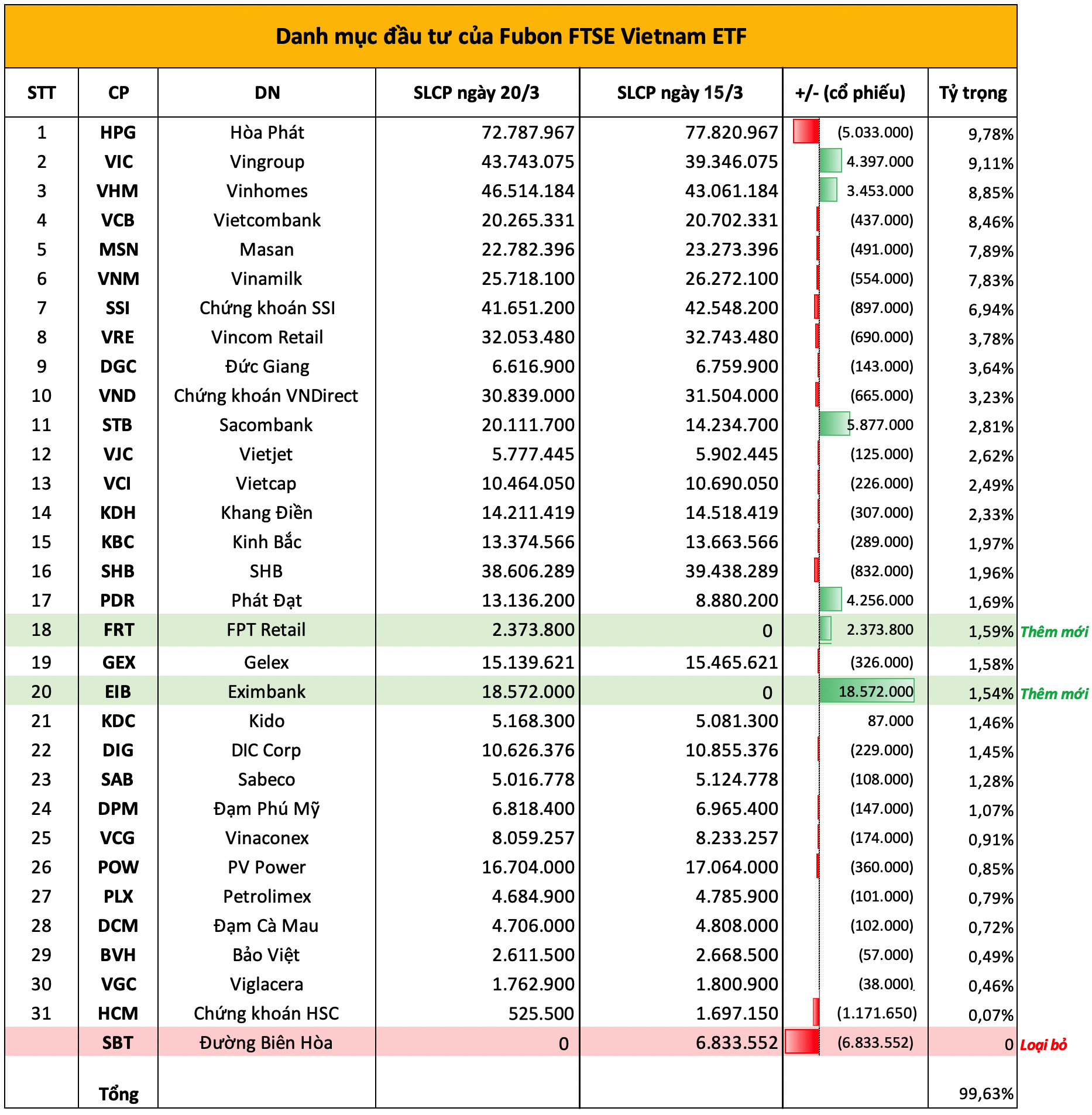

Statistics from Fubon FTSE Vietnam ETF show that the fund has made portfolio restructuring activities in the first quarter of 2024. According to the newly announced portfolio, Fubon FTSE Vietnam ETF has added two new securities, FRT of FPT Retail and EIB of Eximbank, to its portfolio.

In contrast, Fubon FTSE Vietnam ETF has removed the stock SBT of Thành Thành Công Biên Hoà from the portfolio.

After this restructuring period, the number of stocks in Fubon FTSE Vietnam ETF’s portfolio has increased to 31. This number is one stock higher than the FTSE Vietnam 30 Index (HCMC) reference basket.

From March 15 to the end of March 20, Fubon ETF has sold all of its more than 6.8 million SBT shares.

In the same direction, HPG shares were also sold more than 5 million units, reducing the holdings to nearly 73 million units, still the largest stock in Fubon ETF’s portfolio with a proportion of 9.78%. The ETF has also sold nearly 1.7 million HCM shares, with holdings remaining over 525 thousand shares (0.07%).

On the buying side, the fund has purchased nearly 18.6 million EIB shares and 2.4 million FRT shares to add to the portfolio, with proportions of 1.54% and 1.59% respectively.

At the same time, Fubon FTSE Vietnam ETF also bought nearly 4.4 million VIC shares, with a current proportion of 9.11%; bought an additional 3.5 million VHM shares, with a current proportion of 8.85%; bought an additional 5.9 million STB shares, with a current proportion of 2.81%; bought an additional 4.3 million PDR shares, with a current proportion of 1.69%.

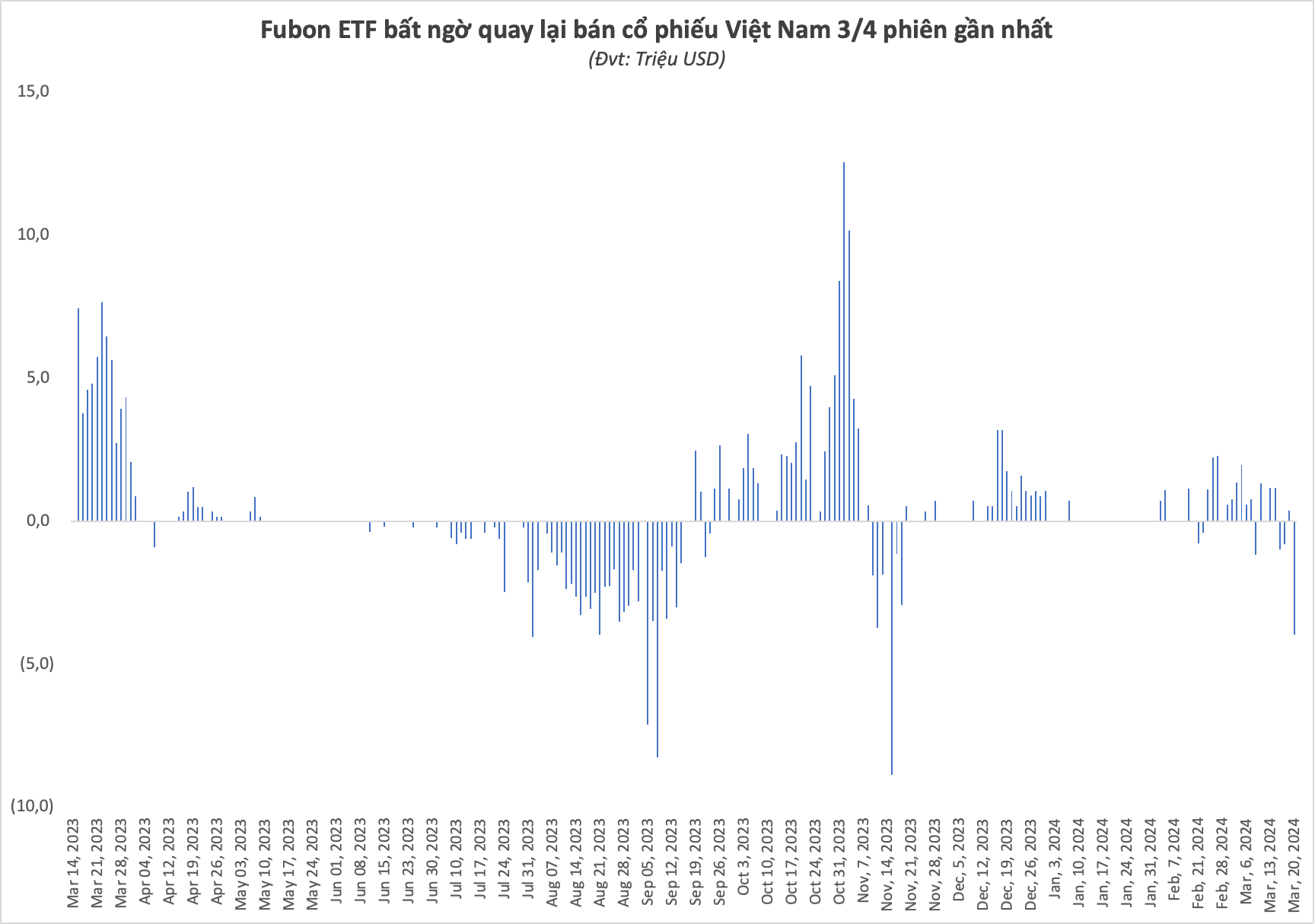

One notable point is that the Fubon ETF capital flow unexpectedly reversed and drew net selling in 3 of the last 4 trading sessions after a strong capital inflow period last month. In total, in less than a week (from March 14-20), Fubon ETF has been net sold $5.3 million, equivalent to about VND 130 billion of Vietnamese stocks being sold. Of note, the nearly $4 million net withdrawal recorded in the March 20 trading session marked the strongest net selling session of Fubon ETF in the past 4 months (since mid-November 2023).

After a few sessions of capital withdrawal, the total value of capital inflow into Fubon ETF accumulated from the beginning of 2024 until the end of the March 20 trading session is about $12 million (~ VND 284 billion). Currently, the size of Fubon FTSE Vietnam ETF’s portfolio reaches over NTD 28.7 billion, equivalent to VND 22,300 billion, continuing to be the largest ETF in the Vietnamese stock market.

According to Mr. Nguyen Thanh Tung, CEO of Yuanta Vietnam Securities, foreign investors and specifically Taiwanese (Chinese) organizations still have a great interest in the Vietnamese stock market, actively investing and constantly seeking new opportunities. This means that foreign capital inflows into the market will be increasingly better.