Despite low transactions, real estate prices continue to remain high

Real estate market advisory firm CBRE reports that although the number of units sold in Hanoi and Ho Chi Minh City has improved since Q3 2023, it is still significantly lower than the previous years.

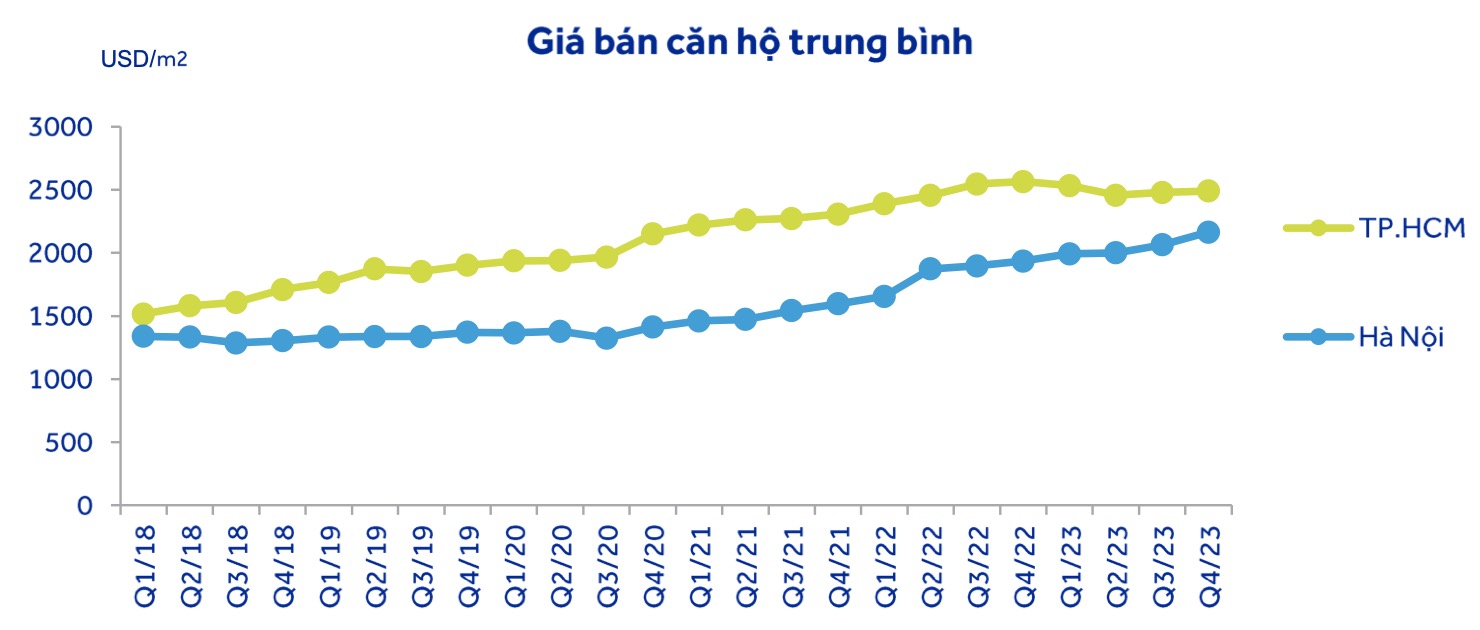

Average apartment prices in Hanoi and Ho Chi Minh City. (Source: CBRE, ACBS)

Meanwhile, apartment prices remain high, with the average price in Q3 2023 in Hanoi at $2,163/m² (up 14.6% compared to the same period) and in Ho Chi Minh City at $2,490/m² (down 1.7% compared to the same period). The main reason is the new supply in the high-end segment (from $2,000 – $4,000/m²), accounting for 75% of the total new supply in Hanoi and 84% in Ho Chi Minh City in 2023.

For the townhouse segment, data from JLL consultancy shows that the supply and number of townhouses sold in the South (Ho Chi Minh City, Binh Duong, Long An, Dong Nai, Ba Ria – Vung Tau) increased significantly in Q3 2023, but still remained unchanged in the North (Hanoi, Hai Phong, Bac Ninh, Hung Yen, Vinh Phuc).

Average townhouse prices in Hanoi and Ho Chi Minh City. (Source: JLL, ACBS)

Notably, townhouse prices continue to increase, with an increase of up to 16.1% in the South (reaching $4,881/m²) and a slight increase of 0.7% in the North (reaching $6,032/m²).

According to the assessment of securities company ACB Securities (ACBS), the real estate market will gradually recover in 2024, with expected low interest rates, strong infrastructure development nationwide, and high urbanization rate.

At the same time, the amended Housing Law, which removes the provision of allocating 20% of project land area for social housing development, will address legal difficulties for real estate developers. In addition, the amended Real Estate Business Law promotes transparency and stability in the market, protecting the rights of homebuyers and limiting the participation of weaker businesses, thereby ensuring a sustainable market recovery.

Strong net profits expected for Nam Long Group and Nhà Khang Điền

According to ACBS, the valuation of some real estate stocks is currently attractive. Among them, the business results of Nam Long Investment Corporation (Nam Long Group, stock code NLG) and Khang Dien Investment and Trading Joint Stock Company (stock code KDH) are expected to strongly recover this year.

ACBS states: “Residential real estate stocks often experience early growth as sales improve and peak when revenue is recorded. Therefore, the sales volume of the companies is an important indicator to track early on to confirm the upward trend of real estate stocks.”

For Nam Long Group, sales volume has shown signs of recovery as absorption rates for new launches have been relatively good. ACBS currently forecasts the 2024 sales volume of the company to reach nearly VND 6,000 billion, a 50% increase compared to 2023.

Project sales volume of Nam Long Group in recent quarters. (Source: Nam Long Group, ACBS)

Nam Long Group is currently focusing on affordable and mid-range products that match real demand through three main product lines: Ehome/EhomeS apartments with prices ranging from VND 1 – 1.7 billion/unit, Flora apartments with prices ranging from VND 2.7 – 4 billion/unit, and Valora townhouses with prices ranging from VND 3.7 billion/unit.

Notably, the development activities of Nam Long Group have faced almost no legal difficulties due to the implementation of the next phase of existing projects. In addition, the group is currently researching six new social housing projects with a total area of nearly 47 hectares in Dong Nai, Can Tho, and Hai Phong.

ACBS forecasts that Nam Long Group’s 2024 revenue will exceed VND 6,300 billion and net profit will reach VND 845 billion, an increase of 98% and 74%, respectively, compared to 2023, thanks to completions at Southgate, Akari, Mizuki, Izumi, and Can Tho projects, along with the recognition of a transfer transaction of 25% of capital in the Paragon Dai Phuoc project with a value of VND 663 billion.

For Nhà Khang Điền, the Scarcity of new supply and favorable financial support packages have contributed to the good absorption rate of the Privia project, which was launched in Q4/2023.

Projects currently being implemented by Nhà Khang Điền. (Source: Nhà Khang Điền, ACBS)

ACBS evaluates that Nhà Khang Điền will continue to benefit from the scarcity of new supply in the townhouse segment in Ho Chi Minh City. The company’s projects have the outstanding advantages of transparent legal framework and the reputation of the developer, which have been proven through a series of projects. At the same time, Nhà Khang Điền’s financial situation is improving positively, with a low net debt-to-equity ratio compared to the industry average.

The ACBS forecast for Nhà Khang Điền in 2024 is a revenue of over VND 4,000 billion and a net profit of VND 1,100 billion, an increase of 91% and 50%, respectively, compared to 2023, thanks to completions at the Privia, Clarita, Emeria, and Classia projects. Specifically, Nhà Khang Điền has completed the transfer of 49% of capital in the Clarita and Emeria projects to partner Keppel.

Not VHM or DIG, these are the two real estate stocks ready to break out in the new cycle