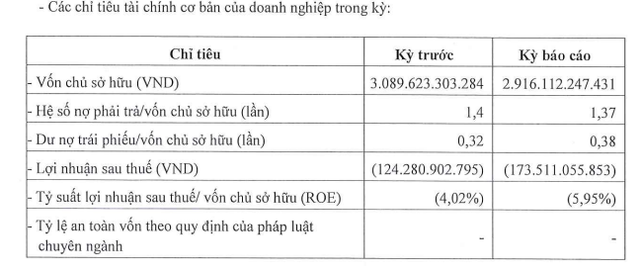

Unity Real Estate Investment Co. Ltd, a subsidiary of Novaland, has just published its periodic report on the financial situation in 2023. Accordingly, Unity’s after-tax loss was 173 billion VND, an increase of nearly 40% compared to the same period in 2022.

As of the end of 2023, Unity recorded equity of 2,916 billion VND, while at the beginning of the year it was nearly 3,090 billion VND. The ratio of debt to equity is 1.37 times, equivalent to an outstanding debt of 3,995 billion VND, a decrease of 8% compared to the previous year. Outstanding bonds/equity ratio is 0.38 times, equivalent to outstanding bonds of 1,108 billion VND, an increase of 12% compared to 2022.

As of the end of 2023, Unity’s total assets were recorded at 6,911 billion VND.

Regarding the company’s bond situation, according to information from HNX, Unity currently has 2 bond series, UNICH2124001 and UNICH2124002. These are 2 bond codes that were issued at the end of 2021, with values of 416 billion VND and 584 billion VND, respectively.

These are all non-convertible corporate bonds with secured assets. Interest rate of 12.5%/year. The custodian is PetroVietnam Securities JSC.

At the end of 2023, the company extended the term of 2 bond series. Specifically, for the 416 billion VND bond, the adjusted maturity date was extended to October 2026 instead of 2024. Interest from April 14, 2023 to July 13, 2025 will be paid in a lump sum on the maturity date or early interest will be received by agreement between the bondholders and the Company. From July 14, 2025 onwards, bondholders will be paid interest every 3 months as before.

The plan to buy back bonds early has also changed. Unity Real Estate will buy back in 3 tranches; in which the first tranche will buy back 100 million VND (calculated in the 26th month from the date of issuance), the second tranche will buy back 207.9 billion VND (in the 48th month) and the remaining 208 billion VND in the third tranche (in the 60th month).

Commitments regarding the time to complete the project’s legal procedures have also been postponed. Accordingly, the design of the project’s construction drawings approved by the competent authority (the old plan was the fourth quarter of 2021) and the building permit for the project’s infrastructure and works (the old plan was the first quarter of 2022) are adjusted to be expected to be completed in the first quarter of 2024.

The time for completion of the acceptance certificate of the competent authority for the corresponding technical infrastructure part according to the project progress was changed to from the second quarter of 2024 onwards (the old plan was from the third quarter of 2022).

In addition, there are a number of other adjustments. For example, the cash flow from sales of products at the project must be in accordance with the sales report of Binh An Company/Brokerage Company instead of being in accordance with the list of customers registering for business, buying and selling, and leasing as before.

Bond series UNICH2124001 aims to increase the scale of working capital and then to acquire capital at Binh An Tourism Company Limited, thereby owning the high-end Binh Chau – Phuoc Buu eco-tourism and resort project in Binh Chau, Xuyen Moc district, Ba Ria – area. – Vung Tau, invested by Binh An Tourism.

Similarly, with the 584 billion VND bond series UNICH2124002, issued on November 4, 2021, in order to increase the scale of working capital and then acquire capital at Da Lat Lake Real Estate Company Limited, thereby owning the Hoan Vu – Ho Tram Resort project in Binh Chau, Xuyen Moc district, Ba Ria – Vung Tau province, which is invested by Hoan Vu JSC.

In addition to adjusting the maturity date to November 2026, the interest on this bond, from May 4, 2023 to August 3, 2025, will be paid in a lump sum on the maturity date or early interest will be received in accordance with the agreement between the bondholders and Unity Real Estate. From August 4, 2025, bondholders will be paid every 3 months.

The company will buy back in tranches including tranche 1 (in the 25th month from the date of issuance) 100 million VND, tranche 2 (in the 48th month) is 291.9 billion VND, the remaining 292 billion VND in tranche 3 (in the 60th month).

The approval time for the project extension is expected to last until the first quarter of 2025 (the old plan was the fourth quarter of 2021); complete the design of the construction drawings of the competent authority in the first quarter of 2024 (the old plan was the first quarter of 2022) and the building permit for the infrastructure and works in the second quarter of 2024 (the old plan was the first quarter of 2022); The forest environment lease contract signed with the Department of Natural Resources and Environment of Ba Ria – Vung Tau province will be extended to the third quarter of 2024 (the old plan was the first quarter of 2022); The investment policy decision is expected to be made in the fourth quarter of 2025; Decision approving 1/500 in Zone B (forest area) in the first quarter of 2025; the acceptance certificate for the corresponding technical infrastructure part according to the project will be from the second quarter of 2024 (the old plan was from the third quarter of 2022).

At the same time, Unity Real Estate commits to providing the investment certificate for the Binh Chau – Phuoc Buu project and the investment policy for the Hoan Vu – Ho Tram project, no later than the third quarter of 2024 and the fourth quarter of 2025, respectively.

It is known that Unity Real Estate is a subsidiary of Novaland, established in September 2016 with the name Nova Hospitality JSC, with an initial charter capital of 50 million VND. Currently, Novaland owns 99.98% of Unity’s capital, the representative is Mr. Bui Dat Chuong.