VN-Index has just witnessed a volatile week of trading despite seeing an increase in points compared to the previous week. VCB (-1.16%); VPB (-1.84%) and SAB (-3.33%) put pressure on the overall index. On the other hand, GVR (+19.31%), FPT (+5.45%) and GAS (+3.52%) were the main contributors to the market’s upward momentum. Liquidity improved with a trading value of 30,135 billion VND/session on all 3 exchanges. Foreign investors continued to sell off, mainly on the HoSE with a value of 2,609 billion VND.

Strong net selling by foreign investors during ETF restructuring session.

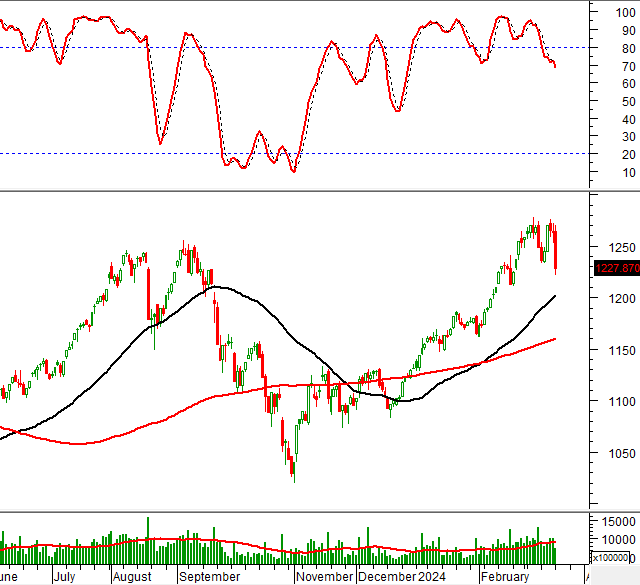

Analysts believe that next week, the stock market is heading towards an important trading week as the Fed has a monetary policy meeting on March 19-20 and the VN-Index may retest the resistance zone around 1,280 points.

Mr. Dinh Quang Hinh, an expert from VNDirect Securities, believes that if the possibility of the Fed maintaining the current interest rate at the upcoming meeting is almost certain, the hotness of this event will not diminish as the focus will be on the speech of the Fed Chairman.

The market is expecting new insights into the future direction of the Fed, specifically the expected start time of interest rate cuts and the expected magnitude of cuts this year. If the Fed’s scenario is not too far from the market’s previous expectations (starting interest rate cuts from Q2/2024 and at least 3 cuts in 2024), we can completely expect a positive reaction from global financial markets.

Regarding domestic issues, the stock market’s response to the State Bank of Vietnam’s bond issuance initiative is not overly negative. The market has many supportive factors compared to the time when the regulatory agencies had similar initiatives last year (September to November).

Specifically, there are clearer signs of economic recovery, positive business results for the first quarter, and support for the market (in contrast to the third quarter of last year), as well as a strong domestic money flow supported by low interest rates and expectations of market upgrade.

The expert from VNDirect Securities believes that the market’s upward trend since the beginning of the year has not been compromised and the VN-Index can retest the resistance zone around 1,280 points next week. Investors can continue to hold stocks, prioritizing allocation to stocks with supportive fundamentals such as securities, consumer goods, exports, and industrial real estate.

Although the upward trend is still maintained, the analysis team of KB Securities (KBSV) believes that the recovery opportunity is still open, the weakening of demand and the lack of leading groups will reduce the probability of the VN-Index breaking through the top and increase the risk of a reversal.

Investors are advised to avoid chasing the market in recovery phases and can take partial profit-taking and reduce trading positions when the index approaches the next resistance zone around 1,300 (+-10 points).

Investors are advised to avoid chasing the market in recovery phases.

Mr. Nguyen Huy Phuong, an analyst from Rong Viet Securities (VDSC), believes that the market has a fairly wide fluctuation range but overall is in a state of contention with liquidity remaining high. This state of contention is partly due to the restructuring activities of ETF funds. With the stable state of the score, there is a possibility that the market will have more time to explore supply and demand before there are more specific signals.

According to Mr. Phuong, differentiation can develop strongly during this tug-of-war period. Therefore, investors need to slow down and observe the supply and demand dynamics to assess the market’s situation.

“Currently, it is recommended to prioritize stocks with good signals from the support zone for holding, but consider taking profits for stocks that have rapidly increased to the resistance zone or are having cautious developments at the resistance zone,” Mr. Phuong recommended.