Buy POW stocks with a target price of 14,000 VND/share

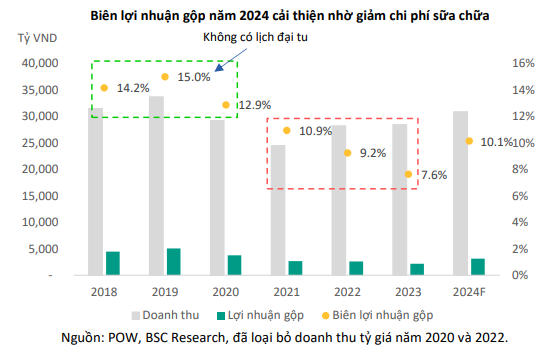

According to the analysis of BIDV Securities Company (BSC), in 2024, the power plants of PetroVietnam Power Corporation (PV Power, HOSE: POW) will mainly carry out minor repairs and have shorter downtime compared to previous years.

Therefore, BSC expects that POW will maintain stable production and fewer maintenance incidents, which will help the company improve its gross profit margin from 7.6% in 2023 to 10.1% in 2024.

In addition, BSC expects the revenue of 155 billion VND from Nhon Trach 2 to be recognized in the first half of 2024, as the company was completing documentation to account for the compensation.

Along with the projected decrease of 28% in interest expense compared to the same period in a low-interest rate environment, BSC forecasts that POW’s net revenue and net profit in 2024 will reach 29,447 billion VND and 2,135 billion VND, an increase of 5% and 98% respectively compared to the previous year.

In 2024, most of POW’s electricity production will come from the Vung Ang 1 power plant, while gas power plants will reduce production. BSC forecasts that the mobilized output of Vung Ang 1 power plant may increase by 46% compared to the same period, thanks to the decreasing input costs and stable coal supply.

Meanwhile, the electricity output of Nhon Trach 2 plant will decrease by 44% compared to the same period, and Nhon Trach 1 will remain at a low level. Therefore, the increased mobilized output of Vung Ang 1 power plant will be the main factor contributing to the growth of the company, compensating for the decrease of Nhon Trach 2 plant.

In addition, POW may receive an insurance compensation of 300 billion VND for the business interruption incident at Vung Ang 1 power plant. However, the company is still negotiating with the insurance company, and there is no official information yet. Therefore, BSC has not included this amount of money in the valuation model, but it is still a short-term support factor for investor sentiment.

Based on the above analysis, BSC maintains a buy recommendation for POW stocks, with a target price of 14,000 VND/share in 2024.

For more information, click here.

Follow SBT stocks with a target price of 14,900 VND/share

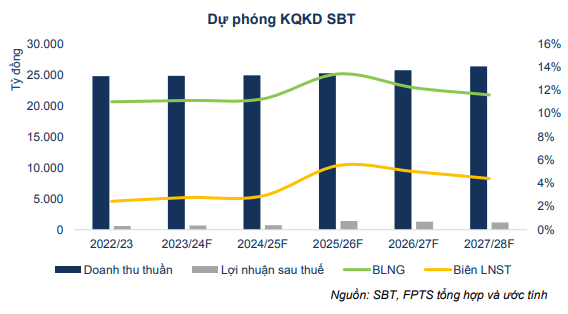

After a period of strong growth, FPT Securities Company (FPTS) forecasts that the annual sugar consumption of Thanh Thanh Cong – Bien Hoa Sugar Joint Stock Company (TTC Sugar, HOSE: SBT) for the 2023-2024 season will remain at a high level compared to the 2022-2023 season, estimated at 1.3 million tons.

During this period, the growth in export market will compensate for the decrease in commercial channel as the trading activities of sugar do not bring effective profits.

The selling price of finished sugar is forecasted to reach 17,600 VND/kg, remaining stable compared to the high level in the same period, thanks to the growth in the first half and adjustment in the second half of the 2023-2024 season.

With the forecasted stable sugar consumption and selling price after a period of strong growth, FPTS projects that SBT’s net revenue for the 2023-2024 season may reach 24,814 billion VND, equivalent to the previous season.

The estimated gross profit is 2,758 billion VND (an increase of 1.4%) and the gross profit margin is expected to reach 11.1%, approximately the same as the previous season due to the still high imported sugar price.

The expected net profit will improve from a low level to 687 billion VND (an increase of 13.7%), equivalent to a 0.4 percentage point increase in profit margin, mainly due to financial revenue.

For the 2024-2025 and 2027-2028 periods, SBT’s net profit is expected to grow at a rate of 13.9% per year as the negative factors in the 2022-2023 season gradually decrease.

In conclusion, FPTS recommends monitoring SBT stocks for long-term investment, with a target price of 14,900 VND/share.

For more information, click here.

Buy MWG stocks with a target price of 56,100 VND/share

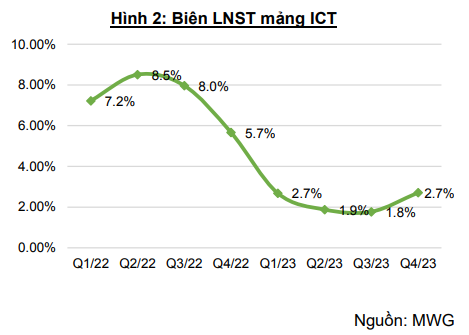

Vietcombank Securities Company (VCBS) recommends buying shares of Mobile World Investment Corporation (MWG) with a target price of 56,100 VND/share, equivalent to a target P/E of 35x based on the positive prospects of the merger of Bach Hoa Xanh and the recovery of the electronics business in the coming year.

In the latest Consumer – Retail report, VCBS expressed its view on the slower recovery trend in the second half of 2024, based on the economic recovery and government support policies for domestic consumption.

VCBS believes that MWG may maintain the profit margin of the ICT segment at around 2.8% in 2024, equivalent to the first quarter of 2023 (before the price war) and the fourth quarter of 2023 (when the demand improved and the price war eased).

The revenue of Thế Giới Di Động and Điện Máy Xanh chains is projected to slow-growth in the double-digit figures, reaching 89,767 billion VND, an increase of 7% compared to the same period.

The merger of Bach Hoa Xanh in December 2023 has brought MWG into a new stage of development. VCBS believes that the revenue of Bach Hoa Xanh will continue to grow in 2024 due to the growth of existing and new stores in a selective manner.

With the assumption that the revenue of Bach Hoa Xanh will reach 36,700 billion VND in 2024 (an increase of 18% compared to the same period) and MWG continues to cut costs, Bach Hoa Xanh is expected to bring in a net profit of 300-400 billion VND this year.

Investors should note that the risks to MWG may come from a slower-than-expected recovery in the ICT segment, continued intense price competition, and lower-than-expected revenue growth of Bach Hoa Xanh (<15%).

For more information, click here.

—