The Nâm Mủ Hydroelectric Plant is located in Tan Thanh commune, Bac Quang district, Ha Giang province

|

Advance payment of dividends in 2023 and organization of the 2024 Annual General Meeting in April 2024

HJS announced the advance payment of dividends for the 1st/2023 term in cash at a rate of 10%, equivalent to 1 share receiving 1,000 VND, ex-dividend date being 27/03 and expected payment date on 10/04. With nearly 21 million shares in circulation, the estimated cost for this dividend payment is close to 21 billion VND. Previously, the 2023 Annual General Meeting of Shareholders passed a profit distribution plan at a rate of 22%.

In terms of shareholder structure, Song Da 9 Joint Stock Company (HNX: SD9) is the parent company directly owning over 10.7 million HJS shares, equivalent to a 51% stake, expected to benefit the most by receiving over 10.7 billion VND from this dividend payment.

Recently, HJS welcomed a new major shareholder, Icapital Investment Joint Stock Company (HOSE: PTC) after the company purchased 3.25 million HJS shares in the period from 06-23/02/2024, thereby increasing ownership from more than 590 thousand shares (2.8% stake) to over 3.84 million shares (18.3% stake). With this amount of shares, Icapital is estimated to receive over 3.8 billion VND.

Icapital Investment becomes a major shareholder of HJS, VIX Securities as the counterparty?

With the plan to organize the 2024 Annual General Meeting of Shareholders, HJS announced the ex-dividend date on 03/04 and will be held in April in Hanoi, with plans to approve several important contents including the 2023 business results and the 2024 plan.

2024 business plan declines

Regarding the business performance in 2023, HJS had net revenue of 159 billion VND and post-tax profit of 54 billion VND, decreasing by 11% and 6% respectively compared to the previous year, exceeding the 2% after-tax profit plan (53 billion VND). The net profit is nearly 54 billion VND, decreasing by 6%.

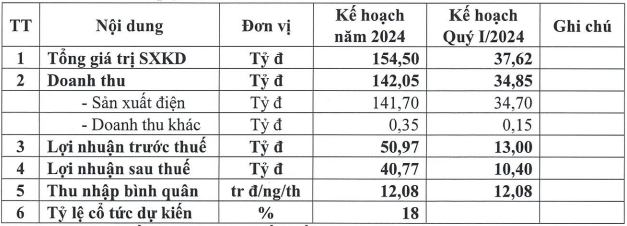

On March 5, the Board of Directors of HJS approved the business plan for the first quarter and the whole year 2024. Accordingly, the Company set a plan to bring in nearly 35 billion VND in revenue in the first quarter, mainly contributed by the electricity production segment; post-tax profit of 10.4 billion VND.

For the whole year 2024, the Company targets a revenue of 142 billion VND and a post-tax profit of nearly 41 billion VND, decreasing by 11% and 23% respectively compared to the 2023 performance. The Company also plans to distribute the 2024 profit at a rate of 18%.

|

Business plan for the first quarter and the whole year 2024 of HJS

Source: HJS

|