The business outlook for SNZ in 2023 looks promising as it achieved a net revenue of nearly VND 5,447 billion and a net profit of over VND 813 billion, representing a 3% and 29% increase compared to the previous year, respectively. This is the second-highest net profit year for the company since its listing in 2017, only behind 2021.

| SNZ’s Financial Performance from 2017-2023 |

At the annual conference to review the year 2023 and set the business production plan for 2024 in mid-January 2024, Sonadezi set its 2024 plan with an estimated consolidated revenue of about VND 6,366 billion, a 17% increase compared to 2023, and a post-tax profit of VND 1,370 billion, a slight decrease of 1%.

In other developments, on March 12, Sonadezi approved the exercise of more than 56.2 million convertible warrants to purchase over 28.1 million SZC shares under the Sonadezi Chau Duc plan (HOSE: SZC). With a purchase price of VND 20,000 per share, Sonadezi will need to spend over VND 562 billion to complete the transaction.

Prior to that, at the end of 2023, SZC issued nearly 60 million additional shares to existing shareholders at a ratio of 2:1 (2 existing shares entitle the shareholders to purchase 1 new share). The offering price was VND 20,000 per share. The additional shares offered will not be subject to transfer restrictions. If the issuance is successful, SZC’s charter capital will increase to nearly VND 1,800 billion.

The total capital raised from the offering is expected to be nearly VND 1,200 billion. With the proceeds, SZC will use the funds, in the following order of priority, to supplement investment capital, construct the Chau Duc Industrial Park project, and restructure SZC’s outstanding loans from credit institutions and repay bond principal and interest at maturity.

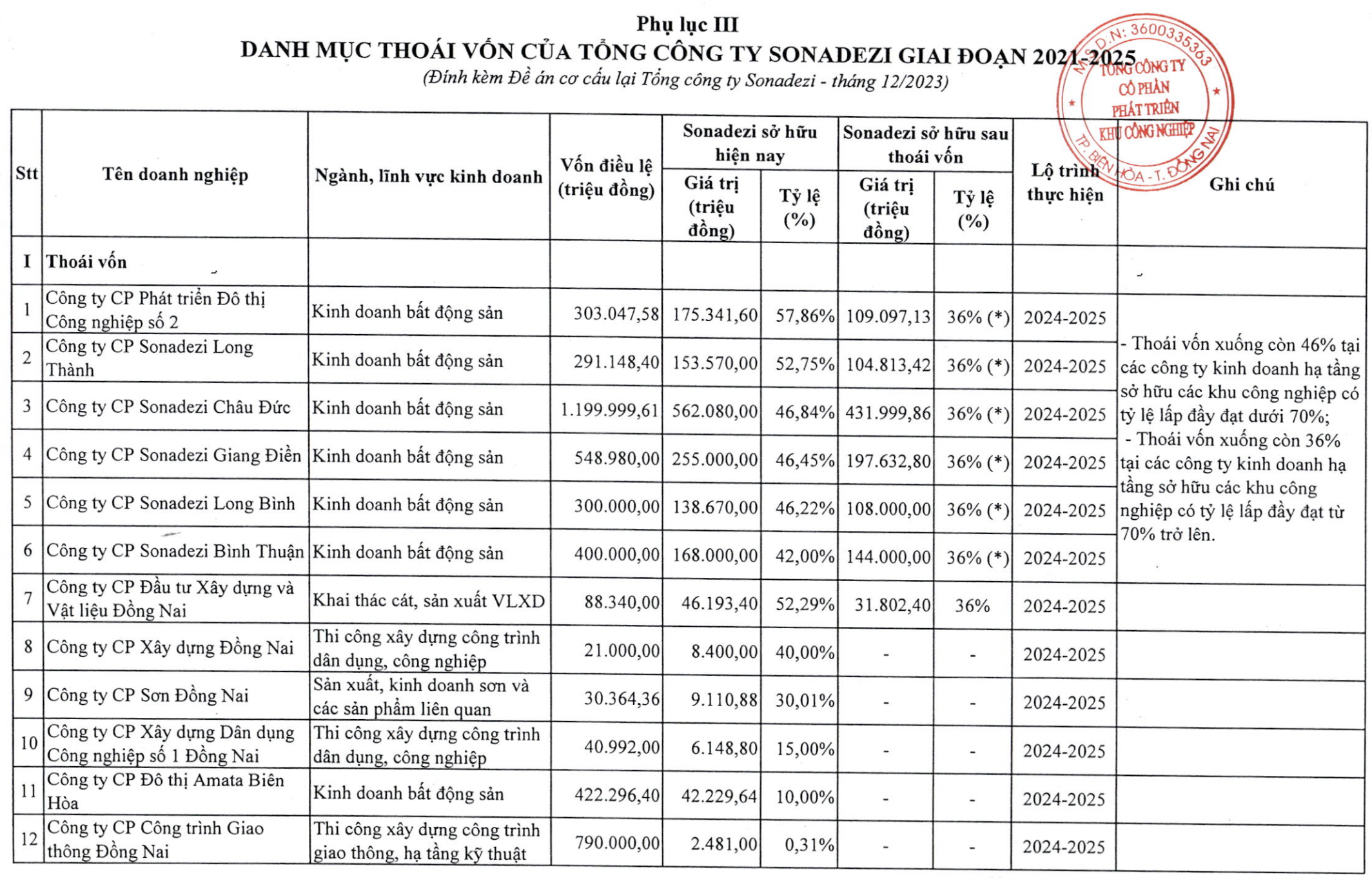

Sonadezi stated that after exercising the warrants, the company will proceed with divestment according to the approved roadmap of the Restructuring Project for the 2021-2025 period.

Specifically, for the 6 industrial infrastructure companies including Sonadezi Urban Development Joint Stock Company No. 2 (HOSE: D2D, ownership ratio of 57.86%), Sonadezi Long Thanh (HOSE: SZL, 52.75%), SZC (46.84%), Sonadezi Giang Dien (UPCoM: SZG, 46.45%), Sonadezi Long Binh (HNX: SZB, 46.22%), and Sonadezi Binh Thuan Joint Stock Company (42%), SNZ will reduce its ownership stake to 36%.

In addition, SNZ will also reduce its ownership stake in Dong Nai Construction Investment and Building Materials Joint Stock Company (UPCoM: DND) from 52.29% to 36%.

Furthermore, SNZ will divest its entire stake in the following 5 companies: Dong Nai Construction Joint Stock Company (40%), Son Dong Nai Co., Ltd. (HNX: SDN, 30%), Dong Nai Civil and Industrial Construction Joint Stock Company No. 1 (15%), Amata Bien Hoa Urban Joint Stock Company (10%), and Dong Nai Transport Construction Joint Stock Company (UPCoM: DGT, 0.31%).

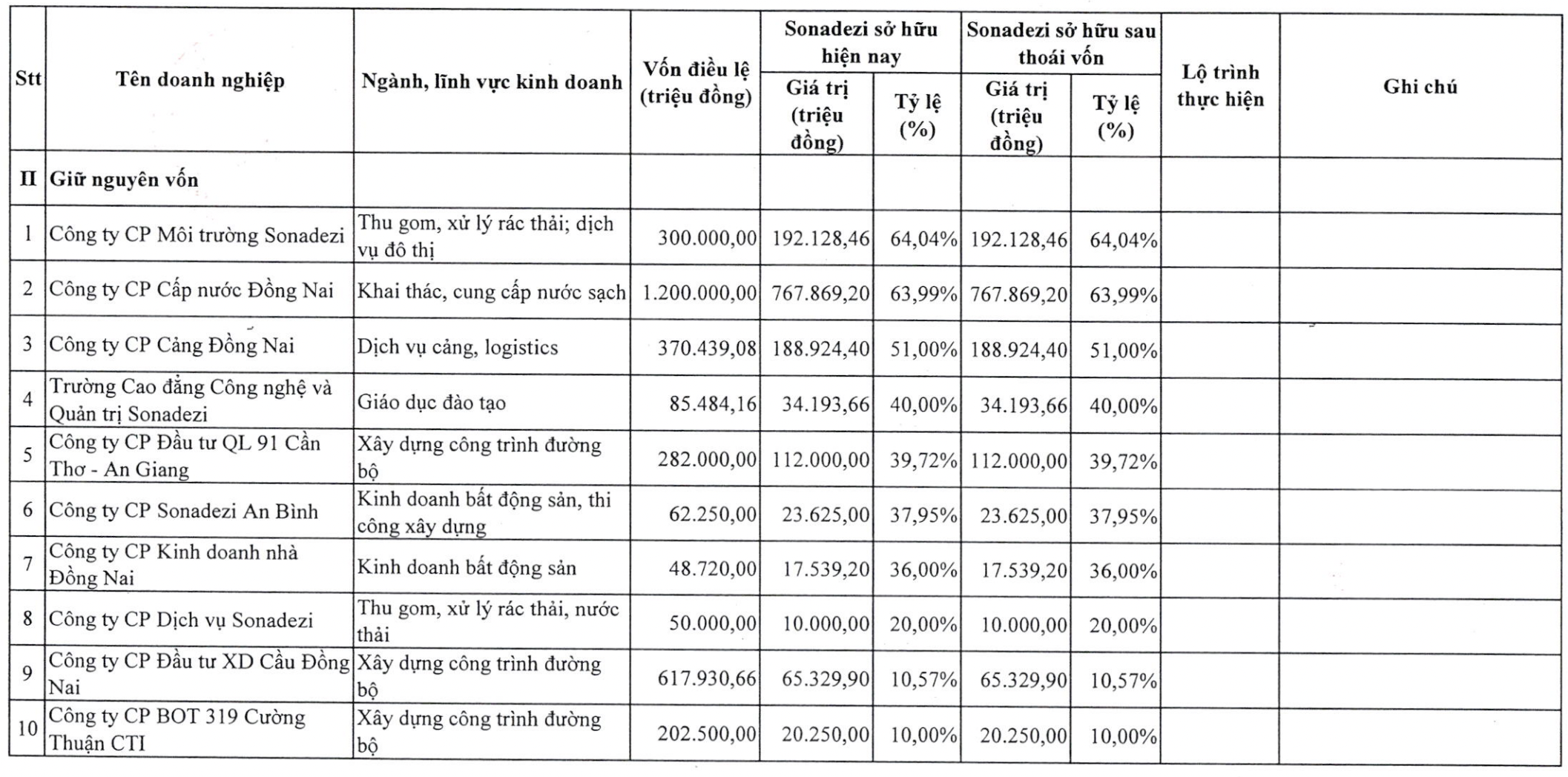

The ownership ratios of the remaining companies in the investment portfolio will be maintained.

Source: SNZ

|