Mr. Do Quang Vinh – Chairman of the Board of Directors of Saigon – Hanoi Securities Joint Stock Company (stock code: SHS) shared his plans for a company that is both a securities company and a listed organization.

How do you assess the stock market in 2023, the prospects for 2024, and could you share some achievements of SHS last year?

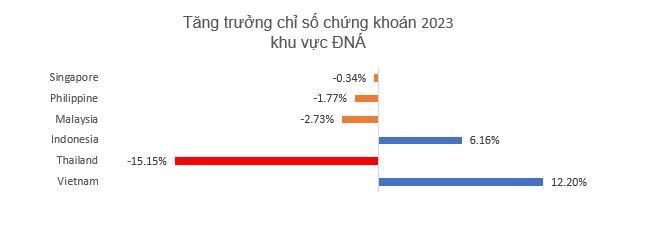

In my opinion, the Vietnamese stock market in 2023 was quite positive. After a sharp decline in 2022, the main indices all recorded growth, with the VN-Index rising by 12.2%, which is quite high compared to other markets in the Southeast Asian region. This is also significant considering the global uncertainties, Vietnam’s economic slowdown, and strong net foreign selling.

In 2023, SHS achieved positive business results with VND 684 billion in pre-tax profit, an increase of 247% compared to 2022, and ranked among the top 10 securities companies with the highest profits in the market. We have also officially launched derivative securities services, providing our customers with risk hedging tools in the underlying market.

In 2024, Vietnam will continue to face external challenges as the global economy is expected to experience a “soft landing” with a decline in growth rates, while there are ongoing political conflicts in some regions and increased economic fragmentation risks.

However, in my view, the economic outlook for Vietnam in 2024 is still positive, with higher growth rates compared to 2023, thanks to the momentum from FDI, relaxed fiscal policies, reduced external pressures, and exchange rates. These are important factors that provide a stable foundation for the stock market and pave the way for further development in the coming years. Additionally, with the gradual reduction of interest rates by the FED in the second half of 2024, global interest rates are forecasted to cool down, creating a basis for foreign capital inflows to return to emerging and frontier markets, including Vietnam.

Recently, you have registered to buy SHS shares. Could you share the long-term development strategy of SHS?

In the long term, specifically from now until 2030, SHS aims to take the lead and build a leading financial investment conglomerate in Vietnam, in which SHS will be the core center. The financial conglomerate will include SHS and entirely new subsidiaries in the financial market. With the support of other specialized subsidiaries, SHS will have more impetus to take off in the securities industry. In the next 1 to 2 years, SHS will have specific plans to present to the Shareholders’ General Meeting.

With a charter capital of VND 8,131 billion, total assets of VND 11,457 billion, and a 2023 profit of VND 684 billion, SHS has a strong advantage as one of the listed securities companies with efficient capital utilization in the market. We will continue to enhance our financial capacity and, as a result, improve safety measures to maximize the efficiency of capital utilization. We will leverage our efficient capital utilization to provide customers with comprehensive investment advisory products and help them optimize asset management.

With the above strategic plan, I, as an investor, have also registered to buy an additional 5 million shares of SHS to increase my ownership percentage. After a successful transaction, my shareholding ratio will be 1.54% of SHS’s charter capital. This may not be a large percentage, but it demonstrates my personal trust in SHS’s future development direction, commitment to accompany and pursue the highest interests of shareholders.

We believe that with a passionate, dedicated, creative, and experienced staff, along with a clear development strategy and financial advantage, SHS will continue to achieve success in the future and affirm its unique position.

As Chairman of the Board of Directors, could you share some of SHS’s activities in line with the Government’s orientation for the stock market recently?

According to my knowledge, recently, the Government issued a directive on the development strategy of the stock market until 2030 in Decision No. 1726/QD-TTg dated December 29, 2023. To align with this strategy, SHS will intensify investment activities and issue various types of Green Bonds, Social Bonds, and Sustainable Bonds… SHS is committed to supporting businesses in raising capital for projects that have positive impacts on the environment and society, to provide innovative financial solutions that support the Sustainable Development Goals and create added value for shareholders and the investment community.

In addition to complying with all domestic legal regulations, SHS will enhance cooperation with international financial institutions and adhere to the best standards, regulations, and enforcement measures of the international securities market to ensure a high level of transparency.

As a result, SHS’s credit rating will be elevated, creating more favorable conditions for regional and international negotiations and transactions. We will seize cooperation opportunities, transactions, and attract FDI capital, stimulating indirect investment capital flows into the domestic stock market.

For the Retail Brokerage segment, in addition to the existing products that serve customers and are highly regarded by them, we will provide a system of products accompanied by added value for high-end customer groups, with a focus on optimizing financial investment efficiency. We are determined to regain a top 10 market share in brokerage on both HSX and HNX.