According to the preliminary statistics of the General Department of Customs, Vietnam imported more than 5 million tons of various types of coal in January 2024, equivalent to nearly 670.1 million USD, up 5.3% in volume and 6.5% in value compared to the previous month. Compared to January 2023, coal imports increased sharply by 216.8% in volume and 150.2% in value. The import price in January reached 132 USD/ton, a decrease of 18.3% compared to the same period in 2023. In 2023, Asian countries increased coal imports to replace Europe after the region stopped buying due to Western sanctions against Russia. Vietnam is no exception and has led to a surge in coal imports.

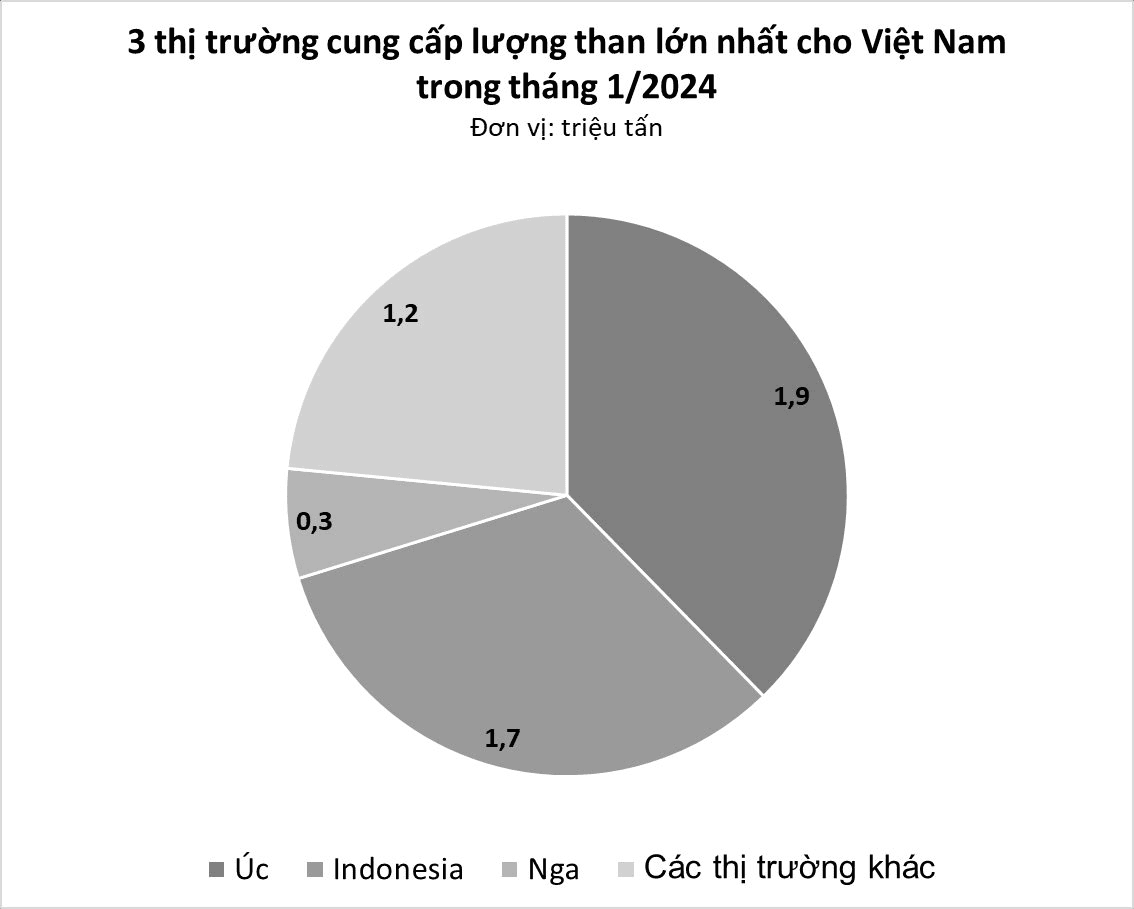

Regarding the market, Australia remains the largest supplier of coal to Vietnam with 1.9 million tons, worth more than 288.2 million USD, an increase of 98% in volume and 69% in value compared to the same period. Following are Indonesia and Russia. At the beginning of 2024, Japan is a market that has not yet imported coal. It is worth noting that coal from Indonesia is continuously flooding into Vietnam at extremely low prices.

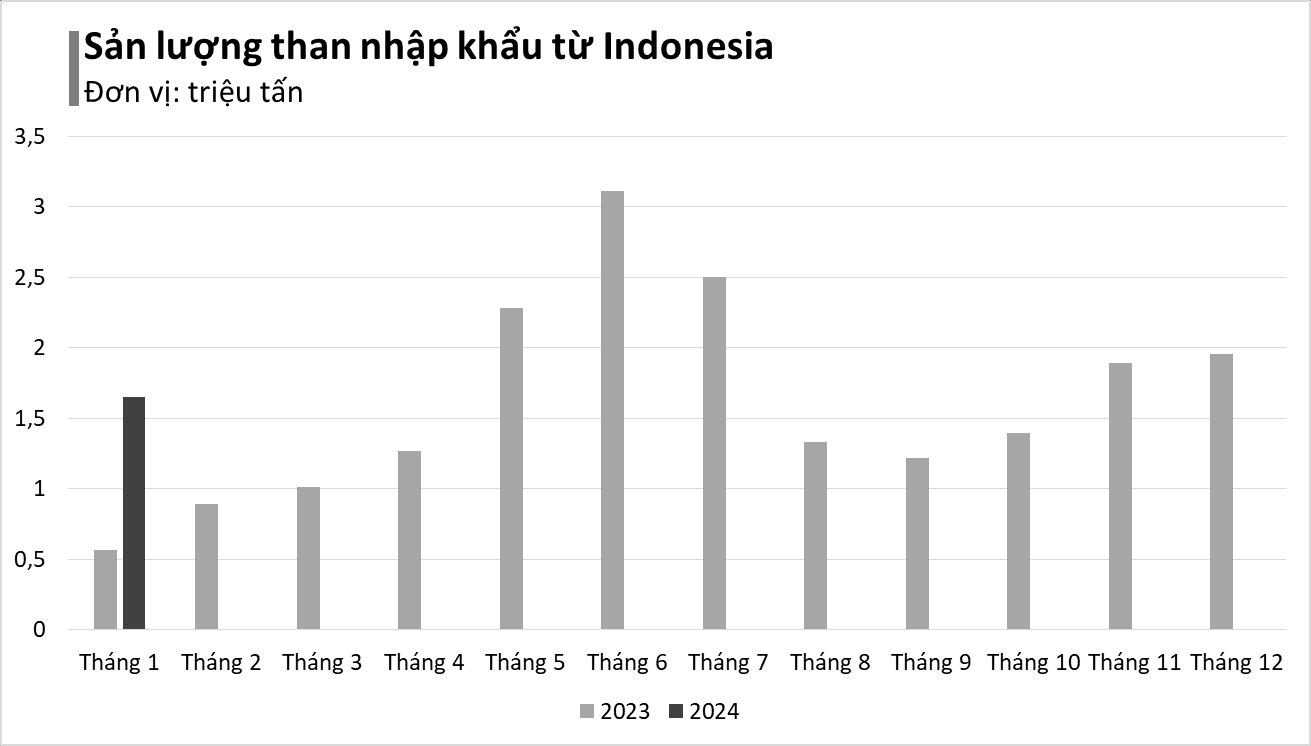

In January 2024, coal imports from Southeast Asian countries reached over 1.65 million tons with a value of over 143.8 million USD, an increase of 2,560% in volume and 2,588% in value compared to the same period last year. This market accounts for 32.5% in volume and 21.5% in terms of trade. The average import price reached $87/ton, a decrease of nearly 21% compared to the same period in 2023. In the global coal market, Indonesia is one of the most prominent countries. According to BP’s statistics in 2019, Indonesia ranked second in the world in coal exports (with 220.3 MTOE, only behind Australia’s coal export production), ranking fifth in the world in terms of reserves (with 37 billion tons, accounting for 3.5% of the total global coal reserves).

In addition to abundant coal resources suitable for the needs of many countries, including Vietnam, Indonesia also has very specific, synchronous, reasonable, and tight coal resource management policies. Indonesian Minister of Energy and Mineral Resources, Arifin Tasrif, said that the country’s coal production reached 775 million tons in 2023, the highest level in history. Of which, 213 million tons were used for domestic power plants, and the remaining amount was for the export market. In the past 4 years, Indonesia’s coal production has grown steadily, from 564 million tons (in 2020) to 614 million tons (in 2021) and 687 million tons (in 2022).

In Vietnam, thermal and hydroelectric power are still the main sources of electricity to serve domestic consumption and production needs. The coal demand for power generation in 2024 is more than 74.3 million tons, but the domestic supply can only meet 65%, the remaining amount must be imported. That is, the domestic coal supply from the Vietnam Coal and Mineral Industries Group (TKV) and the Northeast Coal Corporation can only supply more than 48.2 million tons of coal for power generation next year. To have enough coal for power production next year, the Ministry of Industry and Trade has entrusted investors to diversify imported coal sources, compensate for the amount of coal that TKV and the Northeast Coal Corporation cannot meet, except for BOT power plants using domestic coal whose contracts are guaranteed by the Government.

In addition to large markets, Vietnam is expected to import 11 million tons of coal from the Kaleum coal mine in Xekong Province (Laos) through two international border gates in Quang Tri Province in 2024.