There was considerable selling pressure this afternoon, resulting in a decline in stock prices across the board. Although some large-cap stocks made efforts to cushion the VN-Index, the index still lost 0.49% compared to the reference, with more than twice as many decliners as gainers. The index failed to surpass the previous peak, with foreign investors net selling over 900 billion dong on HoSE.

The blue-chip stocks in the VN30 group traded poorly in the afternoon session, with the VN30-Index closing down 0.94%, with only 4 gainers out of 22 decliners. The morning session saw a slight decrease of 0.02% in this index, with 12 gainers out of 18 decliners.

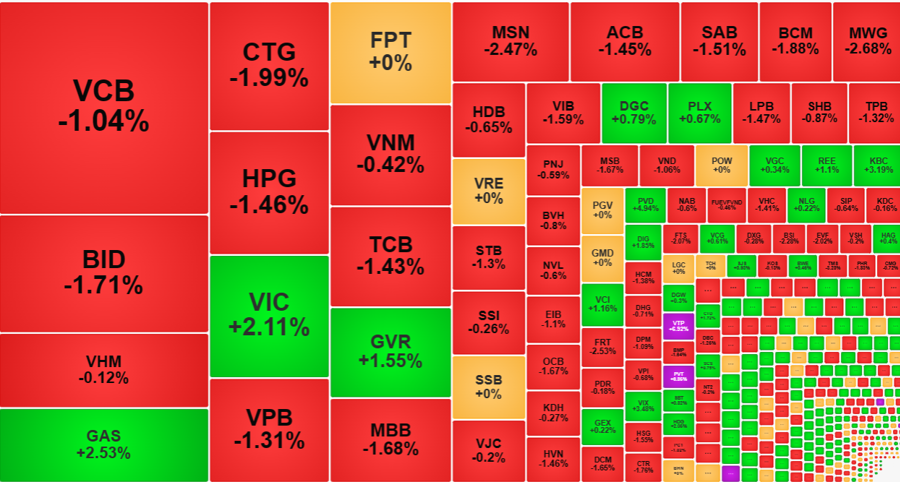

This afternoon, not only did the large blue-chip stocks fall below the reference price, even the gainers couldn’t maintain their strength. The 4 gainers in the group are GAS up 2.53%, GVR up 1.55%, PLX up 0.67%, and VIC up 2.11%. GAS, VIC, and GVR contributed 2.5 points to the VN-Index.

Banking stocks had a difficult afternoon, with all the blue-chip stocks in the group falling even further than in the morning session. VCB closed down 1.04%, BID down 1.71%, CTG down 1.99% are the three stocks with the biggest declines. However, if we look at the magnitude, MSB, OCB, MBB, VIB, LPB all fell more than 1.5%. The entire banking group on all exchanges had only 3 gainers: SGB, ABB, and PGB, while 15 out of 27 stocks dropped more than 1%.

In addition to the banking group, several blue-chip stocks plummeted in the afternoon session, such as HPG dropping an additional 1.14% compared to the morning session, closing down 1.46% compared to the reference price. MSN dropped an additional 1.87%, closing down 2.47%. MWG dropped an additional 1.36%, reaching 2.68% down. After rising 1.4% in the morning session, VHM closed down 0.12% in the afternoon.

The breadth of the market in the afternoon session shows that the balance has been broken. At the end of the morning session, the VN-Index recorded 229 gainers to 213 decliners, but at the close, there were only 193 gainers to 292 decliners. 93 stocks in the red group dropped more than 1% with concentrated liquidity accounting for over 37% of the total trading value on the exchange. Several stocks with great trading volume and significant price declines were VND, HPG, MWG, MSN, STB, MBB, DBC, HCM, PC1, with all of them having liquidity over 300 billion dong.

Foreign investors unexpectedly increased selling pressure by divesting 1.734 trillion dong on HoSE, resulting in a net selling of 659.7 billion dong. In the morning session, this group sold a net of 251.6 billion dong. Therefore, today’s net selling of about 911 billion dong is the highest in the past 15 sessions. On the other hand, this group had a net buying of about 103 billion dong on the HNX, focusing on PVS (+54.5 billion dong) and SHS (+52.2 billion dong). On HoSE, only a few stocks were substantially bought, such as SSI (+129.9 billion dong), PVD (+70.5 billion dong), KDH (+50.3 billion dong), VIX (+49.1 billion dong), PVT (+40.5 billion dong), CTD (+25.9 billion dong). On the selling side, there were too many stocks to mention, with the most significant declines seen in VHM (-165.8 billion dong), VNM (-141.3 billion dong), and FRT (-104 billion dong).

The large net selling by foreign investors today may be due to the portfolio restructuring activities taking place this week. Three ETF funds with a total assets of 45.5 trillion dong will have to complete their transactions on March 15.

Although the index had negative movements after returning to the previous peak yesterday, there are still positive aspects from stock perspectives. Among the 193 gainers, there are still 90 stocks with gains of more than 1%, but only 17 of them have high liquidity exceeding 100 billion dong. PVT, VTP, and IJC hit the ceiling price with impressive liquidity. In addition, VIX, DIG, KBC, VCI, PVD, and GAS are among the other stocks that traded over 300 billion dong with significant price increases. The mid-cap and small-cap groups also had solid performance with stocks such as FCN, KSB, HDC, TCM, DPR, REE, TV2, GIL, ASM, HQC…

The total trading value of both exchanges today increased by 17.3% compared to yesterday, reaching 30.237 trillion dong. This is the second session with trading value exceeding 30 trillion dong within 5 days and the third session since the Lunar New Year. The market is attracting strong capital inflows.