Textile stocks have increased by at least 16% in 2023, higher than the VN-Index growth rate of 3.9%. Notable gainers include TNG, which rose 70%, and ADS, which rose 61%. There are multiple factors driving the strong performance of these stocks in 2024.

Firstly, there is a strong recovery in orders expected in 2024. International customers placing orders for textiles and footwear from Vietnam have informed manufacturers of their plans for higher order volumes this year, according to industry sources. Manufacturers also note that customers are placing smaller orders with shorter delivery times compared to the 6-12 month lead times previously seen.

Reports from VnEconomy indicate that many textile companies in Thanh Hoa province have resumed production after the Lunar New Year holiday to meet existing orders. For example, Truong Phat Manufacturing, Service and Trading Co., Ltd. in Nong Cong district, with over 300 workers, is currently working overtime to fulfill export orders in 2024.

Similarly, South Fame Garments Limited in Thuong Xuan district has secured orders from European, American, and Japanese customers despite the global uncertainties. The company has already confirmed orders for the first and second quarters of 2024.

SOTO Co., Ltd. in Tien Trang commune, Quang Xuong district has also signed multiple orders, ensuring employment for its workers until the end of August 2024.

The Director of the Ho Chi Minh City Department of Industry and Trade stated that the outlook for business orders in the first quarter of 2024 is optimistic. Many textile, leather, and footwear businesses have received orders until June, and some have secured orders for the entire year.

The Vietnam Textile and Apparel Association (VITAS) forecasts a positive growth in exports, with export revenue reaching $44 billion, a 9% increase compared to the same period in 2023.

Secondly, the recovery in business performance is supported by increasing orders. TNG, an investment and trading company listed on the Hanoi Stock Exchange (HNX), reported a post-tax profit of VND 1.5 trillion ($65 million) in January 2024, nearly triple the profit in the same period last year.

According to the company’s financial report for the month of January 2024, TNG achieved net revenue of VND 52.4 trillion ($2.3 billion), a 32% increase compared to the same period last year, making it the highest January revenue in the past five years. However, due to a faster increase in costs than revenue, the gross profit margin decreased slightly by 0.4 percentage points to 12.6%.

In January, financial income increased by 27% to over VND 700 billion ($30 million), but this was not enough to offset the financial expenses of VND 1.8 trillion ($78 million). In addition, selling expenses and administrative expenses reached VND 700 billion ($30 million) and VND 2.9 trillion ($126 million) respectively, an increase of 39% and 9% compared to the same period last year.

Despite these costs, TNG achieved a strong post-tax profit of VND 1.5 trillion ($65 million), a significant increase of 168% compared to the same period last year. However, this is the lowest profit level in the past seven months. To achieve these results, TNG secured export orders with various partners such as Decathlon, Columbia, The Children’s Place, Sportmaster, Costco, Nike, and Adidas.

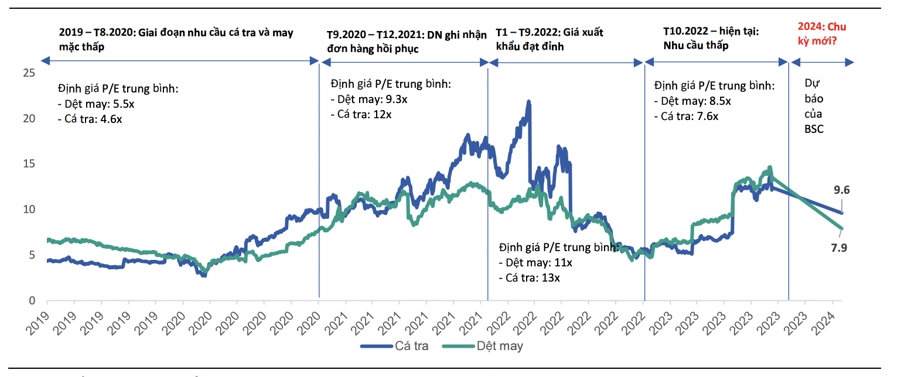

Thirdly, the textile sector is currently trading at a forward P/E ratio of 7.9x for 2024, which suggests a reasonable valuation for accumulating stocks for a new recovery phase in 2024.

BSC expects the textile, leather, and footwear industry to be the first beneficiaries within the value chain after the deeper level of cooperation between the United States, China, and Vietnam.

Therefore, BSC believes it is a suitable time to accumulate and invest in stocks of textile companies, especially those involved in export, as there are early signs of recovery in the industry, such as rehiring in the textile and footwear sectors in southern provinces.

According to BSC’s observations, stock prices of these companies are sensitive to order information and export prices, and are likely to react ahead of business performance results. Therefore, BSC considers it a reasonable time to accumulate textile stocks as their valuations are at the beginning of the recovery cycle (at the end of 2020), and much lower than the average valuations during the recovery phase, with P/E ratios of 9.3x and 12x respectively.