The loose monetary policy has supported the stock market’s upward trend in 2023, especially for small and mid-cap stocks. In its latest update report, VnDirect believes that in 2024, with the government’s target of 6%-6.5% economic growth, the monetary policy will continue to be eased to support the economy.

Some factors contributing to the increase in the VN-Index and stocks in the securities industry include: successful capital increase by securities companies; the expected operation of the KRX system and the prospect of upgrading the market to emerging market status, boosting market liquidity; and the return of foreign investment.

Recently, the government has prioritized upgrading the Vietnamese stock market from a frontier market to an emerging market. Many investors believe that the upgrade is significant for the stock market and will attract more capital from global investment funds.

In addition, investors also expect that the upgrade will enable large-cap companies to more easily raise capital from foreign investors with abundant financial resources.

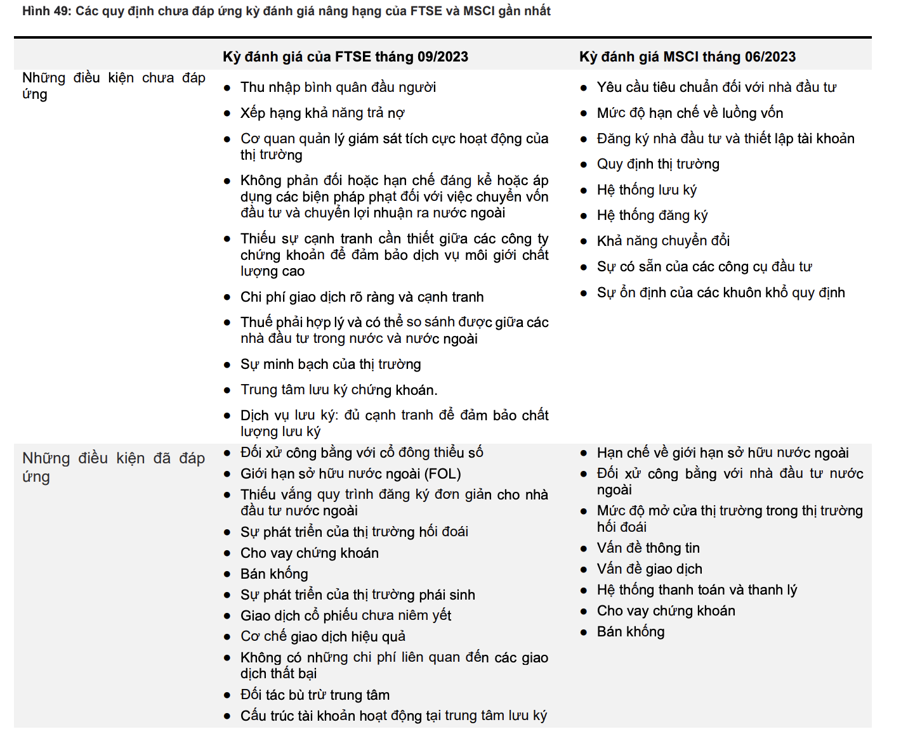

In the latest assessment, Vietnam has met 9 out of 18 criteria of MSCI and a total of 11 out of 24 criteria of FTSE (including 22 market quality criteria and 2 economic positioning criteria). Notably, the unmet criteria do not differ significantly from the previous assessments by these organizations, indicating little improvement in the past three years.

Although there are still 13 unmet criteria, FTSE’s classification clarifies that it is not necessary to meet all criteria to upgrade from a frontier market to an emerging market. The three most important criteria that Vietnam did not meet in the September 2023 review by FTSE Russell are related to:

DvP – ranked as a constraint due to market practice requirements. Investors must have cash available before executing trades. Due to the factor of “pre-funding requirement”, resulting in no failed trades, the “Settlement – Cost related to failed trades” criterion is not ranked; Complex registration procedures for foreign investors; Issues related to foreign ownership restrictions and foreign ownership ratios.

These are also the three factors mentioned by MSCI when considering an upgrade for Vietnam.

In addition, MSCI has six other important criteria. Therefore, it can be seen that the FTSE upgrade is generally simpler than MSCI, and the resources needed to address the two common key issues mentioned by both organizations, FOL and prefunding.

For the DvP issue, long-term and fundamental solutions include the deployment of the KRX system and the Central Securities Depository (CCP). In addition, short-term measures that could be implemented immediately include: allowing investors to pre-deposit a portion of the money or requiring only sufficient cash or securities balance at a time prior to executing trades

Using collateral assets (stocks, bonds, cash) for transactions with a condition that the value of collateral is sufficient to offset executed trades by applying a discount rate.

VnDirect believes that it will be very difficult to prepare for the upgrade to emerging market status in 2024, but it is still achievable if the government is truly determined. The most optimistic timeframe could be the September 2024 review by FTSE Russell. Regarding the KRX system, regulatory agencies are making significant efforts to implement it early this year.

VnDirect expects that the daily trading value will increase by 25-30% compared to the same period thanks to the development of the KRX system, along with additional funds from new investors when market conditions are favorable.

Finally, there is the return of foreign investor capital flows. Foreign investors net sold about VND 24.8 trillion ($1.01 billion) in 2023 due to interest rate differentials between the US and Vietnam. However, the net selling trend is not unique to Vietnam but is also seen in other developing countries. This reflects that once the interest rate differential narrows, we can expect foreign capital to return to emerging markets (including Vietnam) based on economic recovery prospects.