In a recent report by VCSC Securities, VCSC predicts that the Chemical Group Corporation Duc Giang (DGC) will benefit and continue to gain market share in the industrial phosphochemical (IPC) market in the medium term as China no longer exports yellow phosphorus and DGC accounts for nearly 1/3 of the total global export of yellow phosphorus. This is an important input material in many industrial production sectors such as semiconductors and electric vehicle batteries.

Accordingly, DGC’s total IPC sales volume to Southeast Asia and the United States doubled in 2023 despite weak global demand due to U.S. companies diversifying their supply sources away from China.

Globally, according to VCSC, global demand for yellow phosphorus will grow by single digits in the medium term, driven by the demand for EV batteries and AI chips. The International Equipment and Materials Association (SEMI) forecasts that global semiconductor sales will increase by 12% compared to the same period in 2024. In addition, stable chip inventory levels bolster chip manufacturing activities and thus increase the demand for industrial phosphochemicals in the future.

In the semiconductor sector, DGC has established a dominant presence in East Asia (excluding China) in the yellow phosphorus market and is rapidly penetrating the U.S. market. The company’s highest-purity yellow phosphorus surpasses all competitors in the global export market. Therefore, according to VCSC, DGC is expected to benefit from increased chip production in the U.S. and its allies, regardless of the location of the factories.

In the electric vehicle battery sector, the owners of several electric vehicle battery production plants under construction in Japan and South Korea have expressed interest in purchasing yellow phosphorus from DGC when they become operational in 2025.

VCSC predicts that DGC’s IPC sales volume (in terms of phosphorus content) will increase by 20% to 68,888 tons in 2024 compared to the same period. Thanks to the recovery in demand and the full-year contribution of the new phosphorus plant, VCSC believes that DGC’s low sales volume to India in the fourth quarter of 2023 can be resolved in the first quarter of 2024.

At the same time, the average IPC selling price is projected to recover to $4,300 per ton of phosphorus content in 2024, an increase of 10% compared to the fourth quarter of 2023 and nearly unchanged from the 2023 levels.

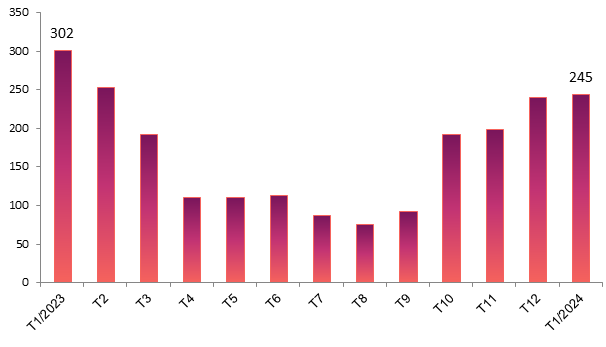

In the stock market, DGC’s stock has been on the rise for over a month. In the past year, DGC’s stock has doubled in value.

As of the end of February 28, DGC’s stock price was VND 110,500 per share, an increase of approximately 24% compared to the end of January. Duc Giang Chemical’s market capitalization also increased by over VND 8,000 billion to nearly VND 42,000 billion.