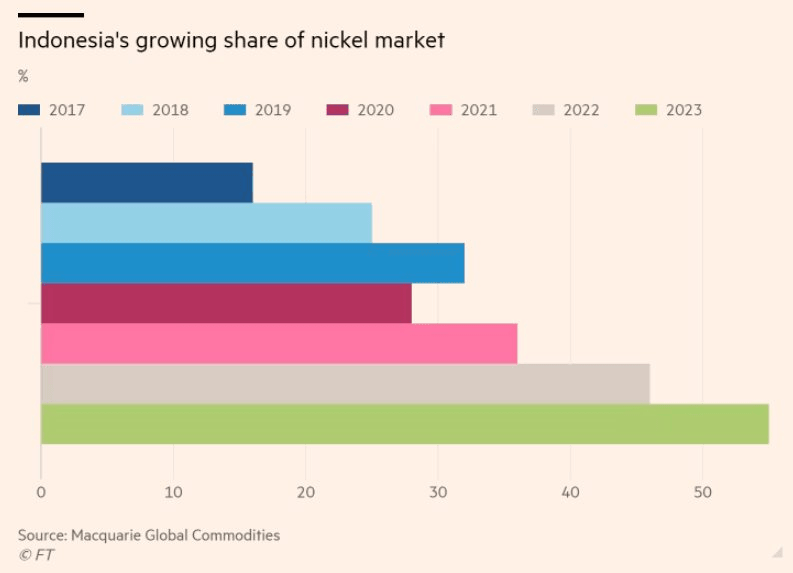

According to Oilprice, the global nickel mining industry is facing difficulties due to the oversupply of cheap nickel from Indonesia. Moreover, this continuous source of supply further exacerbates the global oversupply situation, putting pressure on nickel prices. At this time, this Southeast Asian country accounts for over half of the world’s important metal supply.

Indonesia’s rise to become the leading country in the global nickel industry, leveraging capital and innovation from China, is becoming a notable issue.

In fact, according to this report, this country’s dominance is taking place despite coordinated opposition from the European Union through the World Trade Organization.

In just over a decade, Indonesia has completely transformed its nickel export business while increasing mining output ninefold.

Indonesia’s market share in the global nickel market from 2017-2023.

Together, China and Indonesia currently produce approximately 70% of the world’s total nickel supply. Unable to compete with Indonesia’s abundant capital and low operational costs, nickel mining companies in Australia and elsewhere are at risk of permanent closures or bankruptcies.

Nickel is not an ordinary mineral, it is indispensable for the production of high-capacity batteries, stainless steel, and various advanced alloys. In addition to many difficult-to-mine and costly-to-process materials such as rare earth elements, nickel occupies a key position in modern electronics and high-performance technology.

Low-grade nickel is a raw material for stainless steel, while high-grade nickel is used in products such as electric vehicle batteries, etc. For the West, where countries continue to focus more on “clean” raw materials, Indonesia’s nickel is difficult to supply for electric vehicles.

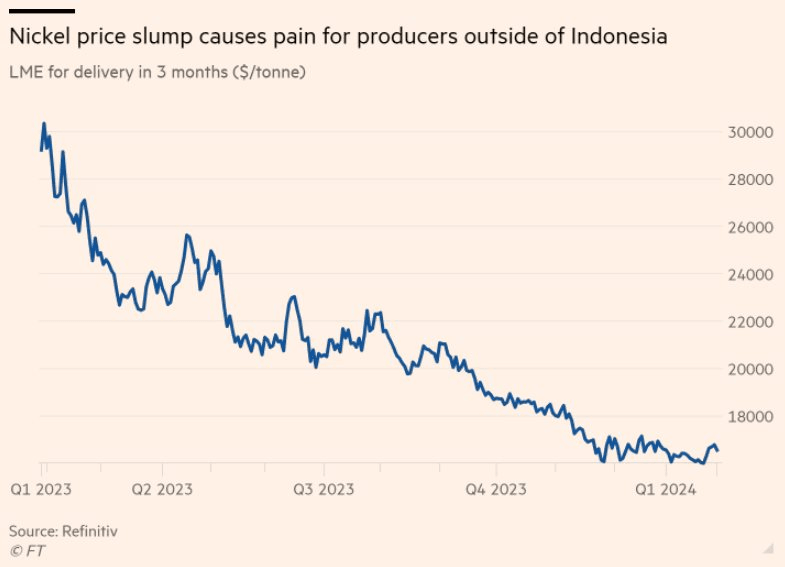

Nickel prices plummeted from Q1/2023 due to oversupply from Indonesia.

Not only does Indonesia’s nickel have problems, but the ongoing oversupply situation also makes other mines around the world unsustainable. Even in the US, reliable non-Indonesian nickel sources are difficult to grasp. This has sent a serious message to struggling metal battery manufacturers elsewhere: do not expect any meaningful price recoveries.

The world has recently witnessed a significant decline in nickel prices. Nickel prices fell about 45% last year and quickly dropped below $16,000 per ton at the beginning of this month.

Meanwhile, a recent report from Reuters stated that both China and Indonesia plan to reduce nickel production by at least 100,000 tons this year. This move comes as producers seek to minimize losses following the global drop in nickel prices.