In the Q4 2023 Hanoi real estate market report by Savills, the apartment segment in Hanoi is showing positive signs of recovery, while the villa/townhouse segment still faces difficulties.

Hanoi apartment prices have increased for 20 consecutive quarters.

In the Q4 2023, there were 2,876 new apartment units, a 52% increase compared to the previous quarter but a 1% decrease compared to the same period last year. The primary supply reached 11,911 units, a 40% decrease compared to the previous quarter and a 41% decrease compared to the same period last year.

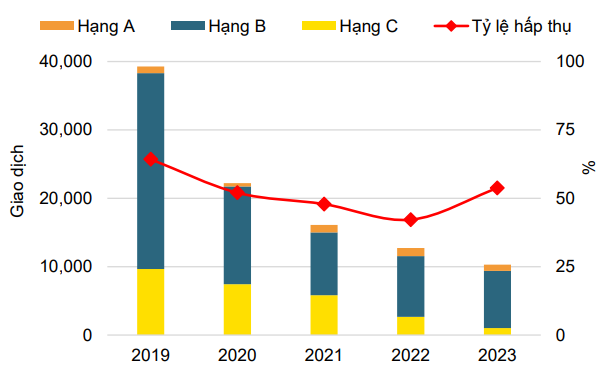

Throughout 2023, the new supply reached the lowest level in 10 years with 10,403 units, of which Grade B accounted for 84% of the supply.

The number of units sold reached 3,045 units in Q4, a 45% increase compared to the previous quarter and a 5% increase compared to the same period last year. Among them, Grade B accounted for 84% of the units sold. The new supply had an absorption rate of 46%.

In terms of apartment prices, the average primary prices increased for 20 consecutive quarters to 58 million VND/m2, a 7% increase compared to the previous quarter and a 12% increase compared to the same period last year. Savills stated that this is due to the increasing land and construction costs, improved infrastructure, and quality. Along with that, affordability has decreased and loan demand has increased.

The popular price range for apartments with prices from 51 – 70 million VND/m2 accounted for 63% of the new supply, a 24% increase compared to the same period last year. Apartments in this price range accounted for 49% of the units sold, a 21% increase compared to the same period last year.

Apartments with prices above 4 billion VND accounted for 42% of the units sold in 2023, an increase from 3% in 2019. Apartments with prices from 2 – 4 billion VND accounted for 55% of the market share. Meanwhile, only 3% of the units had prices below 2 billion VND.

|

Apartment Market Performance from 2019 – 2023

Source: Savills

|

Vinhomes Ocean Park and Vinhomes Smart City accounted for 46% of the new supply and 33% of the units sold since their launch at the end of 2018 and the beginning of 2019, reflecting continued demand in suburban areas.

In 2024, 15 new projects and the next phase of 2 projects are expected to provide 12,100 units. Grade B will account for 79% of the market share.

According to Ms. Do Thu Hang – Senior Director, Research and Consultancy Savills Hanoi, there is a disconnect between supply and demand in Hanoi, especially in affordable housing. The completion of urban railway and ring roads will accelerate the shift to areas outside the city center.

The villa/townhouse segment still faces difficulties

In this market, there were 87 new units, including 58 units from the new Solasta Mansion project in Ha Dong and 29 units from the existing An Lac Green Symphony project in Hoai Duc.

The total new supply in 2023 reached 272 units, an 82% decrease compared to the same period last year and the lowest in 10 years. The primary supply reached 710 units from 16 projects, a 23% decrease compared to the same period last year. Townhouses accounted for 44% of the market share.

The number of transactions in Q4 2023 decreased by 67% compared to the same period last year to only 64 units. The absorption rate in the quarter only reached 9%, a 12% decrease compared to the same period last year.

In 2023, only 359 units were sold, the lowest since 2014. The total number of transactions decreased by 76% compared to 2022, and the absorption rate in 2023 reached only 36%, a 31% decrease.

Although most developers did not change their prices, limited new supply and high-priced inventory affected the low-rise residential market. Future infrastructure development will continue to drive housing demand to provinces and neighboring areas with more reasonable prices and large land reserves.

In 2024, an additional 2,932 units are expected from 13 projects, of which 82% will come from new projects. By 2026, it is estimated that there will be 14,000 new units from 37 projects. New major projects will provide additional supply to the market, including Vinhomes Co Loa and Vinhomes Wonder Park.