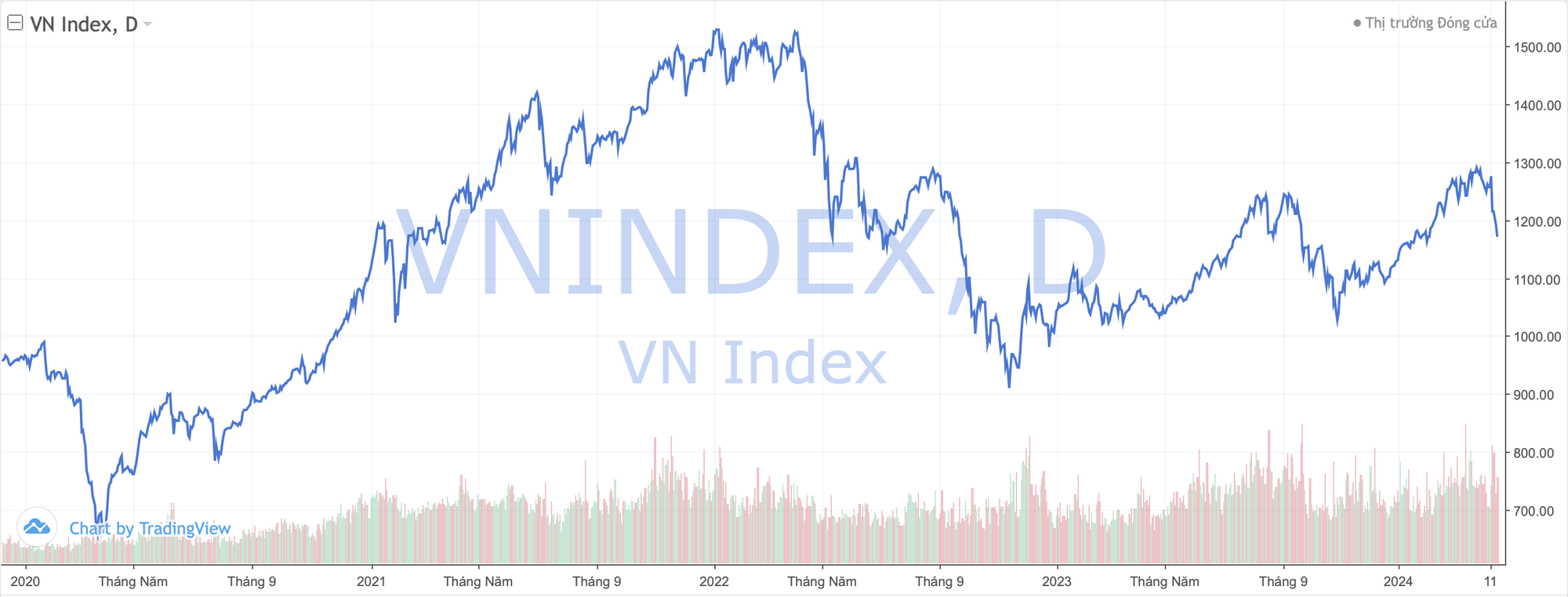

After a sharp drop of over 100 points last week, the stock market had a period of growth in the first quarter of the year. From under 1,100 in mid-December last year, the VN-Index rose almost steadily to a 19-month high at the end of the first quarter. The main impetus came from domestic资金, including the indispensable catalyst of “margin” leverage.

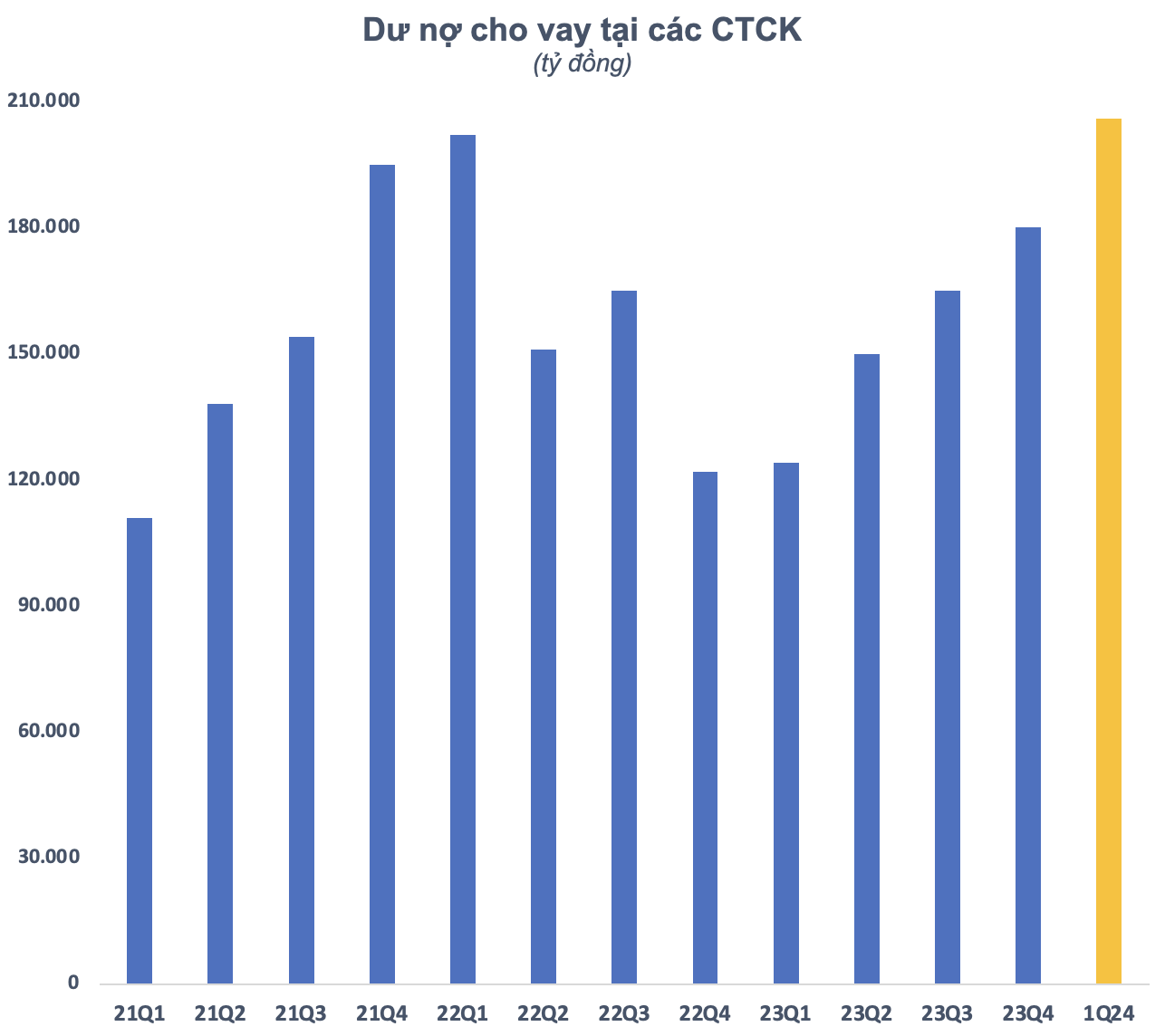

According to statistics, the outstanding loan balance at brokerage companies at the end of the first quarter of 2024 was estimated to have increased by 26,000 billion compared to the end of 2023, reaching approximately 206,000 billion VND. This is the highest level ever, surpassing even the first quarter of 2022 when the VN-Index was at its historical peak of 1,500 points. Of which, the estimated margin debt was approximately 195,000 billion VND, an increase of 23,000 billion compared to the end of 2023 and also a record number in the history of the Vietnamese stock market.

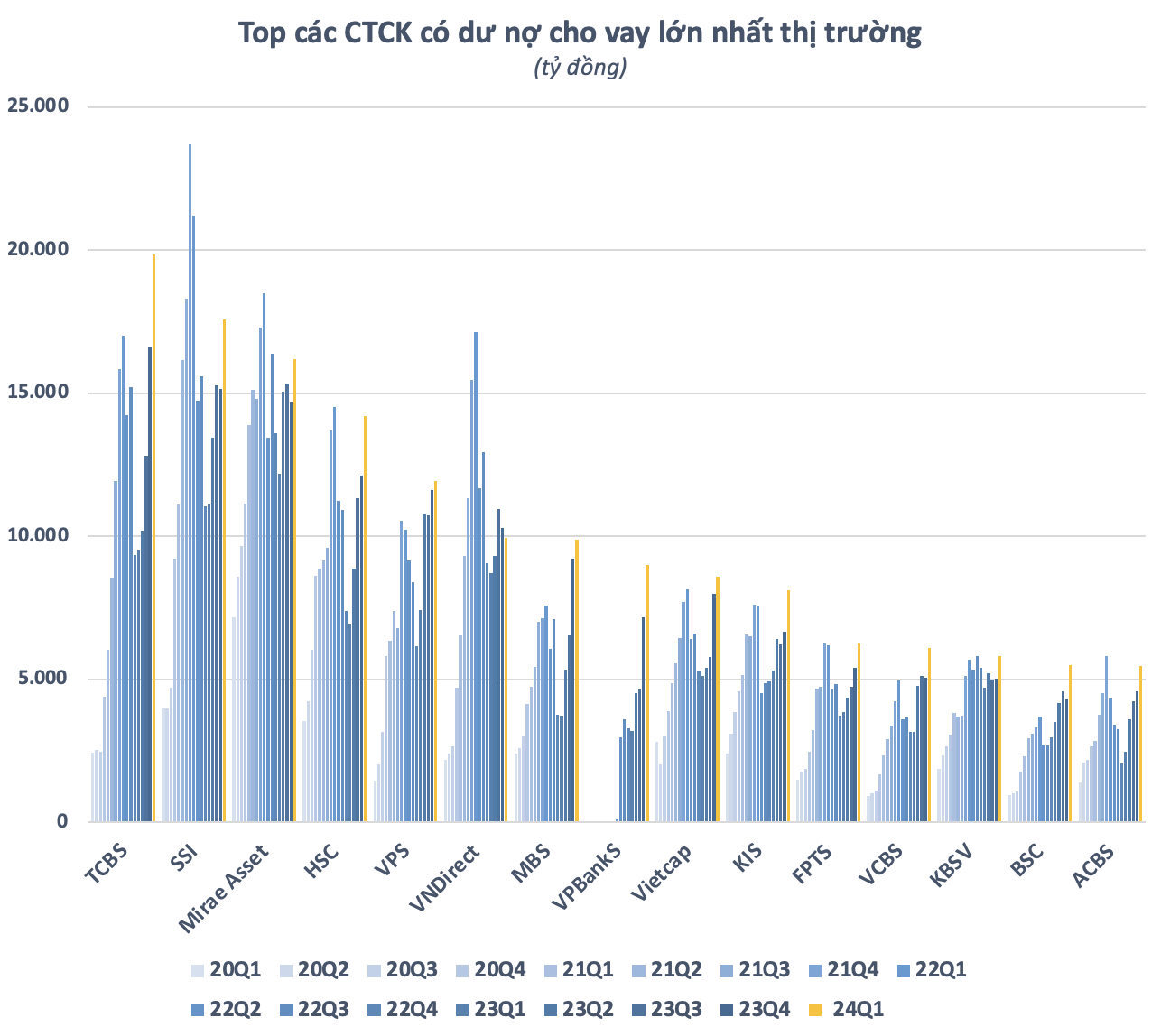

In general, most brokerage companies recorded an increase in outstanding loans in the first quarter of 2024. In the top group, only VNDirect had a lower balance than at the end of last year, but the decrease was not significant. In contrast, many brokerage companies had outstanding loans increasing by thousands of billions, such as TCBS, SSI, Mirae Asset, HSC, VPBankS, KIS, VCBS, BSC,…

The brokerage company with the strongest growth in outstanding loans in the first quarter was TCBS, with an increase of over 3,200 billion VND. As of March 31, TCBS’s outstanding loans amounted to over 19,800 billion VND, continuing to hold the No. 1 position among the group of brokerage companies. This is also the highest outstanding loan level of TCBS since its operation.

In addition to TCBS, many brokerage companies also broke records in terms of outstanding loans in the past quarter, such as VPS, MBS, VPBankS, Vietcap, KIS, VCBS, BSC, etc. Meanwhile, the outstanding loans of the SSI and VNDirect duo are still far from the highest level reached in the period at the end of 2021 and the beginning of 2022.

Record low interest rates have stimulated the flow of money into the stock market, while also stimulating investors’ demand for leverage. The market has been on a positive trend for quite a long time, further boosting investor confidence. Margin has accordingly been more aggressively used to improve investment performance.

However, the record high outstanding margin debt is also one of the reasons that the market’s correction phase has become more severe. In the past week alone, the VN-Index has lost more than 100 points (-8%), marking the sharpest decline in a year and a half. Total market capitalization has also “evaporated” by 480,000 billion (~20 billion USD), to around 6.28 million billion VND.

In addition to the “tight” margin factor, in a recent report, SGI Capital also pointed out many pressures on the cash flow in the stock market, such as foreign institutions continuously net selling; the issuance plans of many listed companies in the second quarter and the net selling volume of domestic shareholders also increased. The liquidity of the market is attracted to a number of highly speculative and expensive stocks with a very large supply.

The Fund believes that the buying demand has been met quickly and the market is at risk of a correction in the short term. “The period with the best interest rates and liquidity of the year has passed. A period of correction and accumulation is necessary for the market to find a more balanced point and reallocate cash flow more reasonably for the long-term positive trend with the general recovery of the economy”, SGI Capital emphasized.

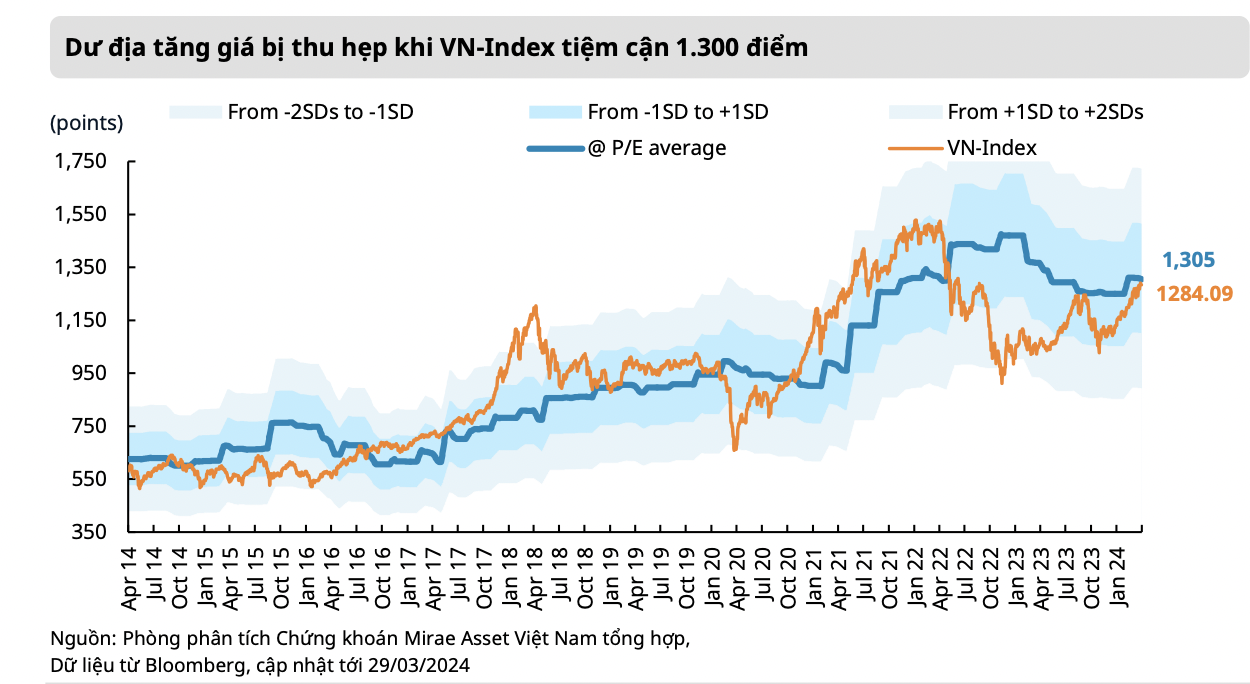

Agreeing, Mirae Asset also believes that the stock market is facing potential risks, when any period of adjustment in the banking group can put pressure on the VN-Index’s decline due to the significant weight of the sector. According to this brokerage company, the potential for the uptrend has somewhat narrowed as the VN-Index approaches the 1,300-point mark, corresponding to the average P/E level of the last 10 years.

Commenting on the market, Mr. La Giang Trung – CEO of Passion Investment said that this is a healthy adjustment of the market in a growing period. According to this expert, usually in uptrend market periods, there will be a correction every 5-6 months. In terms of time, the current market is also just enough.

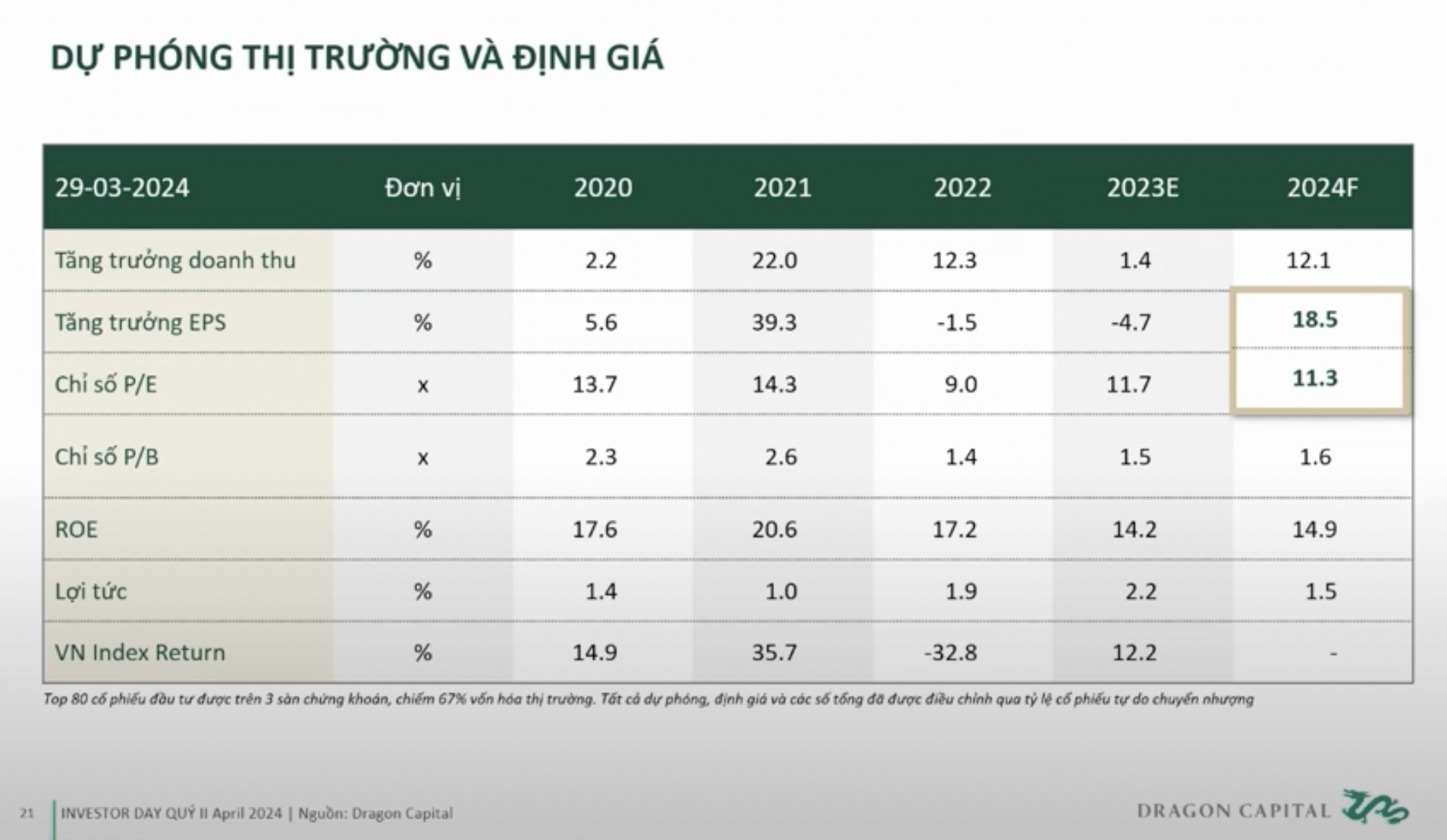

Similarly, foreign fund Dragon Capital also has a more positive view based on a medium- and long-term perspective. Accordingly, Dragon Capital’s statistics show that the valuation of the top 80 companies is currently at 11 times, while EPS growth is up to 18.5%. This means that the valuation is relatively attractive from a medium-term perspective.

“The correction period is not a time for investors to leave the market but should take advantage to disburse for a medium- and long-term perspective. With the attractive valuation level, the probability of the market falling by another 10-15-20% is very difficult, it may be 10%, but if it falls by more than 15%, investors should take drastic actions in terms of investment”, the expert Dragon Capital commented.