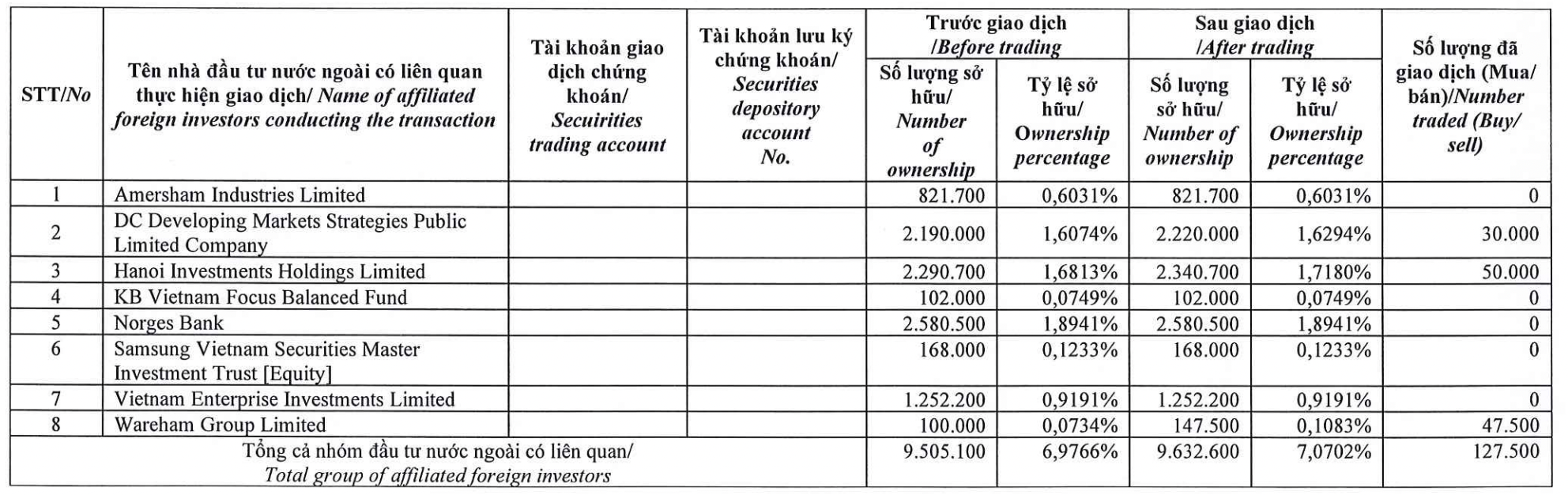

In the latest announcement, Dragon Capital’s fund group reported buying a total of 127,500 shares of FPT Retail Corporation (FRT) Digital Retail Joint Stock Company.

Accordingly, the three member funds including DC Developing Markets Strategies Public Limited Company, Hanoi Investments Holdings Limited, and Wareham Group Limited bought 30,000 shares, 50,000 shares, and 47,500 shares of FRT, respectively. The transaction took place in the session on February 27, through which the ownership of Dragon Capital group increased from 6.98% to over 7.07%, equivalent to more than 9.6 million shares.

Based on the closing price of the same session, this foreign fund group has spent more than 17 billion VND to increase its ownership in FPT Retail.

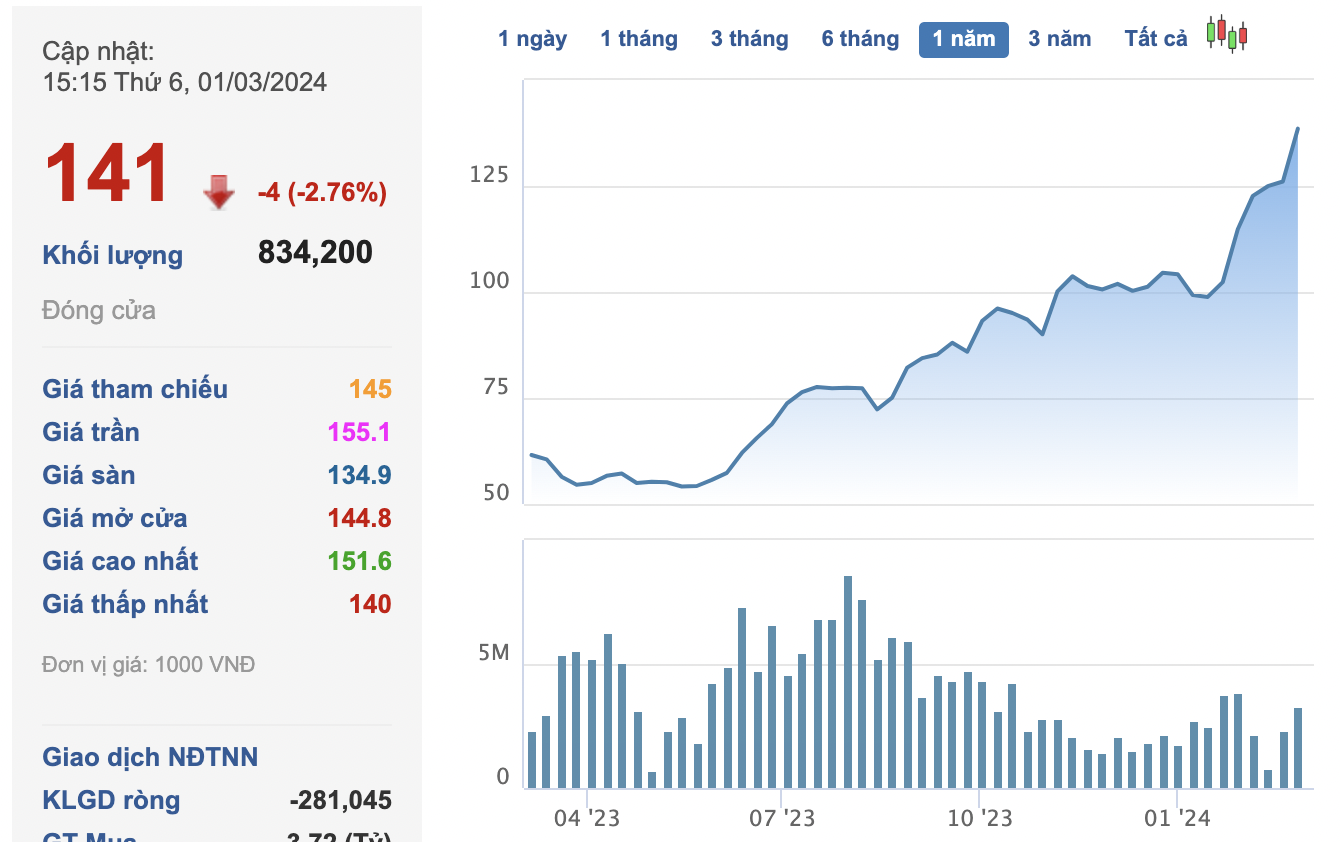

The transaction of Dragon Capital takes place in the context of the stock price of this retail company skyrocketing and repeatedly setting new price records. At the end of the session on March 1, the FRT share price reached 141,000 VND/share, a slight decrease of nearly 3% compared to the record high set in the previous session on February 29 at 145,000 VND/share. Since the beginning of 2024, FRT’s share price has increased by nearly 32%.

Unlike the explosive development of FRT shares on the market, the business situation of FPT Retail is still facing difficulties. The company has incurred losses for the entire four quarters of 2023, with a total after-tax loss of 346 billion VND for the year, marking the first year of loss since its listing.

The bright spot lies in the revenue when the total revenue for the whole year of 2023 reached nearly 32,000 billion VND, an increase of 6% and the highest on record, mainly thanks to the motivation from the FPT Long Chau drugstore chain.