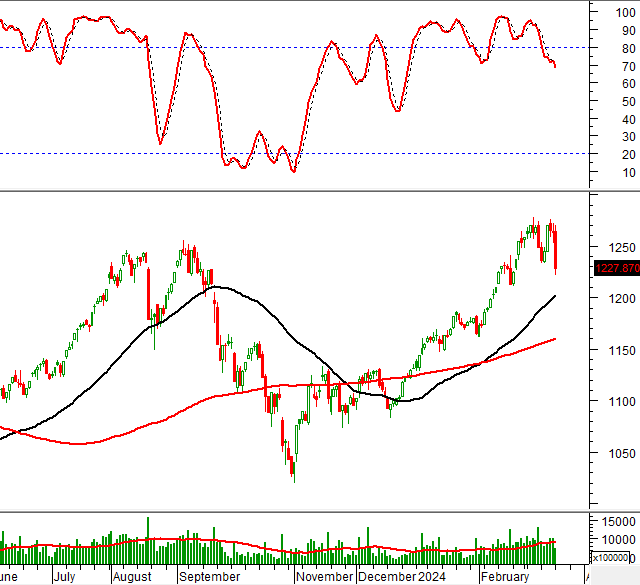

The market liquidity increased compared to the previous trading session, with the trading volume of VN-Index reaching nearly 665 million shares, equivalent to a value of nearly 15 trillion dong; HNX-Index reached nearly 62 million shares, equivalent to a value of nearly 1.2 trillion dong.

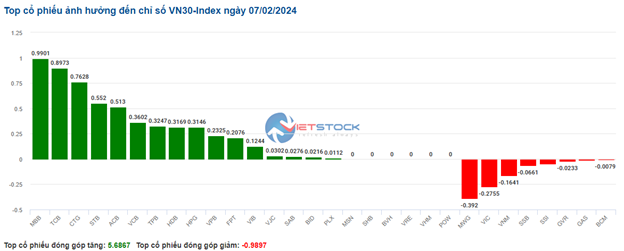

VN-Index opened the afternoon session on an optimistic note as buying force appeared right from the beginning, pushing the index continuously higher and closing near the highest level of the day. In terms of impact, CTG, TCB, VHM, and VCB were the most positive influencing stocks on VN-Index, contributing over 4.5 points. On the contrary, MWG, VPI, and HVN were the most negative impacting stocks, deducting more than 0.25 points from the index.

|

Top 10 stocks impacting VN-Index on February 7th Ranked by points |

HNX-Index also had a similar pattern, with the index positively influenced by stocks such as DDG (3.92%), BVS (2.31%), VCS (1.48%), VC3 (1.43%),…

|

Source: VietstockFinance

|

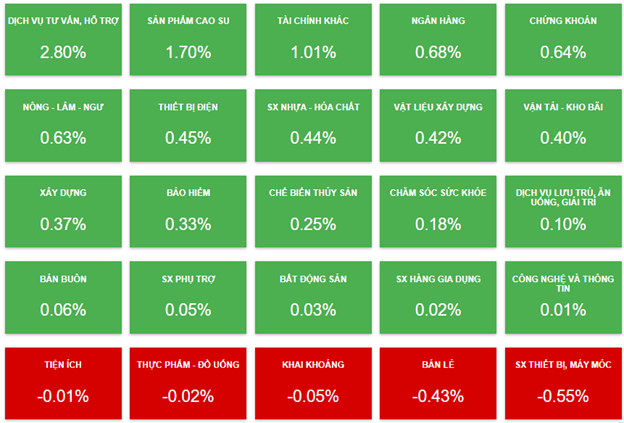

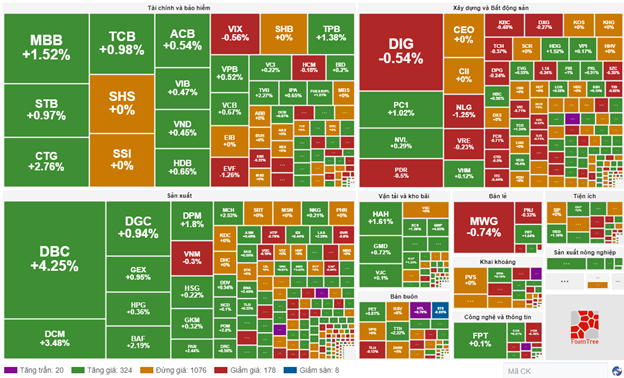

The financial sector is the strongest performing sector, with a 2.3% increase mainly driven by stocks such as IPA (+3.87%) and OGC (+0.82%). Following closely are the consulting and support services sector, and the rubber products sector, with growth rates of 2.14% and 1.71% respectively. On the other hand, the retail sector experienced the sharpest decline in the market, with a -0.24% decrease mainly due to MWG (-0.85%).

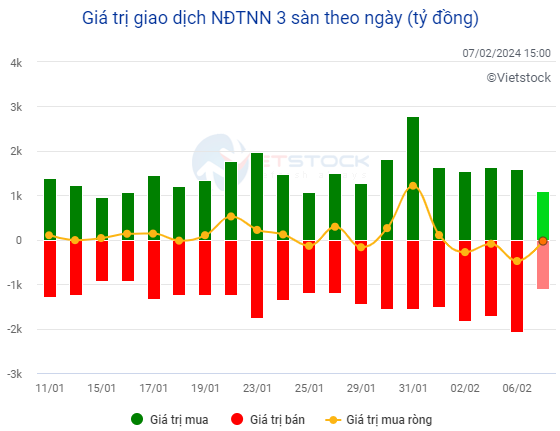

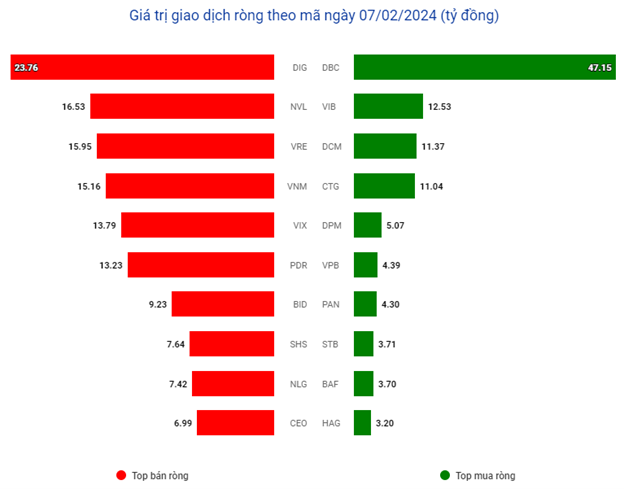

For foreign trading, foreign investors continued to be net sellers on HOSE with a net selling value of over 9 billion dong, mainly focused on stocks such as NVL (80.75 billion dong), VNM (61.73 billion dong), VRE (46.04 billion dong), and MWG (45.11 billion dong). On HNX, foreign investors were net sellers of over 22 billion dong, focusing on stocks such as SHS (18.31 billion dong), CEO (6.9 billion dong), and MBS (3.54 billion dong).

Source: VietstockFinance

|

Morning session: Positive session with securities stocks

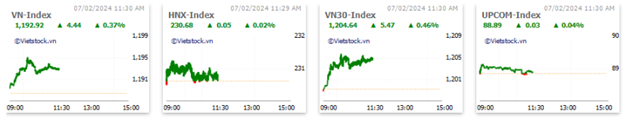

The market ended the morning session with continued positive momentum from the start, as VN-Index increased by 4.44 points to reach 1,192.92 points; HNX-Index increased by 0.05 points to reach 230.68 points. The majority of the market leaned towards buyers, with 365 stocks increasing and 205 stocks decreasing. The VN30 basket mostly stayed in the green: 19 stocks increased, 8 stocks decreased, and 3 stocks remained unchanged.

The trading volume of VN-Index recorded in the morning session reached nearly 266 million shares, with a value of over 6 trillion dong. HNX-Index recorded a trading volume of nearly 28 million shares, with a trading value of over 524 billion dong.

At the end of the morning session, the consulting and support services sector temporarily took the lead with a growth rate of 2.8%, with stocks such as TV2 recording a 4.27% increase, and KPF increasing by 0.44%.

The securities sector also contributed positively to the overall market growth. Many stocks in the sector maintained positive trends, such as SSI (+0.29%), SHS (+0.57%), VND (+2.26%), VCI (+0.56%), HCM (+0.92%), MBS (+1.12%), VDS (+3.68%), FTS (+0.62%),…

Similarly, the banking sector continued its strong performance in recent sessions. Stocks in the sector recorded good growth, such as CTG (+3.05%), TCB (+1.12%), MBB (+1.52%), STB (+1.14%), TPB (+2.21%), VPB (+0.52%), HDB (+0.65%),…

On the other hand, sectors such as utilities, food and beverage, mining, retail, and machinery production all experienced slight declines.

Sector performance at the end of the morning session on February 7th. Source: VietstockFinance

|

At the end of the morning session, the market temporarily leaned towards the green side when looking at the overall sector. Specifically, the consulting and support services sector was the strongest performing sector with a growth rate of 2.8%. On the other hand, the machinery equipment and production sector was the weakest performing sector with a decrease of 0.55%.

10:35 AM: Tilted towards an increase

VN-Index increased by 4.17 points, trading around 1,192 points. HNX-Index increased by 0.08 points, trading around 230 points.

Most of the stocks in the VN30 basket had strong increases. Notably, stocks in the banking sector such as MBB, TCB, CTG, ACB… contributed the most to the VN30 index, with contributions of 0.99 points, 0.90 points, 0.76 points, and 0.55 points respectively. On the other hand, MWG, VIC, VNM, and SSB were still under selling pressure, deducting nearly 1 point from the index.

Source: VietstockFinance

|

The banking sector had a strong start to the session. Specifically, MBB increased by 1.74%, CTG increased by 2.91%, STB increased by 1.14%, and TCB increased by 1.26%… The remaining stocks in the sector were mostly stable or had slight decreases, such as EIB, NVB, EVF, MSB, and SSB… As of 10:30 AM, over 856 billion dong had flowed into this sector, with a trading volume of over 35 million shares.

The transportation and warehouse sector also contributed to the overall market increase with stocks such as GMD (+1.01%), PVT (+0.38%), HAH (+1.36%), and SCS (+1.12%)… On the other hand, some stocks were still under slight selling pressure, such as VJC (-0.1%), AST (-0.7%), CDN (-0.74%), and MHC (-0.13%)…

Meanwhile, the real estate sector had mixed performance with some stocks increasing and decreasing. Stocks that had a negative impact on the market included VIC (-0.59%), BCM (-0.16%), KBC (-0.48%), and PDR (-0.5%)… On the positive side, VHM increased by 0.12%, NVL increased by 0.29%, KDH increased by 0.16%, and DTD increased by 0.71%…

Compared to the beginning of the session, buyers still had an advantage. There were over 340 increasing stocks and over 180 decreasing stocks.

Source: VietstockFinance

|

The total trading volume on all 3 exchanges reached over 192 million shares, equivalent to over 4.4 trillion dong. Foreign investors continued to be net sellers with a net selling value of over 89 billion dong, focused on DIG, NVL, and VRE.

Source: VietstockFinance

|

Market opening: Positive green color spreads

VN-Index opened this morning in positive green colors, covering most sectors. The highest contribution came from the rubber and plastics – chemicals sector.

The rubber sector led the market in the morning session. Leading the way was DRC with a 2.61% increase, followed by BRC with a 1.14% increase.

The plastics – chemicals sector also recorded positive performance from the start, especially stocks such as DGC (+1.15%), DCM (+2.27%), DPM (+1.05%), HRC (+2.3%), BMP (+0.94%),…

The information technology sector continued to contribute to the index’s recent growth. Stocks such as FPT, ELC, CTR, ICT maintained good growth rates.

Lý Hỏa