Compared to the previous year, 2023 witnessed positive actions from the Government and ministries in bringing the real estate market back to growth. However, with the new laws and regulations still not being “penetrating” enough, the general situation has not seen significant changes.

As a result, the new supply of jobs for construction industry is becoming more and more limited, and business results are also affected.

According to statistics from VietstockFinance, 31 civil construction companies listed on the stock market recorded a total revenue of 47.3 trillion VND in 2023, a decrease of nearly 14% compared to 2022. It’s worth noting that the total profit in the year was negative at 64 billion VND, while in the previous year, it was negative at 1,895 billion VND.

If we exclude the results of Hoa Binh Construction Group (HOSE: HBC), the total net revenue and net profit of the remaining 30 companies were nearly 40 trillion VND and over 713 billion VND, respectively. In which, the revenue still declined by 2%, while the profit increased by over 6%.

The reason for the negative total profit of the industry in 2023 comes from 4 loss-making companies, in which HBC plays a major role.

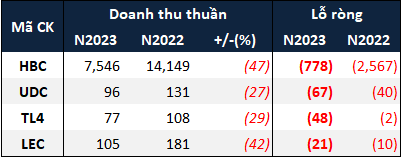

|

4 Construction Companies with Net Loss in 2023. Unit: Billion VND

Source: VietstockFinance

|

Specifically, HBC has had a second consecutive year of loss with a net loss of 778 billion VND, with revenue declining by 47% to 7,546 billion VND. In addition to the loss, HBC has also been warned by HOSE about delisting its shares if the company fails to submit the audited financial statements for 2023 on time. It is known that prior to this, HBC had repeatedly delayed the submission of audited financial statements for 2021 and 2022.

14 companies had profit reduction.

Among the 14 out of 31 companies with declining profit, State-owned LICOGI Holding Corporation (UPCoM: LIC) is the company with the largest decline in profit at 95%, followed by 1369 Construction JSC (HNX: C69) with a decrease of 63%.

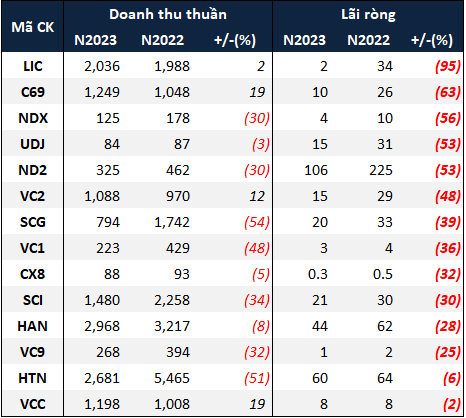

|

14 Construction Companies with Profit Decrease in 2023. Unit: Billion VND

Source: VietstockFinance

|

In 2023, LIC’s revenue remained flat at 2 trillion VND, along with a reduction in most expenses. However, the decrease in other financial income from 162 billion VND to just over 31 billion VND in 2023 has resulted in LIC’s net profit of only nearly 2 billion VND.

Another notable company is Hưng Thịnh Incons Joint Stock Company (HOSE: HTN), which also recorded a 6% decrease in profit to 60 billion VND. As part of Hưng Thịnh Group’s ecosystem, HTN is in a “job shortage” situation, with revenue decreasing by 51% to just over 2.7 trillion VND. The company’s profit did not decrease significantly thanks to doubling financial income compared to the previous year, along with a 50% reduction in management expenses.

It is known that HTN’s management expenses decreased significantly as of December 31, 2023, with the company’s number of employees at that time being only 286, a decrease of nearly 60% compared to the end of 2022.

10 companies had profit increase.

Contrary to the above companies, there are still 10 building companies with increased profit, even some companies with multiple times increase.

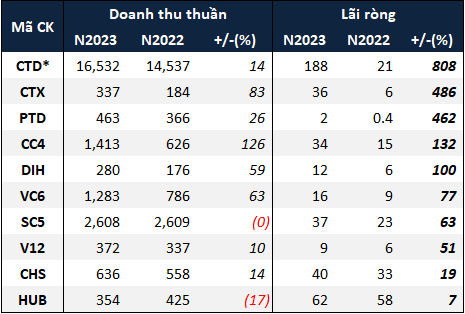

|

10 Construction Companies with Profit Increase in 2023. Unit: Billion VND

* Due to CTD changing its financial year, the figures in the table are calculated based on the total of 4 quarters within the period from January 1 to December 31, 2023.

Source: VietstockFinance

|

The building construction company with the strongest profit increase is Coteccons Construction Joint Stock Company (HOSE: CTD) with a profit of 188 billion VND for the period from January 1 to December 31, 2023, 9 times higher than 2022.

CTD’s exceptional result is achieved thanks to a more than 60% reduction in provisions compared to the previous year, down to over 155 billion VND. Also during the past year, the company has set aside bad debts of nearly 143 billion VND for Saigon Glory Co., Ltd. – the investor of Ben Thanh Square project.

Despite the remarkable increase in results, CTD still considers 2023 a difficult year for the industry as the real estate market froze and the recovery signal was slow in the last 3 months of the year. As a result, construction companies were also affected, as these two industries are closely related, leading to a short supply of jobs in the civil construction sector.

Tong Cong Ty Dau Tu Xay Dung va Thuong Mai Viet Nam (UPCoM: CTX) ranks second with a net profit of 36 billion VND achieved in 2023, nearly 6 times higher than the previous year. This result also comes from construction activities, with revenue increasing by 83% to 337 billion VND.

Although the company did not disclose the revenue from any projects, considering the unfinished basic construction costs of CTX at the projects on December 31, 2023, it can be seen that the value increase mainly comes from two projects: Constrexim Complex and Sapa Resort.

In addition, in 2023, many companies set cautious profit targets, so some companies, despite the declining results, still achieved their annual targets.

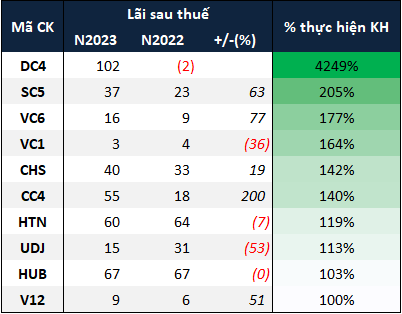

|

Construction companies that have achieved their targets in 2023. Unit: Billion VND

Source: VietstockFinance

|

Entering 2024, civil construction companies expect the market to have more positive changes. CTD representatives believe that the second half of 2024 to the first half of 2025 will be a turning point for the real estate industry. The demand for residential apartments with clear legal status is still high, so for the commercial real estate segment, developers with clean and transparent land funds still have normal deployment plans.

In addition, FDI is a bright spot for Vietnam with a significant increase in newly registered production volume in 2023. Therefore, construction companies also expect to benefit from building factories for global giants in the future.

Ha Le