At the end of 2023, Khang Dien Investment and Business Development Joint Stock Company (KDH) announced the acquisition of 99% of the charter capital of Loc Minh Real Estate Development Joint Stock Company (Loc Minh) for a value of 350 billion dong. The executing unit is Saphire Real Estate Investment and Business Company Limited (a subsidiary owned 99.9% by Khang Dien). Therefore, Loc Minh Real Estate will be an indirect subsidiary of Khang Dien.

Loc Minh Company is the investor of the high-rise residential area project of Loc Minh Company with an area of 1.9ha, in Binh Trung Dong ward, Thu Duc City. The project is included in the list of works and projects implemented in 2023 by Thu Duc City.

Earlier this year, Khang Dien also attracted attention with the establishment of a subsidiary company, aimed at re-implementing the Binh Trung project (district 2) after acquiring it from CapitalLand. Although information about this project was quite secretive, Khang Dien is known as a listed real estate enterprise with a large clean land fund in Ho Chi Minh City. In the market, the company’s shares are also “sought after” by a series of foreign funds.

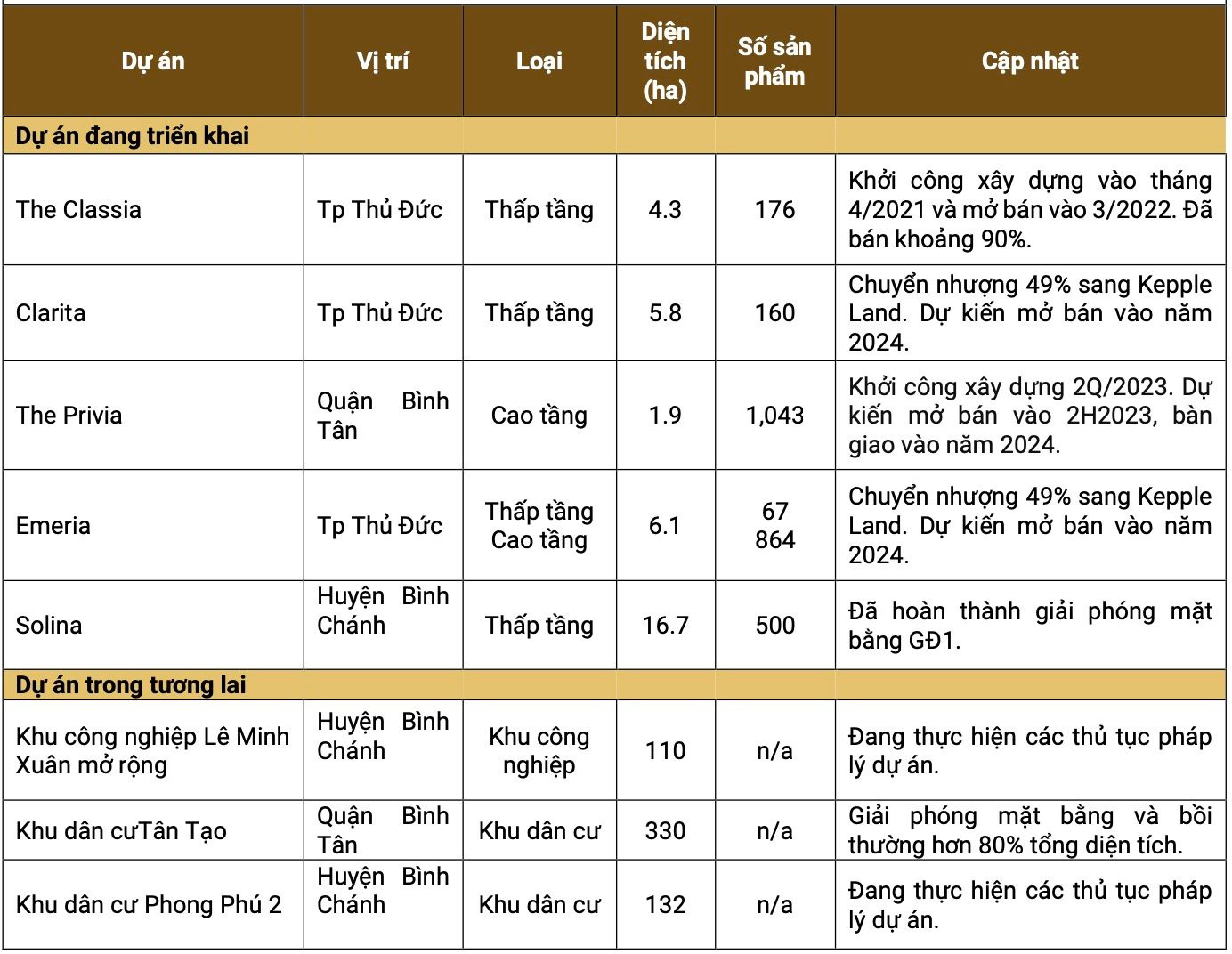

According to the analysis report of Phu Hung Securities Company (PHS), Khang Dien is currently the unit with the largest clean land fund, with over 650 ha, mainly concentrated in Thu Duc City and Binh Chanh district. This is considered an advantage and long-term growth driver for Khang Dien as clean land fund in Ho Chi Minh City is becoming increasingly scarce.

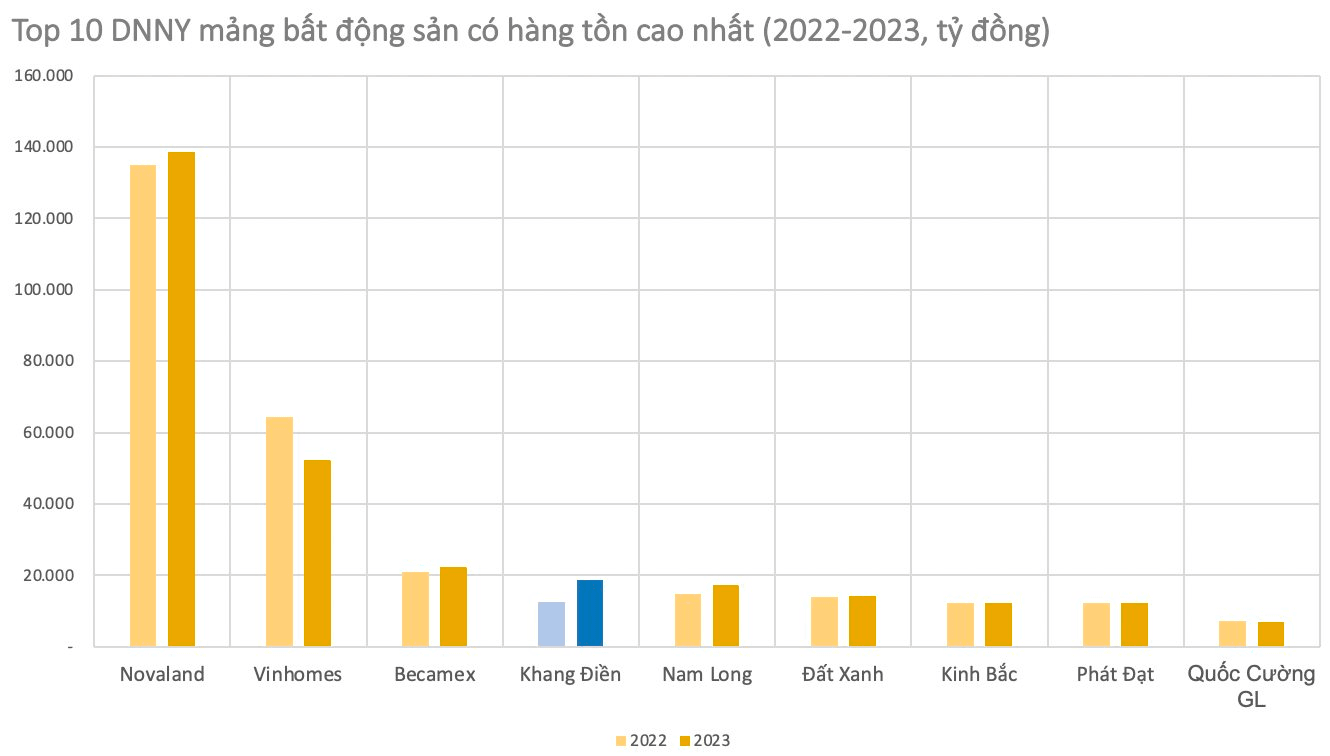

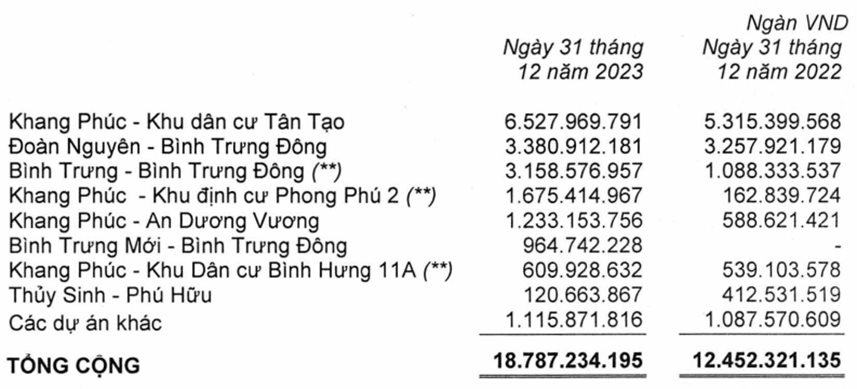

Continuously accumulating project land through M&A, by the end of 2023, Khang Dien also recorded the highest inventory figure ever, reaching nearly 18,800 billion dong, putting the company in the Top 4 group of listed real estate companies with the highest inventory, surpassing Nam Long, Dat Xanh, and Phat Dat.

Among them, the Khang Phuc – Tan Tao Residential Area project has the highest value, with over 6,500 billion, followed by the Doan Nguyen – Binh Truong Dong project with nearly 3,400 billion dong, and the Binh Trung – Binh Trung Dong project with nearly 3,200 billion dong… These are all large projects of well-known investors that Khang Dien has acquired.

Most notably are the two projects in Binh Trung Dong that Khang Dien is about to implement under the commercial name of Clarita Villa Residential and Townhouse Area with a scale of 5.8ha and Emeria project with a scale of 6ha. It is known that these two projects are located in Binh Trung Dong – the place where one of Khang Dien’s key projects in the past, Doan Nguyen, was located.

According to the initial design, the Doan Nguyen Project has an area of 60,732 m2 (6ha) located in Binh Trung Dong ward, district 2, Ho Chi Minh City. In 2013, Khang Dien was “forced” to divest from Doan Nguyen House to solve the company’s difficulties. The partners who received the transfer at that time were two female individual investors, Mrs. Ngo Thi Bich Duyen and Mrs. Nguyen Thi Thanh Thuy.

In August 2018, CapitaLand announced the acquisition of 100% of the shares of Doan Nguyen House, through the acquisition of the entire 86 million shares of BCLand Joint Stock Company (BCLand) for a price of 1,380 billion dong. At that time, BCLand was the parent company holding 100% of the charter capital of Doan Nguyen House.

In March 2022, Khang Dien unexpectedly announced that the group of companies had completed the transfer of 366 million shares, equivalent to 60% of the charter capital of Phuoc Nguyen Real Estate Investment Joint Stock Company (the parent company owning 100% of Doan Nguyen at this time) for a fee of 620 billion dong. This deal helped Khang Dien record a profit of 308.3 billion dong from this transaction, helping the company’s first quarter 2022 net profit grow strongly.

Returning to 2023, the land accumulation also increased the financial leverage pressure of the company. In 2023, Khang Dien’s liabilities exceed 10,000 billion dong for the first time, the highest ever. Among them, debt accounted for 58%, equivalent to over 6,300 billion dong.

However, while the “wallets” of many giants decrease sharply due to the sluggish real estate market, Khang Dien, on the contrary, still recorded an increase in cash and equivalent money. Currently, the company’s equivalent money amounts to 3,730 billion dong by the end of 2023, an increase of 35% compared to the end of last year.

Among them, Khang Dien recorded cash and bank deposits of 1,452 billion dong, while the remaining 2,277 billion dong is equivalent money. Khang Dien said that equivalent money reflects bank deposits with a maximum term of 3 months and an interest rate ranging from 2.7 – 4.3% per year.