Illustrative photo

Crude oil prices continue to rise

Crude oil prices rose more than $1 per barrel as OPEC+ is considering extending voluntary production cuts into the second quarter of 2024 to support prices.

At the end of trading on February 27, Brent crude oil rose $1.12, or 1.4%, to $83.65 per barrel, while West Texas Intermediate (WTI) crude oil rose $1.29, or 1.7%, to $78.87 per barrel. Both oil types increased more than 1% in the previous session after falling 2-3% the previous week.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, agreed in November 2023 to cut a total of 2.2 million barrels per day (bpd) in the first quarter of 2024, with Saudi Arabia leading the way.

US crude oil inventories for the previous week are expected to increase by about 2.7 million barrels, while distillate and gasoline inventories are expected to decrease.

Russell Hardy, CEO of oil trading company Vitol, said that the global crude oil market is expected to stabilize at around $80 per barrel this year. At the Energy Forum conference, he also added that global oil demand is expected to peak in the early 2030s.

Lowest natural gas prices in nearly 4 years in the US

Natural gas prices in the US hit their lowest level in nearly 4 years due to high inventories, near-record-high production levels, and milder weather.

The March 2024 natural gas futures price on the New York Mercantile Exchange (NYMEX) fell 4.4 US cents to $1.615 per million British thermal units (MMBtu). The price fell to $1.511 per MMBtu at the beginning of the trading session, the lowest level since June 2020.

Gold prices maintain stability

Gold prices remain steady, with important inflation information and comments from officials of the US Federal Reserve this week.

Spot gold on the LBMA exchange changed slightly to $2,031.77 per ounce, and April 2024 gold futures on the New York Mercantile Exchange (NYMEX) rose 0.3% to $2,044.1 per ounce.

The US dollar index weakened, making gold bars more attractive to foreign buyers.

Data shows that durable goods orders in the US for January 2024 decreased the most in nearly 4 years.

Copper and aluminum prices rise

Copper prices in London rose for the first time in 3 sessions, supported by expectations that the upcoming annual National People’s Congress meeting in China, the top consumer, will unveil further economic stimulus measures.

Three-month copper futures on the London Metal Exchange (LME) rose 0.2% to $8,485 per tonne.

Citi expects the price of copper to reach $8,800 per tonne in the next 3 months.

Meanwhile, aluminum prices on the London Metal Exchange (LME) rose for the first time in 4 sessions, up 0.8% to $2,198 per tonne.

Iron ore and steel prices rise

Iron ore prices on the Dalian Commodity Exchange rose, supported by a recovery in demand in the top consumer, China, and potential export duties for low-grade iron ore from India, while short-term steel production cuts limited the gains.

Iron ore futures for May 2024 on the Dalian Commodity Exchange rose 1.24% to 897.5 CNY ($124.7) per tonne. In addition, iron ore prices for March 2024 on the Singapore Exchange rose 1.75% to $117.45 per tonne.

India is considering export duties on low-quality iron ore after small steelmakers urged the government to restrict exports.

Meanwhile, China usually accounts for over 90% of India’s total iron ore exports – the world’s fourth-largest iron ore producer.

On the Shanghai Futures Exchange, rebar steel prices rose 1.62%, hot-rolled coil steel rose 1.42%, cold-rolled coil steel rose 0.82%, and stainless steel rose 1.11%.

Rubber prices in Japan rise

Rubber prices in Japan rose 1% above the 300 JPY/kg threshold, supported by rising crude oil prices and concerns about the weather in the leading rubber-producing country, Thailand.

Rubber futures for August 2024 on the Osaka Exchange (OSE) rose 3.2 JPY, or 1.07%, to 302.6 JPY ($2.01) per kg. In addition, rubber futures for May 2024 on the Shanghai Futures Exchange rose 220 CNY to 13,965 CNY ($1,940.2) per tonne. Rubber futures for March 2024 on the Singapore Exchange rose 1.32% to 161.4 US cents/kg.

Coffee prices rise

Robusta coffee futures for May 2024 on the London Exchange rose $57, or 1.9%, to $3,077 per tonne. In addition, arabica coffee futures for May 2024 on the ICE Exchange rose 3.45 US cents, or 1.9%, to $1.8305 per pound.

Raw sugar prices at a 2-week high

Raw sugar prices on the ICE Exchange rose 3% to their highest level in 2 weeks amid disappointment with new developments in the leading producer, Brazil, due to a lack of rain.

Raw sugar futures for March 2024 on the ICE Exchange rose 0.69 US cents, or 3%, to 23.84 US cents per pound. In addition, white sugar futures for May 2024 on the London Exchange rose 1.2% to $631.7 per tonne.

Corn and wheat prices rise, soybean prices fall

Corn prices on the Chicago Board of Trade rose for the second consecutive session, moving away from their lowest level in over 3 years.

On the Chicago Board of Trade, corn futures for March 2024 rose 1-1/4 US cents to $4.08-1/4 per bushel. Corn futures for May 2024 rose 2 US cents to $4.23-1/2 per bushel, reaching as high as $4.26-1/2 per bushel at one point – the highest level since November 14, 2023. Wheat futures for May 2024 rose 9-1/2 US cents to $5.84-1/4 per bushel. Soybean futures for May 2024 fell 4-1/2 US cents to $11.4-3/4 per bushel, hitting as low as $11.33-1/2 per bushel at one point – the lowest level since November 2020.

Palm oil prices continue to rise

Palm oil prices in Malaysia rose for the third consecutive session, following the upward trend in other vegetable oil prices, while the market awaits an industry conference to be held in Kuala Lumpur next week.

Palm oil futures for May 2024 on the Bursa Malaysia Exchange rose 61 ringgit, or 1.58%, to 3,924 ringgit ($824.37) per tonne.

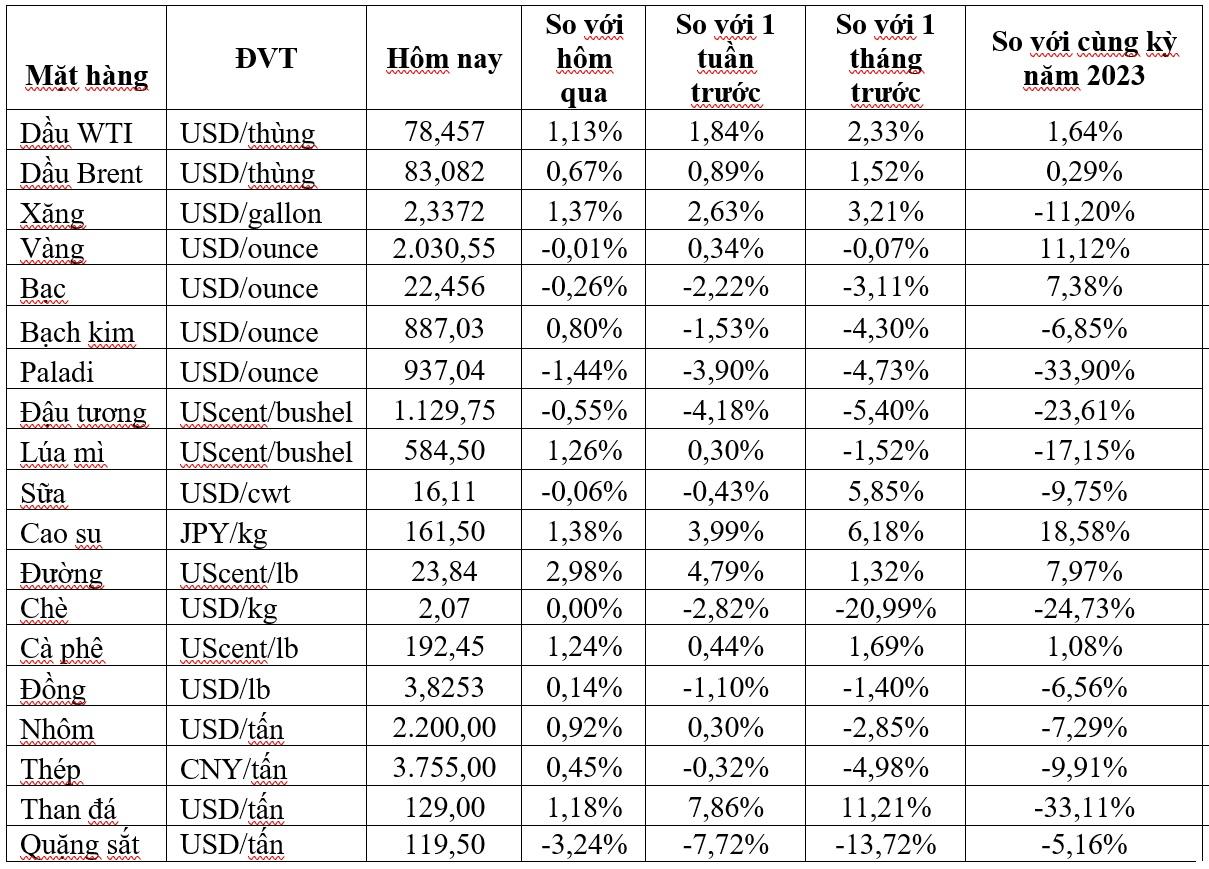

Prices of key commodities as of February 28 morning