On February 27, the stock price of HPG increased by 5.4% to 30,350 VND/share and was the best performing stock that impacted the VN-Index.

The trading volume also spiked with nearly 87 million shares of HPG being traded, of which foreign investors also net bought 15 million shares. This is the highest trading volume of HPG since the end of 2022.

| HPG stock price movement |

Other steel stocks also saw gains, with VGS surging 7.1%, SMC adding 1.9%, NKG increasing 1.7%, HSG advancing 1.8%, POM rising 1.3%…

Steel sector stock movement on February 27

|

The surge in the steel sector occurred amidst a strong market rally with high liquidity.

In this session, the VN-Index increased by 13.29 points (equivalent to 1.09%) to 1,237.46 points, while the VN-30 advanced 14.6 points (equivalent to 1.18%) to 1,247.91 points. The total market trading volume reached 25.7 trillion VND.

In addition, positive evaluations from securities companies have contributed to investors’ optimistic view of the steel sector.

Steel Sector Recovery in 2024?

In its steel sector outlook report, SSI Research stated that this industry could recover in 2024, especially in the domestic market.

In 2024, analysts at SSI Securities anticipate that total steel consumption will recover by over 6% compared to the same period, with domestic consumption growing by nearly 7%.

Regarding domestic consumption, there have been signs of recovery since the end of 2023 when consumption from September to November increased by 13% compared to the same period after declining by 20% in the first 8 months of 2023.

“Steel consumption in 2024 will be supported by macroeconomic conditions and a brighter real estate market. In the previous cycle, construction steel consumption in 2013 increased by about 3% compared to the bottom in 2012,” SSI Research noted in the report.

Furthermore, export volume can maintain growth due to positive global demand prospects.

According to the World Steel Association, global steel demand is expected to increase by 1.9% in 2024 compared to 1.8% in 2023. Demand from developed economies is forecasted to increase by 2.8% in 2024 after a 1.8% decline in 2023, with the US and Europe’s demand expected to grow by 5.8% and 1.6%, respectively.

On the other hand, demand from ASEAN countries (excluding Vietnam) is projected to increase by 5.2% in 2024, higher than the 3.8% in 2023.

SSI Research expects that the volume of steel exports will improve in the first quarter due to the increasing price gap between steel in North America and Europe compared to steel in Vietnam. Additionally, stricter control over imports of finished steel produced by Russia by Europe in 2024 will also support Vietnam’s steel exports to Europe.

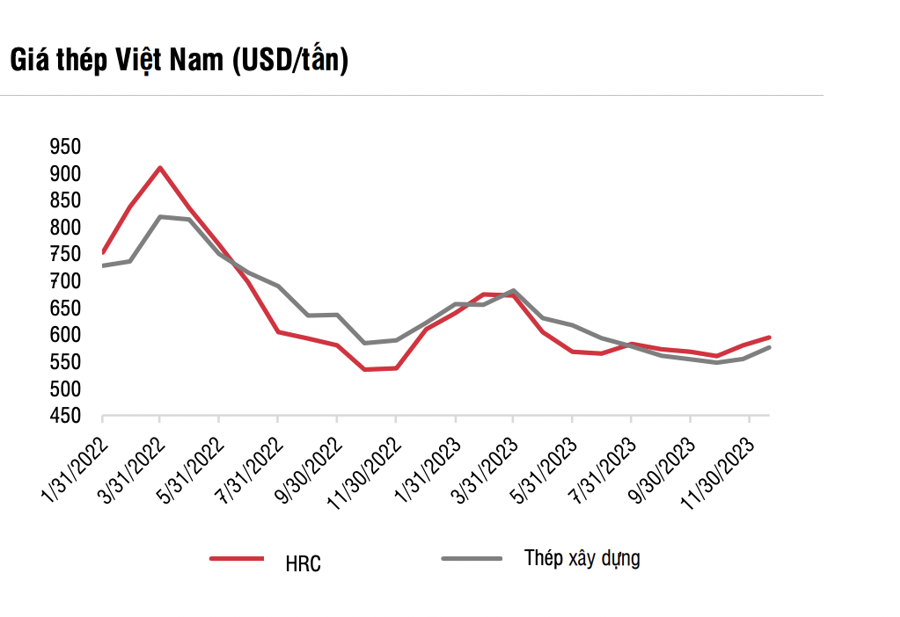

Moreover, the recovery of steel prices also contributes to the bright prospects of the industry. SSI Research evaluates: “Steel prices may have bottomed out and will improve in 2024 due to a better supply-demand balance.”

According to SSI Research, China’s steel production in the first 11 months of 2023 increased by 1.5% to reach 952 million tons. However, on a monthly basis, China’s steel production has continuously decreased from the peak of 95.7 million tons in March to 76.1 million tons in November due to weak demand and rising raw material costs, while steel companies’ profit margins have dropped to a low level.

China’s production decline also led to a decrease in global production from 165 million tons in March to 145.5 million tons in November. Steel inventories in China have also significantly decreased in recent months, helping to reduce global excess supply in the coming time.

Therefore, steel prices may have bottomed out and are expected to recover in the near future. However, SSI Research does not expect steel prices to rise sharply due to weak overall demand, especially in China where the real estate market has yet to show strong signs of recovery.

As for Vietnamese steel companies, SSI Research predicts that their profitability will experience high growth in 2024 from the low base in 2023, and gross margins will rebound from their lows in recent years as steel prices are likely to have ended their downward trend.