Stock trading in Vietnam saw significant volatility in the early week session. Pressure from large-cap stocks caused the index to lose over 40 points in the late morning session. However, investor sentiment stabilized during the afternoon session, helping the market to narrow its decline, led by VIC and VRE.

VN-Index closed at 1,243.56 points on March 18, a decrease of 20.22 points (-1.6%). The trading value on HoSE reached over 40,000 billion dong, the second highest in history, only behind the session on November 19, 2021. Foreign investors put strong selling pressure with a net sell volume of 902 billion dong, however, the selling pressure mainly focused on the over-the-counter channel on the FUEVFVND fund certificates (853 billion dong).

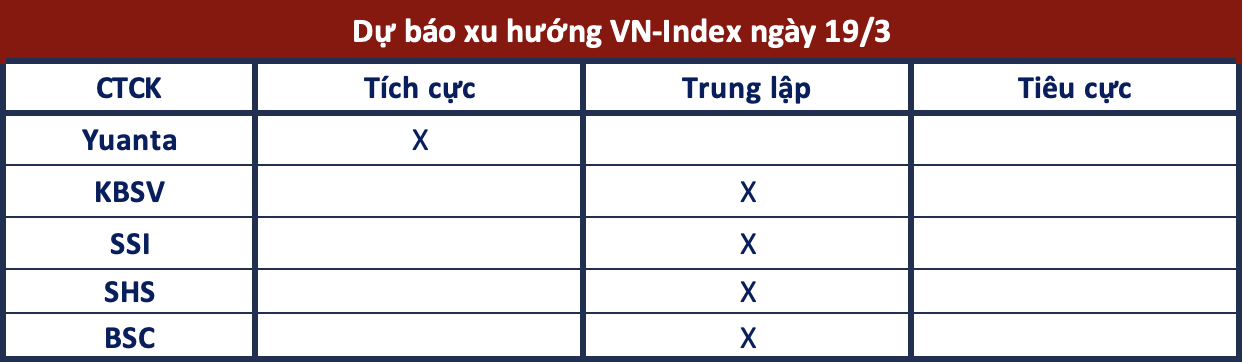

Opinions on the market in the coming sessions are mixed:

Possible return to an upward trend

Yuanta Securities: The market may return to an upward trend in the next session, and the VN-Index may fluctuate around the 20-day moving average. At the same time, the market is still in a short-term accumulation phase, so the capital flow may be divided among different stock groups, with real estate stocks being the highlight as they have shown resilience during the market’s sharp decline.

In addition, the low demand side has been positive with a sudden increase in liquidity and no panic selling, and the selling pressure mainly focused on stocks that have seen strong gains in the recent period, indicating that investors are mainly concerned about losing their profits. Overall, Yuanta Securities assesses the short-term market risk to be low.

Decreasing probability of VN-Index reaching new highs

KBSV Securities: The VN-Index underwent corrective movements in most of the morning session on March 18, before gradually recovering with volatile swings. The formation of a “Long-legged Doji” candlestick pattern indicates a balance between the two sides, with the dominancy swinging back and forth. However, the weakening demand has shown some signs of weakness, and the spillover effect has narrowed on the Midcap stock group, the main leader in recent recovery waves.

KBSV Securities believes that the upward trend is still intact and the possibility of a rebound remains open. However, the weakening demand and the lack of leading groups will decrease the probability of the VN-Index reaching new highs and increase the risk of a reversal in the market direction.

Temporary halt in short-term decline

SSI Securities: The VN-Index had a sharp decline despite a recovery from the 36-day EMA zone at 1,220 points. Technical indicators RSI and ADX have shown signs of positive narrowing, indicating a clear weakness in the index trend. However, with a strong recovery level, the VN-Index may temporarily halt its short-term decline and retest the resistance zone of 1,252-1,254 points before continuing its trend.

Period of abnormal volatile fluctuations

SHS Securities: From a short-term perspective, the market is in a period of abnormal volatile fluctuations, but the demand side is still strong enough to aim for forming an accumulation pattern before the strong resistance zone at 1,300 points. In the positive scenario, if the VN-Index quickly regains the 1,250 point level in the upcoming sessions, the possibility of the index continuing its accumulation before reaching the 1,300 point level becomes likely. In the less favorable scenario, the market may enter a short-term correction phase and move within the range of 1,150-1,250 points.

Opportunity for portfolio restructuring during correction phase

BSC Securities: In the upcoming sessions, the VN-Index may trade in the range of 1,220-1,245 points. Investors can take advantage of this correction phase to restructure their portfolios.