DXG’s Annual General Meeting 2024

DXG’s 2024 Annual General Meeting was held on the morning of April 19, 2024. Screenshot

|

”2024 Market to Flourish”

Speaking about the real estate market and the current state of the company, Chairman of the Board of Directors, Mr. Luong Tri Thin, said that in the past two years, 2022-2023, the economy had started to decline just as the COVID-19 pandemic ended. The economic downturn had affected the real estate market.

The good news was that after the Lunar New Year, the market had begun to show signs of a positive recovery. Apartment units launched in the first quarter across the entire system had once again seen transactions, although not as high as in previous years. However, compared to the last two quarters of 2023 and the first quarter of 2023, the number of transactions had doubled, especially in Hanoi where it had tripled.

Given the overall market situation, the Company had observed some positive signs: there was still a shortage of average to good supply; the demand for housing among the population remained very high; key national infrastructure projects were gradually being completed within the next 3-5 years, such as Long Thanh Airport and the Ben Luc-Long Thanh Expressway; and cheap credit was currently abundant, with many customers taking out loans with a 20-year term and a fixed interest rate of only 5-6% per year for the first three years.

Mr. Thin stated that based on these favorable factors, the market would flourish in 2024, and the market in 2025 would see positive changes.

Accelerated Legal Completion of 8 Projects

In 2024 alone, DXG will complete the legal procedures for 8 large-scale projects, primarily focusing on the southern region, with Gem Riverside being the key project this year. The second is Gem Sky World, and the third is Opal Luxury. These projects range in size from 5-10 hectares and will provide 3-5 thousand apartments each.

Furthermore, the Company will continue to prepare comprehensive strategies to complete, compensate for, and finalize 5 major projects in preparation for the 2025-2030 period; continue to finalize and acquire projects to purchase land development funds, especially in April of this year, when DXG acquired additional land in Binh Phuoc and Dong Nai.

Mr. Thin also announced that this year, DXG had prepared training for its management team and secured the necessary financial resources in preparation for the upcoming phase. In 2023, DXG had restructured its member companies, and as a result, DXG will begin to gain market share from 2024 onwards.

Aiming to Raise Nearly VND 3,541 Billion Through Issuing Shares

At the meeting, DXG proposed a plan to issue more than 150 million shares to existing shareholders at a minimum price of VND 12,000 per share, corresponding to a ratio of 24:05. The shares will not be subject to any transfer restrictions after issuance.

With the above offering price, DXG could raise at least VND 1,802 billion. The Company will use VND 221 billion to pay off bond-related obligations; VND 222 billion to add to working capital; nearly VND 762 billion to partially repay a debt to Hoian Invest JSC; and VND 597 billion to repay a debt to Ha Thuan Hung Construction-Trading-Services Co., Ltd. It’s important to note that both Hoian Invest and Ha Thuan Hung are subsidiaries of DXG.

In addition to existing shareholders, DXG also proposed offering 93.5 million shares to professional securities investors at a minimum price of VND 18,600 per share. Less than 20 investors will be allowed to participate in the offering, and the shares will be subject to a one-year transfer restriction.

DXG stated that with at least VND 1,739.1 billion that could be raised if the issuance is successful, the Company will use these funds to contribute and increase its ownership ratio in the subsidiary.

In 2023, DXG carried out two issuances, 9 million ESOP shares and nearly 102 million shares for existing shareholders, thereby increasing its charter capital from over VND 6.1 trillion to over VND 7.2 trillion.

In addition to the two above issuances, DXG’s 2023 General Meeting of Shareholders also approved a plan for a private placement to professional securities investors with the aim of raising capital to increase its ownership ratio in Dat Xanh Real Estate Services JSC (HOSE: DXS). However, during the licensing process, DXS completed a capital increase share issuance from its own capital sources at a ratio of 1,000:267. As a result, DXG was unable to carry out this share issuance due to the number of DXS shares it planned to purchase changing from the original plan.

Target for 31% Increase in Net Income

For 2024, DXG set a target for net revenue and net income to reach VND 3,900 billion and VND 226 billion, respectively, representing an increase of 5% and 31% compared to 2023.

The Board of Directors of DXG acknowledged that 2024 will be another challenging year for the real estate market in general and the Company in particular. Accordingly, DXG will continue to focus on developing its core business activities of real estate development and real estate services through a recruitment plan and sales plan to anticipate market demand.

Additionally, the Company will continue to focus on seeking out, developing land funds, and identifying investment projects and opportunities in order to carry out its business plan and strategy for the following year. As for its medium and long-term strategy, DXG aims to acquire and accumulate real estate projects in prime locations with complete infrastructure and clear legal status while simultaneously finalizing the necessary procedures.

In relation to the 2024 business plan, in addition to the revenue and profit targets mentioned above, the Board of Directors of DXG also proposed that the General Meeting of Shareholders authorize the Board of Directors to decide on all matters related to the investment and distribution of projects without any limitations on quantity or capital scale. At the same time, the Board of Directors was authorized to decide on providing loans, guarantees, and contracts and transactions to subsidiaries (and vice versa) with the value of each contract not exceeding 35% of the Company’s total assets.

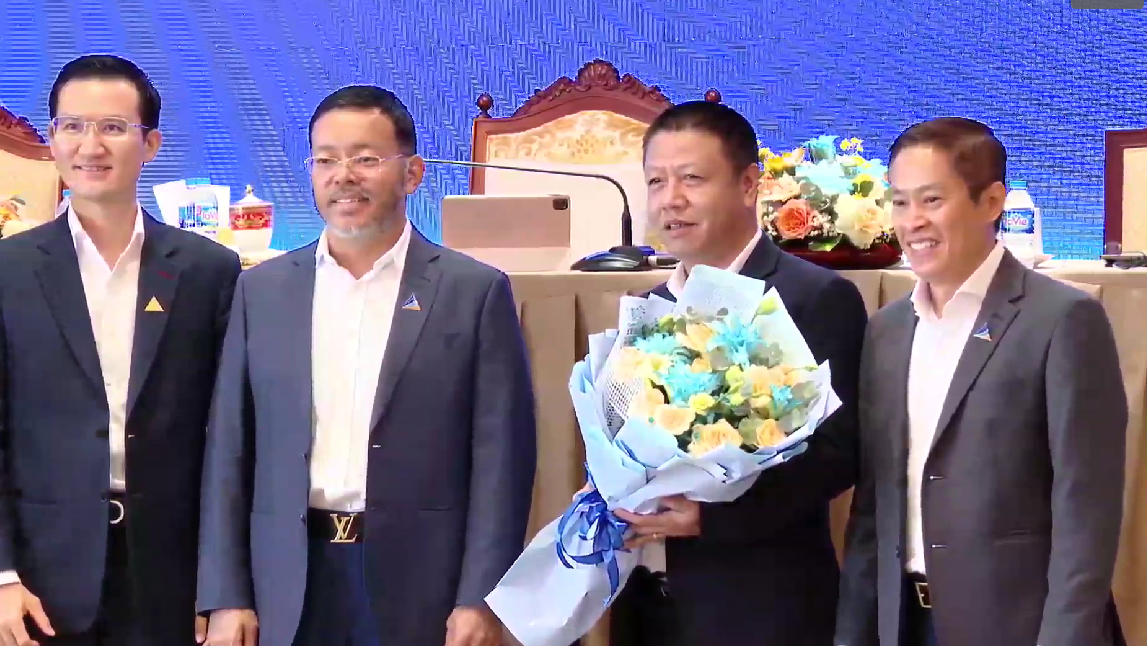

After the passing of Mr. Luong Tri Thao, the DXG Board of Directors currently has one vacant member, and the Company will hold an election to fill this position at this meeting. To date, one candidate has emerged: Mr. Luong Ngoc Huy, born in 1970 in Hung Yen Province, who was nominated by Chairman Luong Tri Thin.

According to his resume, Mr. Huy has held the position of Deputy Director of Legal Projects and Deputy Director of the Northern Investment Department of DXG since September 2023. Prior to that, he worked at the University of Finance-Business Administration from January 1996, where he held various positions such as Accounting Staff, Deputy Head of Equipment Management, and most recently, Head of Equipment Management.

Mr. Luong Ngoc Huy (second from right) introduced to DXG’s General Meeting of Shareholders. Screenshot

|

Capital Increase to Strengthen Project Capabilities

DISCUSSION

Q1 business results?

Chairman Luong Tri Thin: The number of transactions in Q1 showed an improvement compared to Q4/2023 as well as the same period last year. The Company continued to hand over units at Opal Skyline and continued construction at Gem Sky World.

As for the services segment, Q1 results were mostly positive, and Q2, Q3, and Q4 will see the service segment perform better than last year.

DXG’s current financial situation?

Chairman Luong Tri Thin: We have restructured all financing from short-term to long-term. Our partners and banks are willing to provide financing to carry out projects. This year, the Company will prepare financial resources and complete land funds.

The current capital increase plan is a return to the previous capital increase plan (2022) due to the difficulties encountered in 2023 from the impact of the global economy. Therefore, in 2024, the capital increase will enable the Company to strengthen its capabilities and prepare for major projects in the face of many new legal regulations being issued.

Currently, the Company’s charter capital is only a little over VND 7 trillion, so it needs to increase its capital scale to at least VND 10 trillion to ensure capacity for