Update

Mr. Trinh Van Tuan – Chairman of OCB shared at the beginning of the General Meeting that in 2023, faced with global headwinds such as: escalating geopolitical tensions, the tightening of monetary policy by many major central banks to control inflation, a decline in global demand, a weakening of imports and exports, the continued stagnation of the real estate market, etc., the banking sector has also been deeply affected as the economy’s overall absorption of capital weakens, and the ratio of bad debt tends to increase compared to the same period.

Credit growth at OCB reached VND 148,005 billion in 2023, an increase of nearly 21% compared to 2022. The bank focused on priority sectors, public investment, and reduced the proportion of high-risk sectors for its corporate clients. The bank also boosted lending for business operations, secured consumer loans, and credit cards for individual customers.

In addition to debt restructuring measures, OCB has implemented many preferential credit packages with interest rates as low as 5.2% per year. Market 1 mobilization in 2023 increased by 22%, reaching VND 168,000 billion, mainly from customer deposits, funding sources, and investment trusts from financial institutions. Cooperative relationships with international financial institutions such as IFC, DEG, etc. have been strengthened, helping the bank solidify its medium- and long-term capital.

The 2024 Annual Shareholders’ Meeting of OCB was held on the morning of April 15, 2024.

|

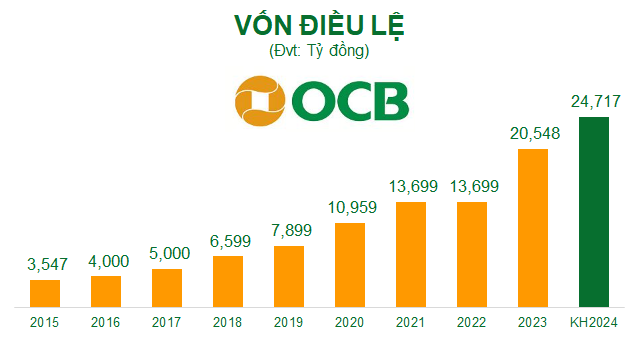

Increased capital to VND 24,717 billion, dividends paid by 20% in shares

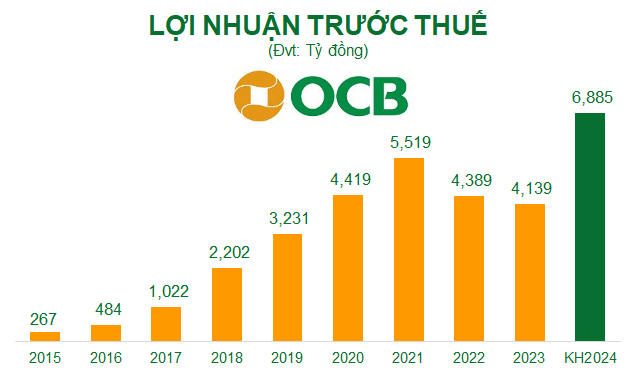

In 2023, OCB achieved a pre-tax profit of over VND 4,139 billion. After setting aside funds in accordance with regulations, the retained earnings for 2023 reached nearly VND 2,770 billion. The retained earnings combined with those from previous years amounted to over VND 5,307 billion.

OCB aims to increase its charter capital by an additional VND 4,168 billion in 2024 through three methods.

The first is a plan to issue nearly 411 million shares to pay dividends to existing shareholders at a rate of 20% from undistributed profits accumulated up to December 31, 2023.

Second, issue 5 million shares under the Employee Stock Option Plan (ESOP) at an issuance price of VND 10,000 per share. The newly issued shares under the ESOP program (and stock dividends arising from these shares) will be subject to a four-year transfer restriction from the date of issuance, with 25% being released each year.

Third, offer for sale a maximum of 882,353 private shares with a total expected offering value of over VND 8.8 billion. The offering price shall not be lower than the book value per share of the Bank as of the end of the most recent quarter prior to the issuance date. These shares will be subject to transfer restrictions in accordance with applicable laws and the agreement between OCB and the investors. Investors offered in this tranche are individuals and organizations both domestically and internationally.

If all three of the above plans are successful, OCB‘s charter capital will increase from VND 20,548 billion to VND 24,717 billion. The proceeds from the capital increase will be used by the Bank to supplement its operating capital, investments, loans, and purchases and construction of facilities.

The timing of the capital increases will be determined by the Board of Directors after approval by the relevant authorities.

It is expected that after the capital increase, Aozora bank, Ltd. will remain the sole major shareholder of OCB with an ownership ratio of 15%.

Source: VietstockFinance

|

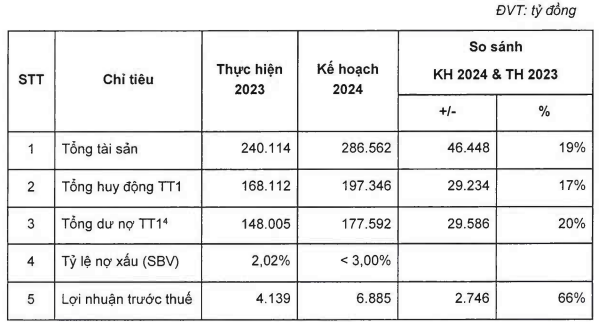

Pre-tax profit plan for 2024 increased by 66%

With the additional charter capital, OCB plans to achieve a pre-tax profit of VND 6,885 billion in 2024, an increase of 66% compared to the 2023 results. The target is to reach VND 286,562 billion in total assets by the end of 2024, an increase of 19% compared to the beginning of the year. Total market 1 mobilization is expected to reach VND 197,346 billion, and total market 1 outstanding loans are expected to reach VND 177,592 billion, increasing by 17% and 20%, respectively. The bad debt ratio will be controlled below 3%.

The target ROE and ROA are 17.11% and 2.06%, respectively.

Source: OCB

|

Source: VietstockFinance

|

In addition, OCB also plans to submit to the 2024 Annual General Meeting of Shareholders adjustments to certain regulations of the Bank and the authority of the General Meeting of Shareholders.

Discussion:

OCB aims to have a profit margin in the top 5 banks

What is the motivation for OCB to set such a high business plan for 2024? What is the plan for provisioning for risks?

Chairman Trinh Van Tuan: When investing in a bank, we always want a high return to bring the highest benefit to our shareholders. OCB has grown from a small bank to a completely different position from 2011 to the present.

In 2021, OCB was among the top 10 banks in the market. 2022 and 2023 were two years in which OCB did not achieve its plan. Due to high inflation, the post-COVID-19 period has caused the global financial landscape to change, impacting the banking industry, including OCB. Core revenue from credit in previous years still accounted for a high proportion, and non-interest income was very good.

When entering a period of interest rate changes, due to the global market, the main reason for not achieving the target in 2022 was TPCP trading. In 2023, we encountered problems with fee income from the insurance segment and have not yet recovered non-interest income issues. In addition, the difficult market led to an increase in overdue debt, which affected bad debt, so the 2023 results were affected.

In 2024, the pre-tax profit plan of VND 6,885 billion is something that the executive board is confident in achieving. OCB aims to have a profit margin in the top 5 banks. This is so that shareholders know that they are investing in a bank that is highly responsible to its shareholders and has a solid foundation.

OCB will become a pioneering green bank

Japanese bank Aozora is still the largest foreign shareholder of OCB. After three years as a strategic partner, how has Aozora supported OCB and what are the results?

Mr. Yoshizawa