On April 10th, FPT Corporation (stock code: FPT) is set to hold its annual general meeting 2024 in Hanoi, both online and offline. The company has just released the meeting documents.

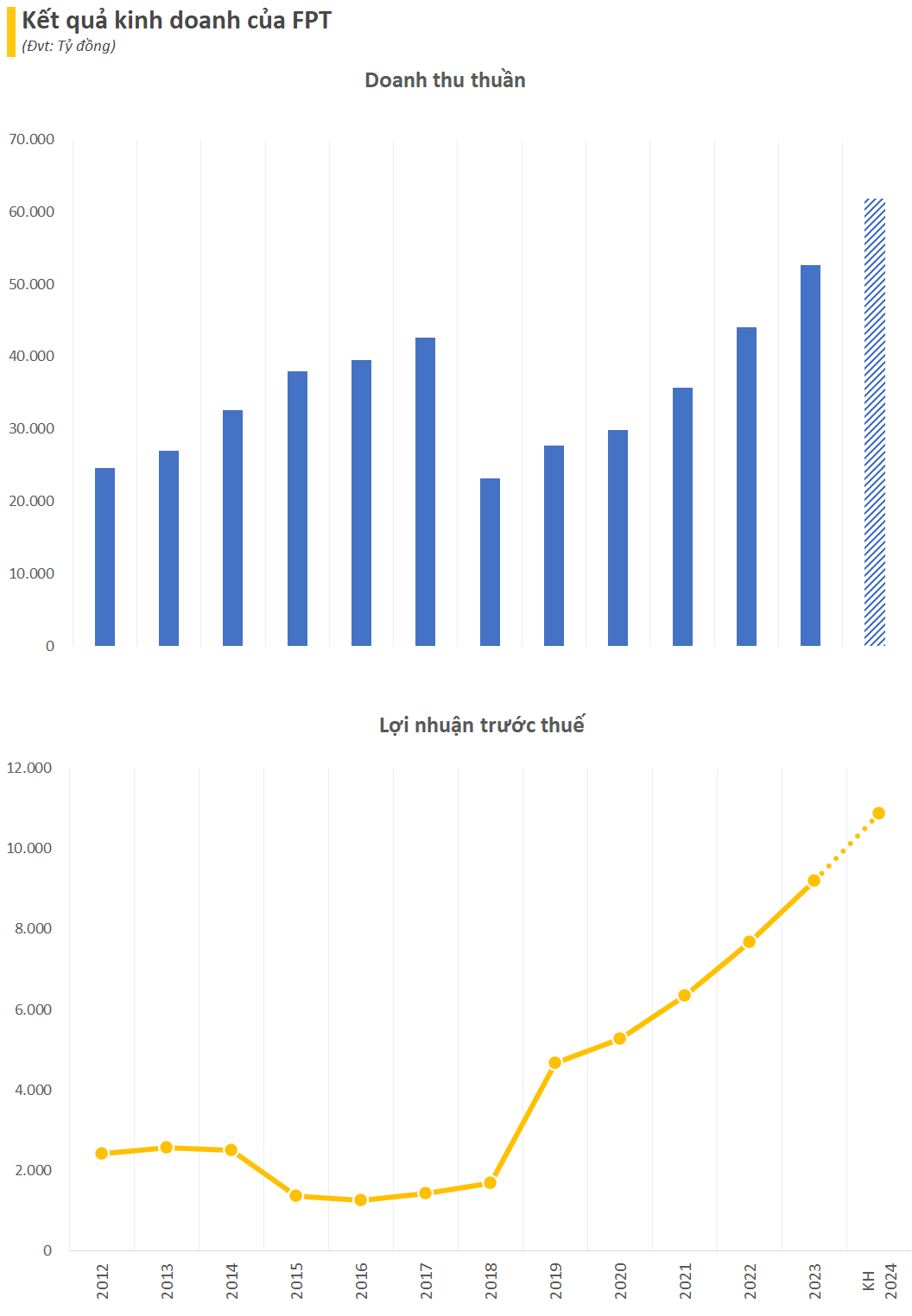

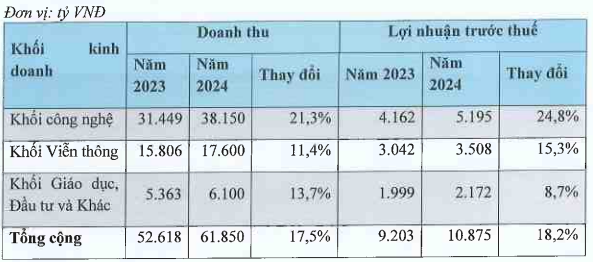

In 2024, FPT plans to achieve revenue of VND 61,850 billion (~ USD 2.5 billion) and pre-tax profit of VND 10,875 billion, a simultaneous increase of about 18% compared to the results of 2023.

Untitled.png

In terms of revenue structure, the Technology segment is expected to generate the highest revenue with VND 31,449 billion, up more than 21% and accounting for nearly 51% of total revenue. The Telecommunications and Education segments aim for revenue growth of 11% to reach VND 17,600 billion and 14% to reach VND 6,100 billion, respectively.

In terms of profit, the Technology segment is projected to contribute VND 5,195 billion in pre-tax profit, an increase of 25%. The Telecommunications segment is expected to generate VND 3,508 billion in pre-tax profit, while the Education and Investment segment is forecasted to reach VND 2,172 billion (up 9%).

Regarding investment plans, FPT has budgeted VND 2,200 billion for investing in the Technology segment, including investing in office complexes in major cities such as Hanoi, Da Nang, Ho Chi Minh City, Quy Nhon, as well as investing in technology infrastructure.

For the Telecommunications segment, FPT will allocate VND 2,300 billion for investing in main cables, submarine cables, upgrading domestic telecommunications infrastructure, and data center systems.

For the Education segment, the corporation plans to invest VND 2,000 billion to expand university campuses in Hanoi, Ho Chi Minh City, and Da Nang, as well as to open new training facilities in other provinces.

Since restructuring its operating model in 2018, FPT has consistently achieved strong growth in both revenue and profit year after year. This technology corporation continues to consolidate its sustainable growth momentum with the 2023 business results setting a new record. The total revenue reached VND 52,618 billion and pre-tax profit reached VND 9,203 billion, an increase of 19.6% and 20.1% respectively compared to the previous year. This is the 6th consecutive year that the enterprise has recorded positive growth in business results.

Based on these results, FPT’s Board of Directors will propose to shareholders a cash dividend distribution plan for 2023 at a ratio of 20% (with 10% interim payment already made in 2023, the remaining 10% is expected to be paid in the second quarter of 2024 if approved).

At the same time, FPT also intends to issue shares to increase charter capital from owners’ equity at a rate of 15%, meaning that existing shareholders owning 20 shares will receive an additional 3 new shares. FPT plans to issue more than 190 million new shares, increasing its charter capital to over VND 14,600 billion. The implementation time will be after the Annual General Meeting of Shareholders and no later than the third quarter of 2024.

Previously, in 2022, FPT’s dividend distribution plan was also similar, with 20% in cash and a 15% bonus share.

In 2024, FPT plans to distribute dividends of VND 2,000 per share to its shareholders, based on the number of new shares after the stock dividend distribution is completed.

The goal of the Technology segment is to reach the billion-dollar revenue milestone and deeply penetrate the Semiconductor industry

FPT stated that in the period from 2024 to 2026, FPT aims to accelerate digital transformation, enhance green transformation, and start smart transformation. The Technology segment will rapidly expand services, sectors, and markets on a global scale through enhancing in-depth capabilities in the Automotive field, with a target growth rate of 50%/year and revenue of USD 1 billion by 2030.

At the same time, FPT will expand its services in the Semiconductor industry, expand chip design models, and participate in chip testing services; the target is to train 10,000 engineers and specialists in the semiconductor field by 2030. FPT also disclosed that it has received orders for 70 million chips for delivery by 2025.

In addition, the company will continue to invest in AI, Cloud, Cybersecurity services, expand Integrated System services and Infrastructure management services, and maintain growth rates in all global markets.

The Telecommunications segment aims to become the provider of the best Internet and Online services. FPT will also expand horizontally and vertically in the Education segment through investing in the construction of a network of inter-level universities, colleges, and high schools, as well as increasing the creation of new training majors to directly serve the development needs of human resources in fields such as Semiconductor, Automotive, Game design, etc.

On the market, FPT’s stock price closed at VND 117,000 per share on March 13th, up 22% since the beginning of 2024 and the highest price that this stock has ever reached in history. FPT’s market capitalization is currently approximately VND 149,000 billion.