USD Exchange Rate Surges

The USD exchange rate in the domestic market has recently surged unexpectedly, especially in the unofficial market. Currently, the popular buying rate for USD is 25,550 dong. The selling rate at many transactions points in the unofficial market has reached 25,700 dong. Thus, from the beginning of the year until now, the free USD exchange rate has increased by approximately 900 dong.

The USD rates at banks are also approaching the peak levels recorded at the end of 2022. At the end of March 5th, the USD exchange rate at Vietcombank was quoted at 24,510-24,850 dong. Other banks also quoted similar rates. Techcombank, for example, applied a USD exchange rate of 24,538-24,838 dong. ACB quoted 24,540-24,840 dong.

Some other banks have raised the cash selling price of USD to almost 25,000 dong. For instance, VPBank is currently quoting a buying price of 24,535 dong and a selling price of up to 24,945 dong.

The disparity in the USD exchange rate between the official and unofficial markets is increasing, reaching 850 dong on the morning of March 5th.

According to experts, the USD exchange rate has been significantly increasing recently in the context of the US dollar maintaining high levels in the international market. The DXY index, which measures the strength of the USD against 6 major currencies, is still around 104. In addition, the difference in interest rates between VND and USD in the interbank market is also putting pressure on the exchange rate.

According to Mirae Asset Securities Company, the exchange rate movement in the first two months of this year is somewhat different from what is usually seen in the previous two years when the first quarter is usually a favorable time for the State Bank to actively increase the foreign exchange reserves through foreign capital sources flowing into Vietnam, such as remittances, trade surplus, and FDI.

However, Mirae Asset continues to expect that the management of Vietnam’s monetary policy will be more favorable compared to 2023, with foreign exchange from trade surplus (2023: 28.3 billion USD; estimated 4.72 billion USD in the first two months of 2024), FDI disbursement (2023: 36.6 billion USD; 2.8 billion USD in the first two months of 2024), and remittances (2023: 16 billion USD). Moreover, the group of analysts observed Vietnam’s efforts in maintaining a minimum of 3 months of import reserves since 2018.

Gold Reaches All-Time High

On the evening of March 5th (Vietnam time), the world gold price continued to rise and reached $2,135 per ounce. This is the highest level ever reached by the precious metal. Investors are paying close attention to gold due to concerns about geopolitical tensions as well as expectations that the upcoming monetary easing cycle will create a favorable environment for gold to increase.

The strong increase in international gold prices has surprised many people as the US dollar is still maintaining high levels. The DXY index, which measures the strength of the US dollar against 6 major currencies in the currency basket, is still close to 104.

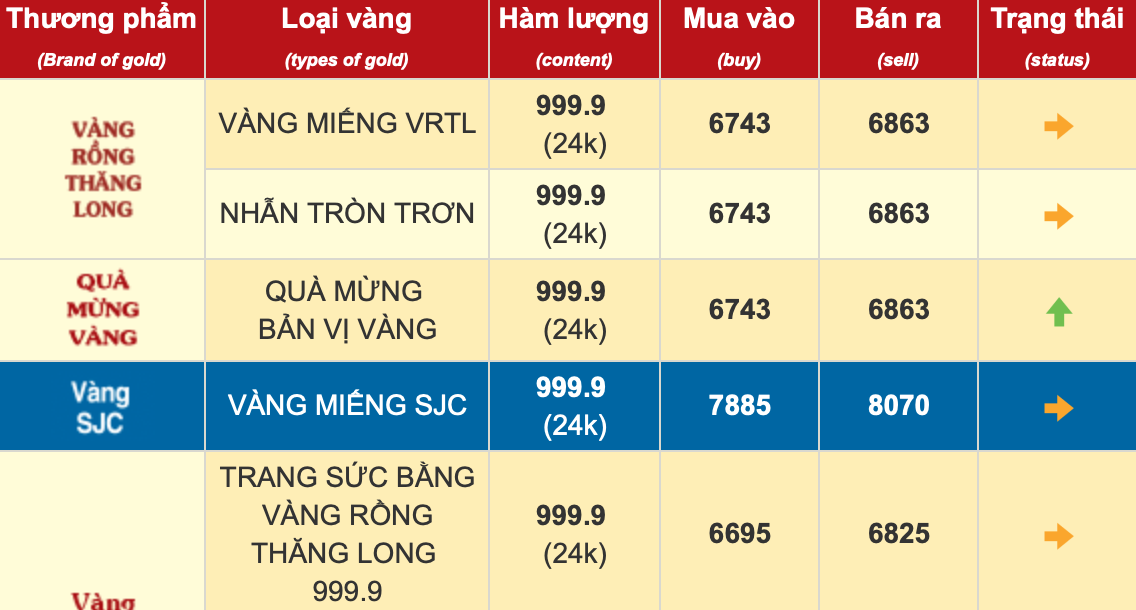

In the domestic market, gold prices have also been skyrocketing recently, along with extremely active buying and selling transactions. At the end of March 5th, the SJC gold price in the market was around 80.7-80.8 million dong per tael, close to the peak level of 81 million dong per tael reached last weekend.

Meanwhile, the price of 24k gold rings, also known as 9999 gold, is at a record high. On March 5th alone, this type of gold increased by about 1 million dong per tael. The price difference of 24k gold among different brands is quite large. While Bao Tin Minh Chau quoted 67.43-68.63 million dong per tael, DOJI quoted 67.3-68.5 million dong per tael, and PNJ applied a rate of 66.5-67.7 million dong per tael.

Domestic gold prices reach a peak level

The price difference between domestic and international gold markets is quite large. Converted at the USD/VND exchange rate at commercial banks, the international gold price is only equivalent to 63.5 million dong per tael (excluding taxes and fees). Meanwhile, estimated at the USD exchange rate in the free market, the international gold price is currently equivalent to around 65.5 million dong per tael (excluding taxes and fees).

The domestic gold market has been extremely active recently, with a significant increase in trading volume. Many gold stores have been crowded with customers trying to sell gold pieces to take advantage of the record high prices of SJC gold. Many investors who purchased gold a few weeks ago have also made a profit of 1-2 million dong per tael when selling at this time.

Bitcoin Breaks All-Time High of $69,000

On March 5th, Bitcoin – the largest cryptocurrency in the world by market value – surpassed the $69,000 mark, breaking the all-time high of $68,990 set on November 10th, 2021. This development continues to surprise investors in the context of the USD still being relatively strong. Other investment channels, including gold, have also attracted a strong flow of money and reached record-high levels.

According to CoinMarketCap, the total market capitalization of Bitcoin has exceeded $1.3 trillion. From the beginning of February 2024 until now, the world’s largest digital currency has increased by about 70%.

Bitcoin price keeps rising

Bitcoin has been on a strong upward trend since the end of 2023 as the US regulatory agency officially allowed the establishment of ETF investment funds in cryptocurrencies. As a result, large legal money has flowed into this channel. In addition, the “halving” event also acts as a catalyst for the sharp increase in the price of cryptocurrencies. This event involves cutting the reward for miners by 50% and occurs once every 4 years. This time, it is expected to take place around April 2024.