In order to promote mechanization in agriculture, the Government has implemented various policies related to the development of the Vietnamese mechanical industry. Specifically, Decision No. 319/QD-TTg on March 15, 2018, by the Prime Minister approves the Strategy for the development of the Vietnamese mechanical industry until 2025 and vision to 2035, in which agricultural production support tractors, cultivation machinery, agricultural product processing and storage machinery, forestry machinery, and aquaculture machinery are prioritized for investment and development.

Decree No. 57/2018/ND-CP on April 17, 2018, by the Government provides mechanisms and policies to encourage enterprises to invest in agriculture and rural areas, in which agricultural production machinery and equipment are included in the priority investment sectors for agriculture and rural areas. Decree No. 98/2018/ND-CP on July 5, 2018, by the Government introduces policies to promote production and consumption cooperation and links in agriculture, stating that linkage projects are eligible for a 30% investment subsidy for machinery and equipment.

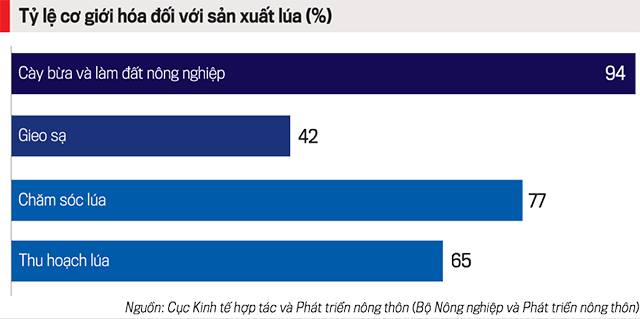

According to the Agency for Cooperative Economics and Rural Development (Ministry of Agriculture and Rural Development), from 2011 to 2022, the number of tractors increased by 60%, seeding machinery increased 10 times, water pumps increased by 60%, combine harvesters increased by 80%, agricultural product dryers increased by 30%, livestock feed processing machines increased by 91%, aquaculture feed processing machines increased by 2.2 times, and plant protection sprayers increased by 3.5 times. For rice production, the mechanization rate for plowing and land preparation reached 94%, seeding reached 42%, crop care reached 77%, and harvesting reached 65%.

FOREIGN DOMINATION OF THE AGRICULTURAL MACHINERY MARKET

A study on the market share, scale, and revenue growth rate of agricultural machinery in Vietnam in 2023, conducted by Mordor Intelligence Industry Reports, shows that there are 1,803 mechanical enterprises in the country, but they only meet about 32% of the demand for agricultural machinery in Vietnam.

Meanwhile, suppliers from Asia, including China, South Korea, and Japan, dominate the agricultural machinery market in Vietnam. Kubota, CLAAS KGaA mbH, Yanmar, Iseki, CNH, and VEAM are the largest agricultural machinery suppliers in the Vietnamese market.

Up to now, the agricultural machinery sector in Vietnam has developed with a variety of products, including internal combustion engines up to 30 horsepower, land preparation machinery (four-wheel and two-wheel tractors), harvesting machinery (combine harvesters, row paddy harvesters, threshing machines), water pumps, pesticide sprayers, and storage and processing machines (rice milling machines, grain dryers).

The appealing agricultural machinery market has attracted many large companies to invest in production. For example, in December 2022, Thaco Industries, a subsidiary of the Thaco Automobile Manufacturing Group, invested 550 million USD to produce a series of agricultural machinery and support industrial products such as auto parts, trailers, and other additional machines for export and domestic sales.

Kubota Vietnam Company (a subsidiary of the Kubota Group of Japan) has collaborated with Nvidia, an American chip manufacturer, to develop highly advanced autonomous agricultural tractors. The tractors are equipped with Nvidia graphic processors and artificial intelligence, combined with cameras to process data instantly and provide labor-saving solutions to address the labor shortage in the agriculture industry in Vietnam and Japan.

WEAKNESSES OF THE AGRICULTURAL MECHANICAL INDUSTRY

According to Mordor Intelligence Industry Reports, the agricultural machinery market in Vietnam has great potential but faces many challenges. Domestic agricultural machinery types are poor, particularly combine harvesters available in the market – 90% are imported, with only 10% being domestically produced. In addition, grain dryers only meet about 30% of the demand and operate at a basic level, meaning simple drying. To ensure high-quality for export, there is still room for improvement.

Mr. Pham Anh Tuan, Director of the Institute of Agricultural Electromechanics and Post-Harvest Technology (Ministry of Agriculture and Rural Development), assessed that the agricultural machinery industry in Vietnam still lags behind the average level of ASEAN countries. Domestic manufacturers have relatively low market share, while a significant portion of the agricultural machinery market is filled by imported products, accounting for about 60-70%.

The reasons for this situation are limited scientific research and technology transfer in agricultural machinery, as well as insufficiently strong policies to encourage leading enterprises to apply modern technology and techniques in the agricultural machinery supply chain. There is still a lack of specialized agricultural machinery manufacturing plants and expansion into the international market. The credit support mechanism for investing in agricultural machinery manufacturing facilities is not attractive enough for mechanical investment.

The content of the article is published in the Vietnam Economic Magazine issue 05-2024 released on January 29, 2024. Please find the full article here:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam