Mirae Asset recently published an updated report on the prospects of the banking industry, highlighting that there will not be many short-term investment opportunities for this sector, especially for “passive” investors with a short hold time.

BETTER PROFIT PROSPECTS IN 2024

According to the report, asset quality continues to improve in 2024 due to more optimistic macroeconomic prospects. Along with favorable factors such as low interest rates, gradual economic recovery, and a slowing pace of bad debt formation, strong credit growth in Q4 2023 also partially supports the rapid decline in bad debt ratio.

Furthermore, the continuous decline in bad debts in the past 4 quarters once again reinforces the expectation that NPLs have peaked. Expanded NPLs (including Group-2 debts) also recorded positive changes in the same period, decreasing by 0.9% from the peak of 4.7% established in Q2. Overall, asset quality is expected to continue improving throughout 2024, especially in the second half of the year.

Although the majority of on-balance-sheet bad debts are likely to have peaked, support measures for postponement of bad debt recognition are still necessary for some banks. While NPLs have started to show a downward trend, NPLs at some banks are still above 2% as of the end of Q4 2023; therefore, extending Circular 02 is deemed necessary.

By the end of 2023, data published by several banks shows that the proportion of restructured debts under this Circular accounted for about 1-2% of total outstanding loans, which is not too significant to critically impact the ongoing operations of banks but also adversely affects the overall reports. In addition, some banks have had to reissue special VAMC bonds as a means to reduce the burden of provisioning in the short and medium term.

Credit risks associated with corporate bonds have been temporarily postponed; however, system risks still exist: Decree 08 has indirectly supported the banking sector (asset quality and provisioning cost) by allowing payment deferrals of principal and interest for up to two years, temporarily resolving liquidity crises for many enterprises, especially those related to real estate.

Despite the expected significant improvement in economic outlook in 2024, investor confidence in the real estate market has not completely recovered, not to mention the instability in the implementation or consumption of new projects. Therefore, enterprises may continue to face difficulties in 2024 or 2025 when debts due in 2023 expire or new debt obligations arise in 2024.

Regarding profitability, better growth prospects are expected in 2024. Firstly, rapid disbursement in the last month of 2023 and sustainable credit growth in 2024 are expected to lay a solid foundation for the recovery of net interest income (NII). Furthermore, the expectation that NIM has hit bottom and is rebounding also acts as a catalyst for NII growth.

In addition, non-interest income will also recover better thanks to more optimistic economic prospects, including: increasing service income from domestic transactions and export activities; cross-selling insurance services will experience more positive growth due to a low base in 2023, with negative growth recorded in many credit institutions; digitization processes will reduce the correlation between revenue and expenses.

NO LONGER OPPORTUNITIES FOR SHORT-TERM STRATEGIES

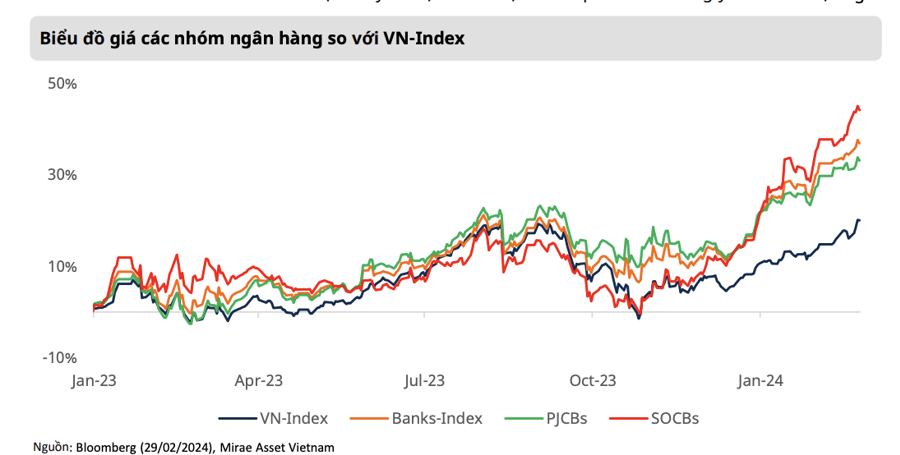

In terms of stock market, the proportion of the banking sector on the VN-Index is relatively large, so this group has made significant contributions to the recovery of the overall index. Fundamentally, events of concern to investors, such as massive withdrawals or liquidity crises, have not yet occurred or have been controlled through timely intervention by regulatory agencies issuing decrees and circulars. It is expected that these policies will be extended in 2024, enhancing the momentum of economic recovery.

Comparing stock price movements among banking groups shows that safety is still the preferred choice for the majority, with State-owned commercial banks (SOCBs) particularly favored. Note that during the period from 2023, private joint stock banks (PJCBs) became more favored due to deep price adjustments, high growth potential, and absence of negative events. However, the performance of this group has not been maintained as well as before due to poorer than expected business results, while SOCBs still demonstrate stability in their operations with a 14.6% profit growth compared to the same period last year.

System risks still exist: Besides existing risks such as decreased on-balance-sheet asset quality, high provisioning pressures have also forced many banks to transfer bad debts to off-balance-sheet categories. Moreover, bank losses have reappeared after a long time, while issues at SCB or corporate bonds under rescheduling are not completely resolved at the present time. Therefore, investors should still be cautious in both the short and medium terms.

In the short term, Mirae Asset believes that price movements will depend more on cash flows rather than fundamental factors. Moreover, banking stocks have increased sharply since November 2023 and are approaching the average 5-year Price-to-Book ratio, or some banks have exceeded historical peaks, indicating optimism about the recovery prospects in 2024.

Therefore, there will not be many short-term investment opportunities for this sector, especially for “passive” investors with a short hold time. Thus, short-term trading will be more appropriate for professional investors, combined with market outlook analysis. Conversely, for long-term investment strategies, there are still opportunities to invest in stocks with factors such as relatively low valuations, stable asset quality, and growth potential, such as CTG, TCB, MBB, or ACB.