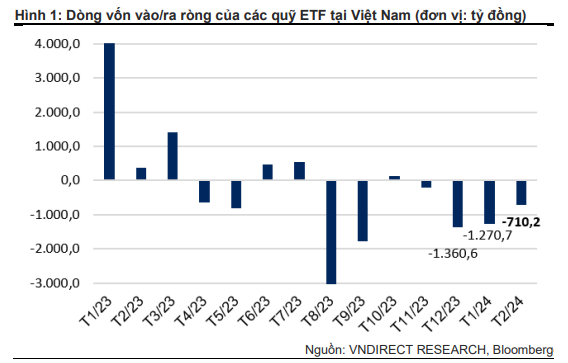

Vietnam ETFs continued to record net capital outflows in February 2024, with a net outflow value of over VND 710 billion, marking the fourth consecutive month of outflows.

Among them, the majority of capital outflows came from DCVFM VN30 ETF, Xtrackers FTSE Vietnam ETF, and DCVFMVN Diamond ETF, with net outflows of VND 347 billion, VND 309 billion, and VND 277 billion, respectively.

On the flip side, only Fubon FTSE Vietnam ETF and VanEck Vectors Vietnam ETF attracted net inflows of VND 203.8 billion and VND 31.8 billion, respectively.

According to data from VNDirect, most of the funds performed well this month, with a 6-8% increase compared to the previous month. This is understandable as the VN-Index has been steadily rising to nearly 1,270 points.

For the first two months of the year, the total net outflows accumulated to over VND 1,980 billion, mainly from DCVFMVN Diamond ETF, DCVFM VN30 ETF, and SSIAM VNFIN Lead ETF.

Will FTSE ETF buy heavily into VCB and EVF?

In recent developments, FTSE Russell has announced the results of the quarterly review of indices, including the FTSE Vietnam Index and FTSE Vietnam All-Share Index.

According to the announcement, EVF shares will be added to the FTSE Vietnam Index, while EVF and OCB shares will be added to the FTSE Vietnam All-Share Index. No shares are being removed from these two indices.

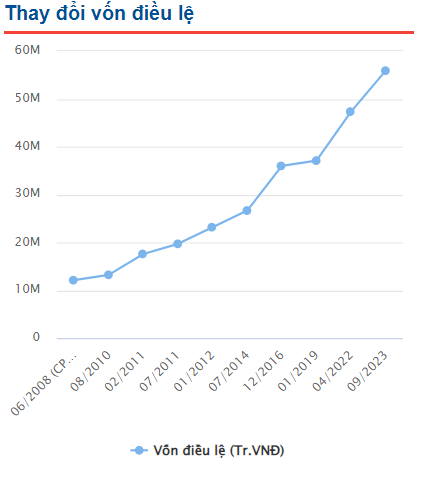

Currently, only Xtrackers FTSE Vietnam ETF (FTSE ETF) tracks the FTSE Vietnam Index and has total net assets of over VND 8,900 billion.

Based on the review results by FTSE Russell, VNDirect estimates that the ETF will buy the most EVF and VCB shares, with volumes of 6.07 million shares and nearly 1 million shares, respectively.

Meanwhile, VIC and VHM shares may be the most sold by this ETF, with volumes of 1.16 million shares and 1.17 million shares, respectively.

|

VNDirect’s forecast of buy/sell

|