According to the five-element feng shui, the year Giap Thin (2024) carries the Fire element, which will not be a very favorable year for Metal investors due to the conflicting nature of Fire and Metal. Therefore, for Metal investors, when constructing their stock investment portfolio, the top priority should be safety. They should only choose stocks that are in harmony with Metal, such as Earth element stocks with solid fundamental factors.

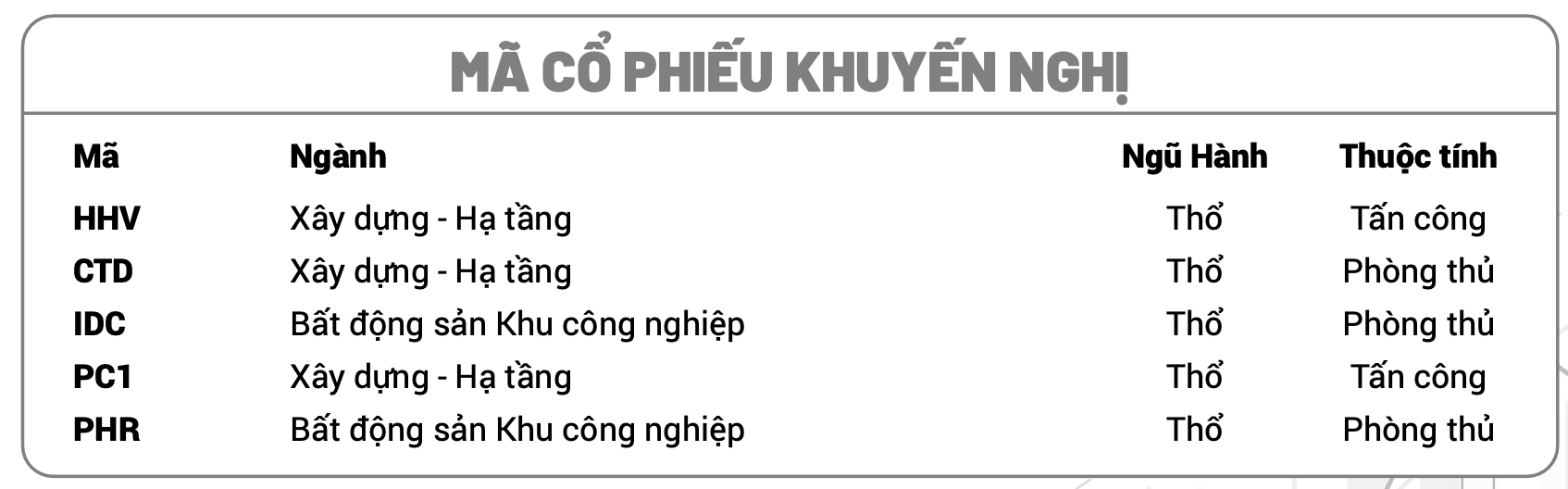

Based on the following criteria: (1) Prioritize industries that are experiencing high growth due to the benefits from government policies or the overall strong economic growth forecasted for Vietnam in the coming years; (2) Prioritize leading companies in their respective industries to maximize the growth potential of the sector, BIDV Securities Company (BSC) has suggested 5 stocks that are suitable for Metal investors according to both offensive (HHV, PC1) and defensive (CTD, IDC, PHR) strategies.

According to BSC, the selected offensive stocks for Metal investors are projected to have revenue and profit growth of over 20% in 2024. On the other hand, the defensive group consists of stocks with reasonable valuation, low price-to-earnings (P/E) and price-to-book (P/B) ratios that approximate the average of the past three years, or stable dividend payments and a good market share in their respective industries.

The dynamic duo – HHV and PC1

Hoa Da Infrastructure Investment Corporation (HHV) operates in the fields of (1) transportation infrastructure construction, and (2) toll road management and operation. HHV is currently the leading BOT investor in Vietnam in terms of total investment value (38,000 billion VND). Among its projects, 2 BOT projects have increased in value in 2023. The toll collection activity of BOT brings HHV a relatively stable source of revenue, expected to reach over 1,500 billion VND in 2023.

According to BSC’s evaluation, the revenue and profit growth of HHV is ensured in the 2024-2026 period, with a projected growth rate of over 20% due to a large backlog value (estimated at 3,300 billion VND), about 6 times the average construction revenue during the 2021-2022 period. This will guarantee the growth of the construction portfolio for HHV in the 2023-2025 period.

Furthermore, growth momentum comes from the implementation of 2 expressway projects: Dong Dang – Tra Linh and Huu Nghi – Chi Lang, with a total investment value of over 25,000 billion VND. These projects are expected to (1) Generate profit from investment contribution for HHV, (2) Boost the traffic flow through toll stations on the Bac Giang-Lang Son expressway thanks to the creation of a continuous traffic route, (3) Increase HHV’s backlog value by at least 20% of the construction volume from the above-mentioned projects.

Power Construction Corporation 1 (PC1) operates in the fields of electricity construction, industrial production, energy investment, real estate investment, consulting, and services. According to BSC, the net revenue from PC1’s construction activities will recover thanks to the investment stimulation of power transmission projects, especially the Quang Trach-Pho Nong 500 kV transmission line project. In addition, the gross profit margin of the construction activities is expected to improve due to the decrease in raw material prices.

The mining sector with a high gross profit margin (about 28%) is expected to maintain its order backlog in 2024 due to the continued increase in demand for electric vehicles. The export volume of nickel is estimated to grow by 50% in 2024 with a good gross profit margin, which will make a significant contribution to the overall profit of the company.

In addition, with a high leverage ratio, the lower interest rate will positively support PC1’s profitability. According to BSC, the interest savings is expected to contribute 19% of the profit in 2024. Furthermore, the industrial real estate business is expected to start recognizing profits from the Yen Phong IIA project from 2024.

The trio – CTD, IDC, PHR

Coteccons Construction Joint Stock Company (CTD) operates in the fields of civil, industrial, and infrastructure construction. According to BSC, CTD has a large backlog value of 20,000 billion VND as of the end of 2023, equivalent to about 1.5 times the revenue for the 2022-2023 period, ensuring the revenue and profit of the company in the 2024-2025 period.

The gross profit margin of CTD is forecasted to improve to 2.7% in 2024 (+0.5 percentage points year on year) and 3% in 2025 (+0.3 percentage points year on year) thanks to the increased proportion of industrial construction projects in its backlog structure. According to BSC’s estimate, the industrial construction sector has a better gross profit margin of 2-3% compared to the civil construction sector and 4-5% compared to the infrastructure sector.

In addition, BSC estimates that CTD will reduce its provision for doubtful receivables to 94 billion VND and 77 billion VND in 2024 and 2025, respectively. The cost savings are equivalent to 4 times the profit of the 2021-2022 period and about 2 times the profit of 2023, thereby ensuring the profit growth of CTD in the coming years.

Industrial Construction Corporation – Joint Stock Company (IDC) operates in the fields of investment, development, and business of industrial parks, urban areas, residential areas, and other industrial and civil projects. IDC currently has a large ready-to-lease land bank, estimated at about 650 hectares, which will provide a competitive advantage in attracting investors, given the increasing scarcity of industrial park supply. In addition, IDC has plans to develop an additional 2,000 hectares of new industrial park area, including Que Vo 2 – GD2 Industrial Park (300 hectares) and Tan Phuoc 1 Industrial Park (470 hectares).

The increasing demand for industrial park land due to the active inflow of FDI into Vietnam will drive the signing of new lease contracts for IDC, in addition to the expected recognition of revenue from project transfers to Aeon in 2024. BSC forecasts that this contract will generate revenue of 547 billion VND and pre-tax profit of 241 billion VND for IDC, guaranteeing profit growth for the company in 2024.

Phuoc Hoa Rubber Joint Stock Company (PHR) is one of the large-scale companies in the rubber industry in Vietnam and is located in the central position of the rubber-growing region in the Southeast region. According to BSC, revenue from rubber of PHR is expected to recover by 15% in 2024 due to the increase in selling prices and production volume (estimated to increase by 3% in average selling prices and 13% in output).

In addition, the revenue and profit of the two industrial park projects, NTC and VSIP 3, will be the main growth drivers for the 2024-2025 period. BSC believes that with favorable location and good infrastructure in the Binh Duong area, these projects will be quickly filled after deployment. PHR is still expanding its land bank, ensuring long-term growth potential with the Tan Lap 1 and Tan Binh projects in Binh Duong province.

Furthermore, the stable financial situation will allow PHR to continue the tradition of high dividend payouts. BSC believes that PHR can maintain an average annual dividend payout rate of about 40% of par value thanks to abundant cash (cash and short-term financial investments of over 2,200 billion VND).