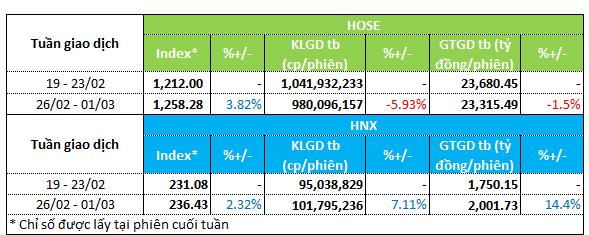

During the week of 26/02 – 01/03, stock markets increased on both the HOSE and HNX exchanges. The VN-Index rose nearly 4% to 1,258.3 points, while the HNX-Index increased by 2.3% to 236.4 points.

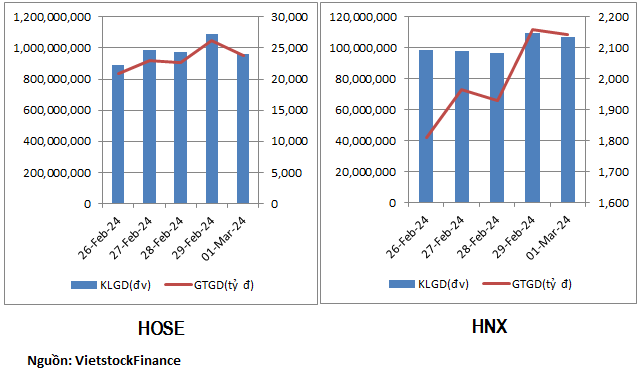

However, trading volume on the HOSE exchange slightly declined. Trading volume decreased by 6% to 980 million units per session, and trading value decreased by 1.5% to over VND 23 trillion per session.

Meanwhile, the HNX exchange experienced the opposite trend, with an increase in trading volume. Average trading volume rose by 7% to 102 million units per session, and average trading value increased by 14% to over VND 2 trillion per session.

|

Weekly liquidity overview from 26/02 – 01/03

|

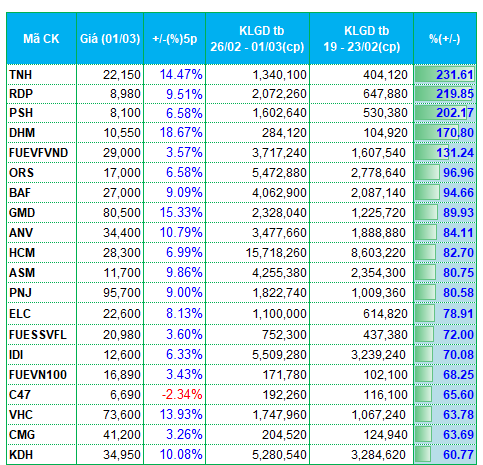

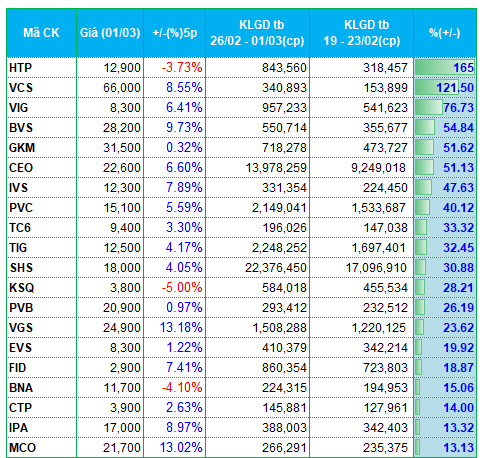

During the past week, capital flow showed interest in certain sectors such as seafood and securities.

Seafood stocks such as ANV, ASM, IDI, VHC emerged as the top stocks with the highest liquidity on the HOSE exchange. In the increasing trend of capital flow, seafood stocks performed well last week, with all these stocks recording price increases of less than 10% compared to the previous week. VHC saw its price increase by 14%, closing the week at VND 73,600 per share.

Securities stocks also attracted strong capital inflows during the week, especially on the HNX exchange. ORS, HCM, VIG, BVS, IVS, TIG, SHS, EVS, and others were representatives of the securities sector with significant increases in liquidity during the week.

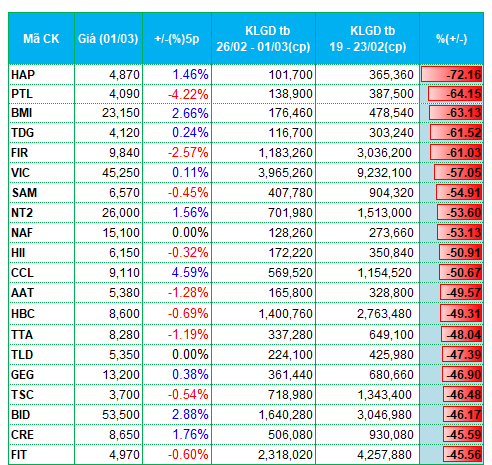

In contrast, real estate stocks did not attract much capital inflow during the past week. PTL, FIR, VIC, CCL, CRE, IDJ, NRC, VC7 all experienced a decrease in liquidity ranging from 30% to 60% compared to the previous week.

The construction sector also experienced a slight capital outflow. HBC, S99, LIG, C69, MST were among the top stocks with decreased liquidity on both exchanges.

The healthcare and pharmaceutical sector had a similar trend. FIT, SRA, DVG, AMV all saw a decrease in liquidity by approximately 50% compared to the previous week.

|

Top 20 stocks with the highest increase/decrease in liquidity on the HOSE exchange

|

|

Top 20 stocks with the highest increase/decrease in liquidity on the HNX exchange

|

List of stocks with the highest increase/decrease in liquidity based on average trading volume of over 100,000 units per session.