Currently, Ms. Tam owns 0.036% of shares, equivalent to nearly 530 thousand shares of MWG. If the transaction is successful, her ownership will decrease to 0.023%, equivalent to nearly 330 thousand shares.

The transaction is expected to be carried out through agreement or matching orders on the exchange. Based on the MWG closing price on March 8, which is 47,750 dong per share, it is estimated that Ms. Tam can earn about 9.6 billion dong.

In a related development, Mr. Robert Alan Willett – Member of MWG’s Board of Directors recently registered to sell 1.2 million shares of MWG during the period from February 27 to March 27, 2024. Currently, Mr. Robert owns over 8 million shares of MWG, equivalent to a 0.55% stake. If the transaction is successful, his ownership will decrease to 0.47%. This leader shares that he is selling the shares to buy a new house for his wife as her health is not good.

* A foreign member of MWG’s Board of Directors wants to sell 1.2 million shares

These registered sell-off movements take place as MWG’s stock price has been recovering since November 2023, after a sharp decline since mid-September 2023.

In addition, based on data ending February 29, HSC Securities predicts that the VN-Diamond index will remove MWG. The explanation for this is that MWG’s P/E is three times higher than the average P/E of the basket. When MWG is removed, HSC believes that CTD is a potential candidate to replace it. Currently, the foreign ownership limit (FOL) of CTD is about 91% and other criteria also meet the VN-Diamond’s requirements.

In case MWG is removed from the VN-Diamond basket, analysts at HSC Securities predict that the DCVFMVN Diamond ETF will sell about 57 million MWG shares.

| MWG Stock Performance in the Past Year |

In terms of business activities, recently on January 31, MWG’s Board of Directors approved the 2024 business plan to present at the Annual General Meeting of Shareholders. The plan is expected to signal a recovery with a net revenue of 125 trillion dong and a post-tax profit of 2.4 trillion dong, an increase of 6% and 14 times, respectively, compared to the actual performance in 2023. BHX will contribute about 30% of the revenue, with double-digit growth, aiming to increase market share and start generating profits from 2024.

* MWG Chairman: Next 5 years’ growth of the Group will rely on BHX

* MWG does not aim to lead the price war in 2024

As for the just-concluded 2023, MWG brought in over 118 trillion dong in revenue. The main contributors were revenue from The Gioi Di Dong (Mobile World, including Topzone) and Dien May Xanh (Green Electronics), with over 28 trillion dong and 55 trillion dong, respectively, a decrease of 18% and 20%. According to MWG, most product lines experienced declines, except for air conditioners. After a series of difficult days, the inefficiency of closing nearly 200 TGDĐ and ĐMX stores in Q4 came as a natural consequence.

Bach Hoa Xanh (BHX) alone saw a 17% increase in revenue, reaching nearly 32 trillion dong. In addition, financial activities brought in a profit of nearly 611 billion dong, instead of a loss of nearly 70 billion dong in the same period.

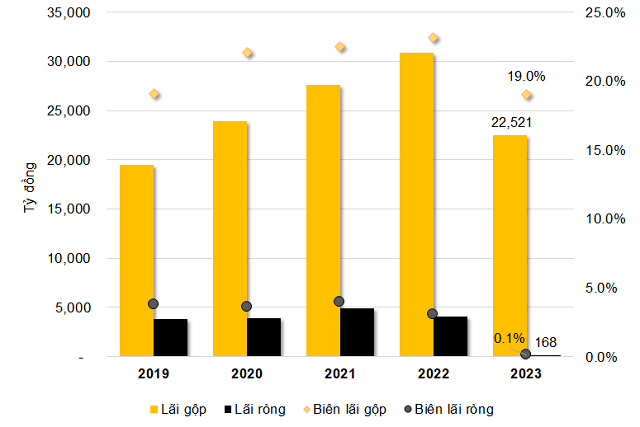

With countless difficulties, MWG ended 2023 with a 96% decrease in net profit, remaining at nearly 168 billion dong. Since its listing in 2014, this is the lowest net profit of MWG.

* MWG’s net profit in 2023 is only nearly 168 billion dong, the lowest since listing

* The sad record-breaking year for the retail giant of phones and electronics

|

Recent financial results of MWG

Unit: Billion dong

Source: VietstockFinance

|