the adjustment of the conversion price into shares for the bond lot worth 300 million USD issued on the bond market.

As a result, the new conversion price will be at 40,000 VND/share, more than twice the market price of NVL on the exchange. This is the fourth time the company has adjusted the conversion price for the above-mentioned bond lot.